As an IRA holder, you have two choices:

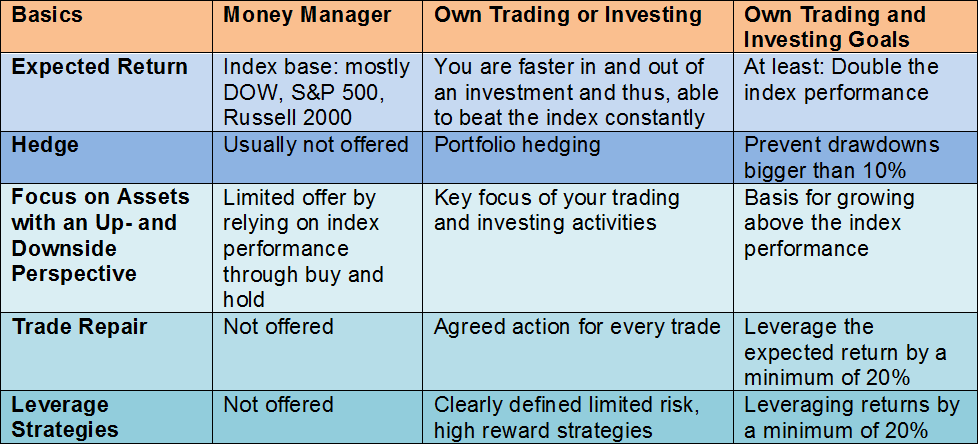

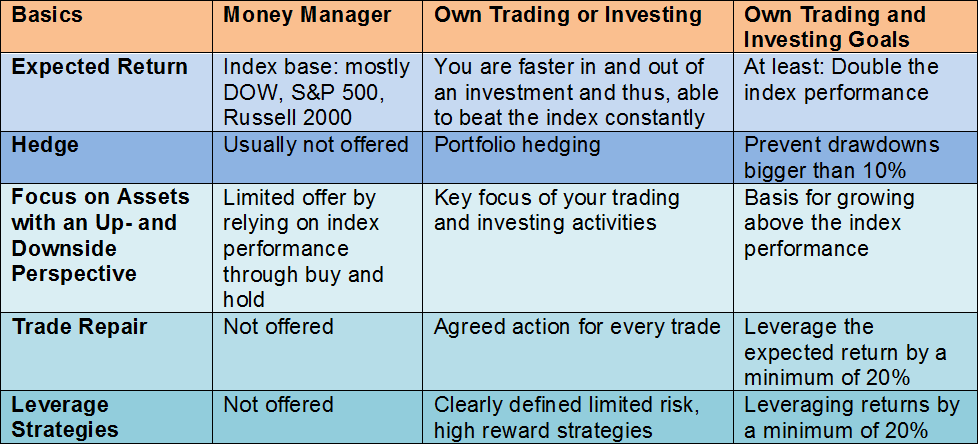

In a short overview, this is what you can expect from a money manager and from you as a private investor:

Goals of IRA’s with Money Managers and as a Self-Investor

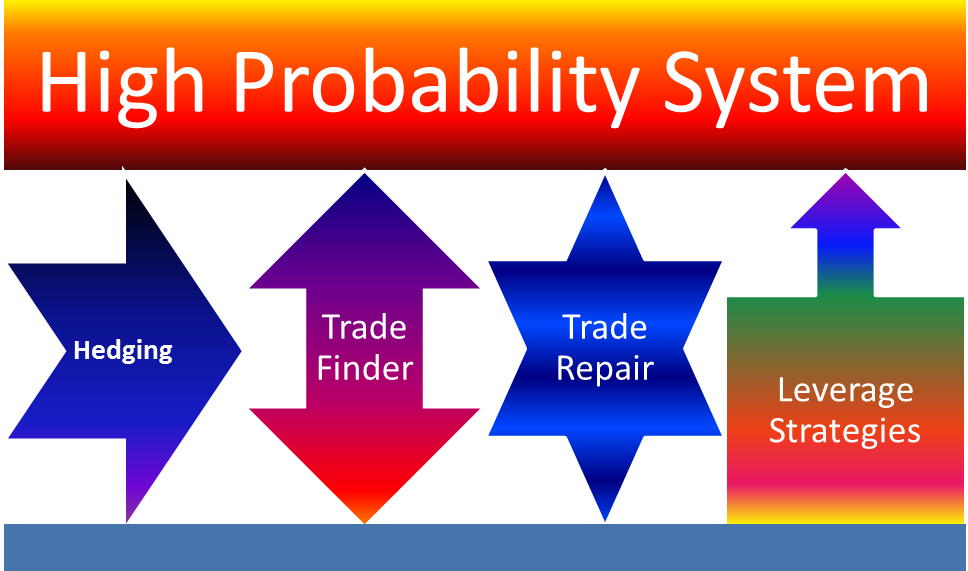

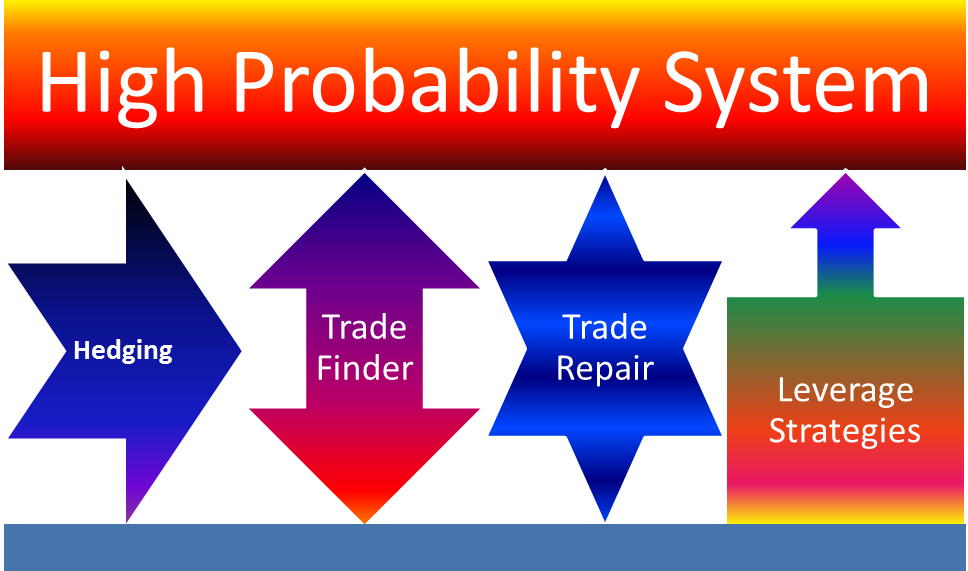

Instruments Needed to Beat Money Managers Index Performance

If you are not already subscribed to our free trading tips, reports, and webinars…sign up here.

Best regards,

Thomas Barmann

Disclaimer, Terms and Conditions, Privacy | Customer Support

- Invest your money on your own.

- Rely on a money manager.

In a short overview, this is what you can expect from a money manager and from you as a private investor:

Goals of IRA’s with Money Managers and as a Self-Investor

Instruments Needed to Beat Money Managers Index Performance

- Operate with a high probability trading system that is able to highlight institutional engagement on the chart: A change in supply and demand is measurable as a pre-stage for a potential future price move. Aim for a predictability ≥ 65%.

- To prevent drawdowns, apply a hedging strategy: In 2008, the stock market dropped 50% in a matter of months; hence, you are in need of a hedging strategy, which protects you even overnight, when the stock markets are closed, letting you find sound sleep – IRA managers do not offer such!

- Find assets with up- and downside price move potentials (trade finder): Invest where prices move (even in an IRA).

- Instead of taking a stop-loss, repair your trade: Imagine you trade 100 times per year, with a one dollar reward and a one dollar risk per trade. When you win 65 and lose 35 trades, your balance is $40. By applying methods of trade repair, you have a high chance to reduce the average loss to 40% of the originally planned loss (and you can do better). Applying our method of trade repair will then increase your gains by $21, giving you a potential for a 53% increase on your return. How does that sound?

- Leverage strategies: Build up your opportunities when they matter: Add to your winners and harvest big and keep the losers small – your key principle of trading and investing success.

- Call +1 866 455 4520 or contact@NeverLossTrading.com

- Enter your email address in the following link and receive a written guideline, putting together the key principles of IRA trading and investing success….click.

If you are not already subscribed to our free trading tips, reports, and webinars…sign up here.

Best regards,

Thomas Barmann

Disclaimer, Terms and Conditions, Privacy | Customer Support