Today, we want to share with you seven key elements to consider for being a successful day trader, swing trader, long-term investor, or a combination of those.

Let us prepare a short list for you and then fill it with life:

- Strategy: System

- Faith: Follow Your System

- Discipline: Focus

- Preparation: Ready

- Management: Execute

- Improvement: Progress

- Dedication: Plan

With the following guide, you have three choices:

- Implement all of those steps on your own: took us more than 10,000 hours.

- Find a provider who can teach you: we are in business since 2008.

- Disregard them and continue the way you always did.

1) Law of Strategy: have a system with clear cut entries, exits, stop- or adjustment levels; that produces repetitive, favorable trade patterns for you.

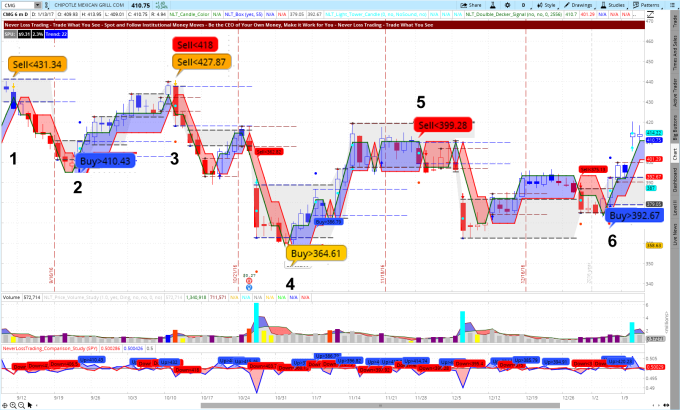

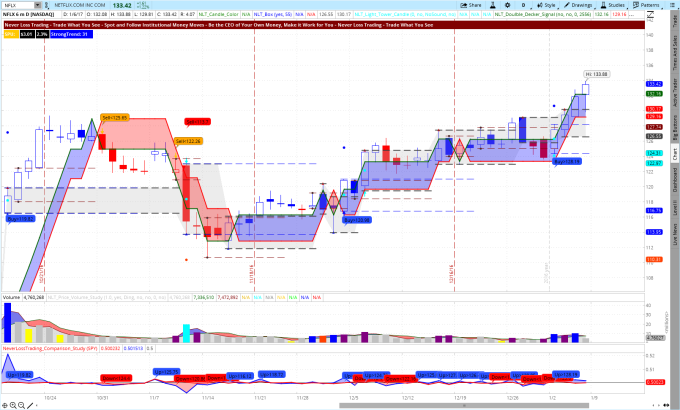

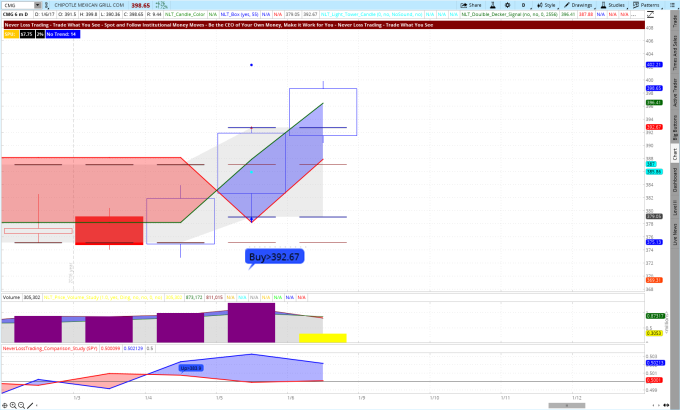

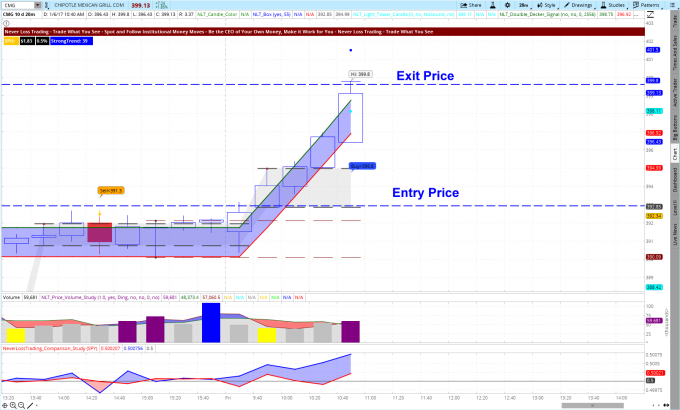

CMG Daily NeverLossTrading Top-Line Chart, September 2016 to January, 11, 2017

The CMG chart shows you multiple highlighted trade potentials, spelled out by the system, with the following conditions:

- Trade, when the spelled-out price threshold is surpassed in the next candle to be sure other market participants follow the indicated direction.

- On red- and blue signals, trade up to five bars or 2-Speed-Units (SPU); on orange signals trade for a maximum of 10-bars. In each case, you can trail your stop with the red line on the chart.

This way, you were able to participate in six trade setups. Let us discuss those one-by-one:

| Situation | Signal | Trailed Stop | 2-SPU Exit | Timing |

| 1 | Orange | +$24 | +$19 | Entry at 9/12/16 |

| 2 | Blue | +$18 | +22 | Entry at 9/23/16 |

| 3 | Red, Orange | +$14 | +$20 | Entry at 10/12/16 |

| 4 | Orange | +$30 | +$22 | Entry at 11/3/16 |

| 5 | Red | -$11 | -$11 | Entry at 11/29/16 |

| 6 | Blue | +$21 | +21 | Entry at 1/6/2017 |

| Result |

| +$96 | +$93 |

|

The above table shows similar results by either trailing the stop or exiting after a 2-SPU move (SPU is an in-house developed algorithmic measure for the expected price move after institutional engagement was assumed and confirmed).

Without compounding interested and trading the stocks, a 25% return on cash in four month was achieved. We are specialists in teaching you how to trade options of the underlying, investing only 1% - 5% of the share value, accelerating returns, limiting risk. It will be eye opening for you!

2) Law of Faith: Follow your system, in particular at times when the going gets tough; no system produces 100% positive results and thus, dealing with setbacks and failure is part of trading.

It is easy to back test a system; just make sure it has clear cut rules for entry, exit, and stop. Check how many trades out of 100 confirmed trade situations were winners and how many losers.

Thus, when you have such system, hold the course, even when things go wrong. Unfortunately, this is where many give up and hunt for the next system; while considering that standard indicators will not give you a higher predictability than 55% on average.

3) Law of Discipline: When your time for trading is there, you focus, you are ready and prepared to execute on the opportunities that arrive, not letting other influences disturb you from doing what you prepared for.

Working or trading from home is not for everybody. Do not let daily life disturb your trading. Have your screen setups and everything in place that you can do what you want to do; focused and undisturbed.

The success principles of trading can be compared to professional sports: Success comes from skill and practice.

- When stepping onto the plate, I am prepared to swing, wait for the right moment and trade.

- On each opportunity, I am prepared to make short-term good profits, administering tight stops, and when the market allows, I am aiming for the fences.

- Bring the odds on your favor; take trades in accordance to defined system entries.

- Fill the bases: Scale in and out of positions to capitalize on home run possibilities.

- Accept losses as part of trading, knowing the next trade will come from your system.

- Concentrate on what you are doing without distraction.

4) Law of Preparation: Every day that you want to trade, you are prepared with a clear cut analysis, knowing which instruments to trade and how; you operate with a cheat sheet (electronic form welcome) of what to do and the strategy to follow.

NeverLossTrading offers multiple alerts to highlight trading opportunities for you. In two of our systems, you even operate with market scanners and watch list indicators, allowing you to do your own analysis on multiple time frames.

Let us give you one example for the newly developed NLT Strong Movers Alert. It is based on

NLT Top-Line signals and highlights specifically strong price turning points.

For January 9, 2016 we had the following trade potentials specified and applying our conditions, this were the results.

| Highlighted Stocks | Sentiment | Daily Chart Setup Approximation (tight stop) | Comment on the Daily Signal | Result |

| WMT | Bear | Favorable | Signal not confirmed | no trade |

| ADM | Bear | Favorable | Signal not confirmed | no trade |

| KBH | Bear | Favorable | Signal confirmed and trade closed 1/12/17 | Win |

| PHM | Bear | Favorable | Stopped | Loss |

| TEVA | Bear | Acceptable | Signal confirmed and trade closed 1/11/17 | Win |

| MDT | Bull | Favorable | Signal confirmed and trade closed 1/11/17 | Win |

| EBAY | Bull | Risky | Risky, no trade. | no trade |

| A | Bull | Acceptable | Signal confirmed and trade closed 1/11/17 | Win |

| TXN | Bull | Acceptable | Signal confirmed and trade closed 1/11/17 | Win |

The report contains per symbol, clear cut entry, exit, and stop rules to follow.

We offer multiple trading

systems….click, all taught one-on-one, with high dedication to your best available times. If you like what you see, ask for a personal demonstration:

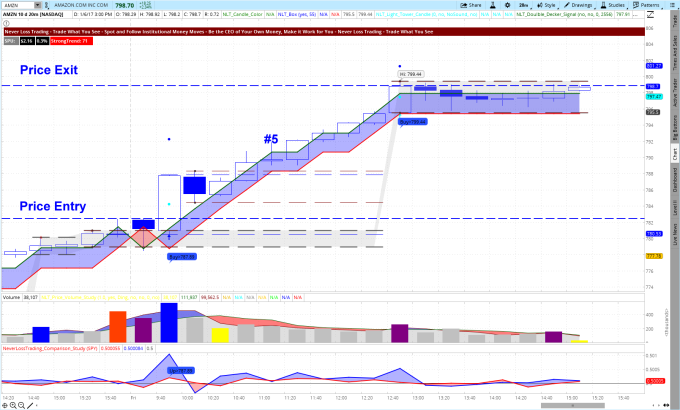

5) Law of Management: All trade mechanics are setup to execute your orders and in case you need to adjust a trade, you will know when and what to do. Trade adjustment has two dimensions: adding to winners and repairing potential losing trades. You work with buy-stop and sell-stop orders (bracket orders preferred), so you can pre-program your conditional orders in advance that they execute automatically when your conditions are met. This way you never run behind the happening and you realize the participation rate you desire.

6) Law of Improvement: You strive for constant improvement by journaling your trades to analyze what you do well, which you will repeat and where you did not do well; which you will stay away from if possible or improve.

We sure help you to do such and add a mentorship period after teaching you how to work with our systems, where you can send in your trades for constant feedback and improvement.

Hence, you are not alone, you are coached to turn yourself into the trader you want to be.

7) Law of Dedication: You treat trading as a business; regardless if you occasionally trade or trade for a living; thus, you follow a written business plan, which contains the elements of a financial plan: expected returns, maximum risk per trade etc. and an action plan: what to do when and how: instruments to trade, trade strategies to follow, times to be in or out of a trade (news announcement, earnings).

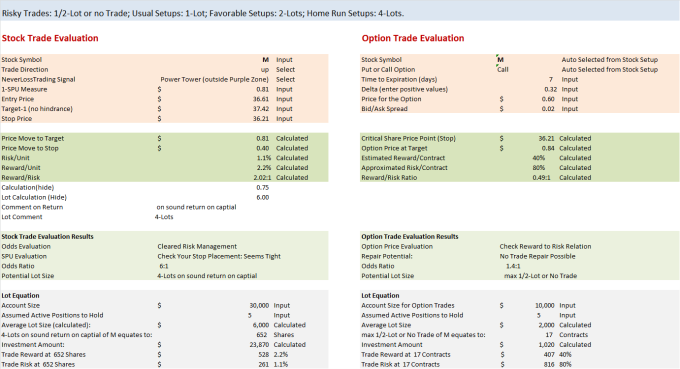

Example of a Position Sizing Model to Decide for Stock or Option Trades

The table above shows just one small instrument, our focus is having you to operate with a clearly distinct written business plan that gives you a sound perspective of the maximum risk you take per trade, the expected returns per instrument and trading strategies; how to put everything into action: a guide to follow striving for trading success as a day trader, swing trader, long-term investor or a combination of those.

We are ready to implement all of this into your trading routine:

By teaching one-on-one, spots are limited, so do not miss out!

If you like to subscribe to our FREE trading tips, webinars, and reports...click

We are looking forward to hearing back from you,