In learning how to trade various financial instruments, option trading is the high art or skill of trading and when done right, it can offer you opportunities with limited risk you might not even have thought of.

Stock trading is the easiest way of trading; when you stick to assets, which exchange more than one million shares per day, you automatically receive tight bid/ask spreads and your orders should fill at ease.

Futures and FOREX trading is the next category: Leveraged instruments, where it is important to understand the rules, obligations and price-moves per time-frame observed. Hence, a bigger step up of what you need to know compared to stock trading.

Option Trading, why do we call it a high art or skill?

You are trading leveraged instruments with lower volumes, wider bid/ask spreads, and you choose from multiple strike prices on Puts and Calls. On top of all, you have multiple combination trades between Puts and Calls, which we spare in this publication and concentrate purely on straight Put and Call buying.

The key to option trading is that you specify the relation to the underlying asset and how you want to benefit when prices go up, down, or moves sideways: hence, you need a system that helps you to estimate expected price moves of the underlying asset:

Example: WYNN-Stock on a trading system where you buy Calls when the price threshold of the buy-initiation candle is surpassed to the upside in the next candle or you buy Puts when the sell-initiation candle price threshold is surpassed to the downside on the next candle.

WYNN Stock Daily Chart with Buy Signals, buy Calls; on Sell Signals, buy Puts

When your trading system gives you the idea of when to enter and exiting a trade: let us take a five bar exit, then you already know the choice of an option to take.

Do you?

When you consider the following, you do:

- Trade with the price move of the underlying instrument.

- Do not bring the option into options expiration week; by expecting a 20-percent time decay of your premium paid per day of holding your asset in options expiration week.

- Choose a meaningful strike price that protects you when the trade is in danger and comes into the money when the trade works out (we teach this in detail in our mentorship classes).

When you buy Puts and Calls this way and you work with a high probability trading system, what will be possible outcomes:

- When the trade continues as originally expected, you have a good chance to achieve a 70% - 200% return on your investment.

- When the trade goes wrong, you lose about 80% of the investment.

- When your trading system allows you to get two out of three trades right and you distribute your investment in 10-partitions, keeping one as cash, you could achieve exceptional results.

For our calculations, we always take a conservative approach, calculating with the lower rate of expectation and by not having a chance to control that you are complying to our trade rules, we cannot commit that you will achieve such exceptional results, but want to share the opportunity option trading can give to you.

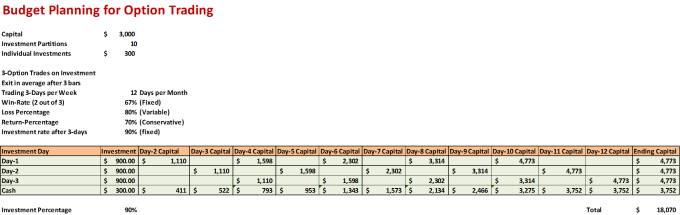

The table below shows you, how we help you to distribute risk and how following our principles carries the potential to turn $3,000 into $18,070 in one month: Trades are based on a 4-hour chart.

The plan above keeps a security chest, in case of a bad streak during the investment cycle.

When you are trading NeverLossTrading style, you always have a clear business plan: financial plan and action plan (what to do when, where, and how) to follow high probability trade setups on multiple time frames for a big variety of assets.

To learn how this is done, we offer multiple mentorships and systems; take a look and let us know on which you want to receive a personal consultation hour...click.

To let you know assets ready for a price move, we offer in addition our NeverLossTrading Alert services…click.

For a live demonstration of your preferred system:

Call +1 866 455 4520 or contact@NeverLossTrading.com

If you are not already part of our free trading tips, reports, and webinars…sign up here.

Good trading,

No comments:

Post a Comment