Summary: Join the world of high probability

trading by combining an existing system with the newly developed NLT SPU Move

Indicator to trade at critical price turning points.

A successful

trader has a systematic way to anticipate the future price action of assets

like stocks, futures, FOREX.

Not

successful traders act reactive and often start to enter into a price action

when it is right at the point where it ends, reverses and takes your money.

Unfortunately,

76% of the retail traders are losing money (get the details: email to contact@NeverLossTrading.com Subj. 76%).

Make a

difference!

In our

yearend offer 2021, we combine the newly developed NeverLossTrading SPU Move

Indicator with TradeColors.com or other NLT Systems, helping you to trade at

significant price turning points, and you get the second indicator for free: a

$3,997 value.

E-Mini S&P 500 Futures NLT

Timeless Day Trading Chart

Chart

Review

|

Entry

Rule

|

Signal

|

Result

|

|

Situation-1

|

Early entry into the price movement by

the lower signal, confirmed by the pride chart signal

|

win

|

|

Situation-2

|

Upper and lower indicators agree to go

short

|

win

|

|

Situation-3

|

Upper

and lower indicators agree to go short

|

win

|

|

Situation-4

|

Upper and lower indicators agree to go

short

|

win

|

|

Situation-5

|

Long trade by the lower indicator

|

win

|

|

Situation-6

|

Upper and lower indicators agree to go

short

|

win

|

In the example above, we used a range

bar chart where each candle is painted when a high/low-price-move of 40-ticks

is concluded (10 Points). In essence, you are trading for a minimum price

change of $500 per contract. The screenshot shows the price action from

September 29 to 30, 2021.

Does that mean a 40-tick chart has the superpower to

determine where the prices for the E-Mini S&P 500 Futures are going?

No, the tick range to choose is dynamic and throughout

2021 varied between 20 and 50 ticks. Our algorithm tells you the tick/range to select

for observing the price movement asset by asset going forward.

TradeColors.com is our introductory concept to

algorithmic trading, and with our yearend offer for 2021, we upgrade it by

adding the NLT SPU Move indicator (Find

more details in this publication…click).

We help traders in multiple dimensions:

· System-defined trading opportunities

at crucial price turning points

· One-on-one training suited to your

wants and needs at your best available times: learning classroom style is

inefficient. Each session is recorded so that you can repeat the learned.

· Executive teaching from a success

coach, experienced in bringing the best out of people, giving focus, sharing concepts,

providing calculations and documentation in mentorships to ensure you are on

the right path.

Indeed, this system also

works for time-based charts and all asset classes: stocks, futures, FOREX, and

their derivatives, like options.

Our systems formulate price

thresholds: Buy > and Sell <. Only when those are confirmed in the price

movement of the next candle, we enter into a trade. Thus, we always trade for a

pre-defined directional price movement and exit the trade when it is reached.

This way, you operate with mechanical rules that leave very little room for

interpretation.

SPY NLT Daily Chart (ETF of the

S&P 500 Index)

Chart

Review

|

Entry

Rule

|

Signal

|

Result

|

|

Situation-1

|

Early entry into the price movement by

the lower signal, confirmed by the pride chart signal

|

win

|

|

Situation-2/3

|

Upper and lower indicators agree to go

long, and the direction is re-confirmed during the price movement

|

win

|

|

Situation-4

|

Short opportunity by the upper and

lower signal

|

win

|

|

Situation-5

|

Upper and lower indicators agree to go

short; however, no trade, by the gap

|

no trade

|

|

Situation-6

|

Only the trade-color-combination-candles

direction was confirmed

|

win

|

|

Situation-6

|

Upper and lower indicators agree to go

long, but no trade by the gap

|

no trade

|

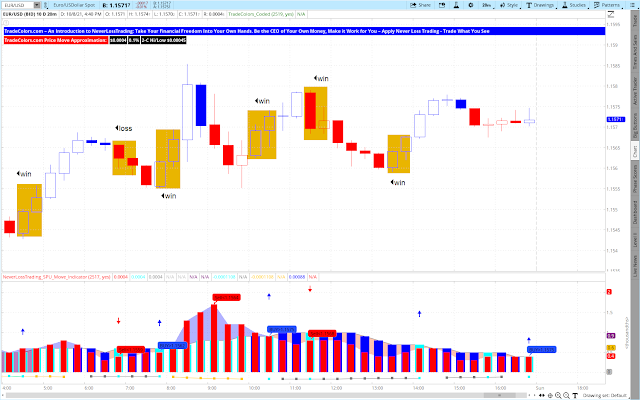

Our FOREX example demonstrates that the system also works on

short time frames; however, we encourage our traders to trade for meaningful

price movements to keep the odds in their favor.

EUR/USD 10-Minute Chart Example, October 8, 2021

Our systems

measure the underlying activity of supply and demand to define critical price

turning points.

Experience

live: contact@NeverLossTrading.com Subj. Demo.

We are a

primer education institution focusing on one-on-one training, where you and

your wants and needs are in focus.

Sign up for our free reports, trading

tips, and webinars.

Our yearend

offer:

Buy

TradeColors.com for $2,642 and get the NLT SPU Move Indicator for Free: a

$3,997 value.

This offer

is limited…do not miss out: contact@NeverLossTrading.com Subj: Offer 2021

www.NeverLossTrading.com

Disclaimer, Terms and Conditions, Privacy | Customer Support