You are interested in trading - and day by day, you are getting between five and 100 offers for systems, concepts, and strategies that shall help you making meaningful decisions in the markets.

This is already, where the trouble starts: the market action is not meaningful; it is random and can best be explained after the fact.

Are you in the markets for making money?

This is usually answered with a yes; however, are you doing or willing to invest into taking a new perspective to get you there?

Find key decision making criteria’s in this detailed report:

Change is the hardest thing for us humans to deal with, except we are forced to do so:

- System Committed Traders: Many traders commit to one system or systematic and are willing to never produce income but aim to proof that the system is right, because they once believed in it; even so the numbers do not add up (psychology talks about cognitive dissonances). Let me give you a short example: Hammer patterns, Doji’s. If those work with a high probability, I would build an indicator in 30-minutes and let a robot trade it.

- Entertainment Traders: A good bunch of trading account holders find entertainment in talking about the million facets of the market and what happened and will be happening; still with no or little income production, mostly not even applying the knowledge of hedging a position that gets challenged or leveraging one, when things run the expected direction. Hedging somehow is generally found risky; however, it is the opposite: it balances the risk when you know what to do and turns potential losers into winners. A skill, you should think about possessing, even so you are not constantly trading, but holding asset positions.

- Single Focused Traders: I only trade the /ES on a 15-minute chart. How about learning how to trade the same on weekly, daily, and on lower time frames, where the congruence from signal to noise is high and you trade a derivative, which allows you to tame your risk in $100 increments, producing multiple streams of trading income. Would that help your trading?

- Low Budget Drivers: Imagine, you had an airplane and you could obtain your pilot license by watching an online video for $297. In this case, the FAA does not approve; however, when you are trading without knowing what you are doing, you are not a potential hazard to others; you are welcome to lose your money. Think about, if you rather want to invest in some one-on-one lessons from a trade instructor, with a quality education, helping you with a system to participate in the markets at specific entry and exit points?

Now you see that you best learn to consider multiple dimensions to conquer the trading challenges. The key challenge usually starts with the system:

By the actual price pattern of the markets, simple math and standard technical analysis does not give you high probability trade setups.

It is a typical human behavior to categorize the happening of now to something related in the past; however, the future is not a function of the past and this is why standard math in technical analysis never produce high predictability:

It would be too easy when you take two moving average crossings to portray the future happening. Does it work at times? Yes; however, only in a random manner and thus: such methods have no high predictability.

In the models we share, the past does not play a role, the action of now is related to the underlying structure of the markets and extrapolated into the future; transforming the actual market happening into mathematical models that filter signal from noise and interpret the expected price expansion, so you assume at entry how far the expected price expansion might reach with a high probability.

More than 95% of all financial market transactions are triggered by institutional orders. They build the underlying structure of the market. Specifically developed filters and a fractal based math lets us specify by the happening of now and what will happen with a high probability in the future.

NeverLossTrading Price Move Model

A fractal is a change in behavior.

How do we look at fractals in the markets?

- Price Momentum Change, measured as acceleration in the price move of the underlying.

- Trend Change, measured on a continuation pattern change.

- Statistical Volatility Change: price moves per observed time unit.

- Price Move Constellation over time with repetitive patterns.

- Volume Momentum Change in the observed time frames, similar but measured differently to price momentum change.

We offer multiple systems that help you to decide from the action of NOW, what most likely will happen in the future.

Our base model is called TradeColors.com. The trade entry follows the pricing model shown above and a trade initiation is given when two newly painted same color candles appear on the chart.

- You trade to the upside when two-new-blue-candles are painted and the price development of the next candle takes out the prior high of the second blue candle.

- You trade to the downside when two-new-red-candles are painted and the price development of the next candle takes out the prior low of the second red candle.

Stock market indexes are usually the hardest to predict, so let us take the challenge:

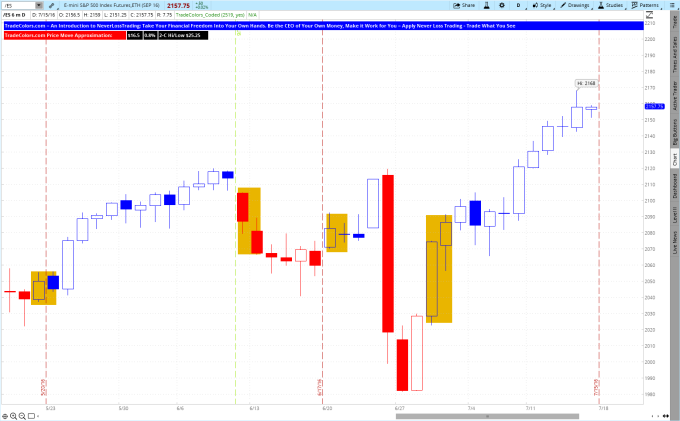

TradeColors.com on S&P 500 Index Futures Contract May – July 15, 2016

The above chart shows how our system is helping you in finding key entry points to go with the direction the market is moving to. Besides that the system will tell you bar-by-bar the expected price expansion, you will learn to exit your trade after a specified number of same color bars.

In case you are not ready to accept the risk associated with trading a futures contract on a daily chart, we show you in our mentorships, how you can trade derivatives of the S&P 500, with about $100-increments of risk. You will even learn how to trade those situations without the constant need for a stop-loss, without increasing you risk: Never Stop Loss Trading, however we found this name a bit lengthy.

In our more advanced systems, we spell out specific entry points, helping you to work with buy-stop- or sell-stop orders, directly from the chart, giving you more trading opportunities and by this a higher productivity and performance rate (NLT TurnPoint Trading is not published for all audiences).

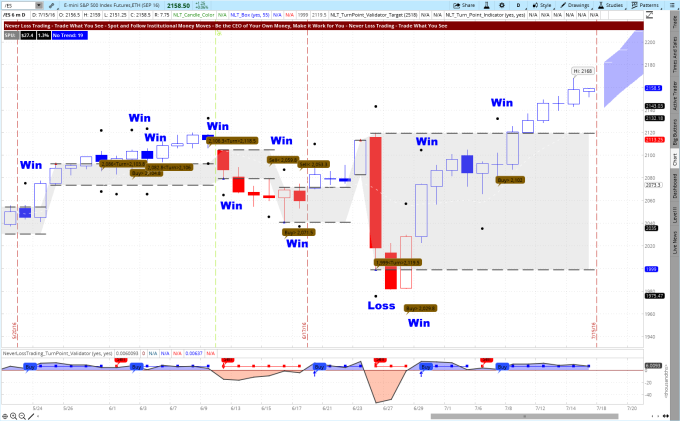

NeverLossTrading TurnPoint on S&P 500 Index Futures Contract May – July 15, 2016

You see on the chart, how eleven trading opportunities that followed our price move model occurred and the win rate in this example just speaks for itself 11:1. The chart shows price chart and lower indicator proposed trade situations. We take profit either at the dot on the chart or after a pre-specified number of candles.

The teaching of the systems is always one-on-one. If you start with TradeColors.com your paid tuition will be discounted on a potential upgrade. Our software is installed on a server and has access to real time date without monthly fees; so it is there, even when you buy a new computer.

For a live demo: Call +1 866 455 4520 or contact@NeverLossTrading.com

By using a fractal based math, our systems replicate trade situations on all desired time frames, ticks or range bars.

Thus, we took the most actual 1-hour /ES chart into the US-market opening on July 15, 2016 and see that the system produced four trade potentials in the pre-market session: midnight EST to 9:00 a.m. EST and all came to target (dot on the chart).

Signals that were not confirmed by the next candle not surpassing the spelled out price threshold did not produce trade conditions.

NeverLossTrading TurnPoint on S&P 500 Index Futures Contract July 15, 2016 (1-Hour)

Aside from learning to trade with the system, we will work on a business plan for your trading with you that shall give you an idea of expected returns per capital invested, with the aim of producing multiple streams of income and we also work with you on an action plan, so you know at each point of time what to do and how to operate in the markets.

By teaching one-on-one, our capacities are limited and we are currently open for new students, so do not miss out.

For a live demo: Call +1 866 455 4520 or contact@NeverLossTrading.com

We are looking forward to hearing back from you,

Thomas

NeverLossTrading

A division of Nobel Living, LLC

401 E. Las Olas Blvd. Suite 1400

Fort Lauderdale, FL 33301

No comments:

Post a Comment