Summary: Successful traders follow a structure, plan what they do, understand that they act under uncertainty, and leave nothing to chance. We share a guideline of what to do.

Everybody comes to trading with a plan, but what to do if a loss hits you?

Understand and accept that you work in an environment with no 100% certainty that the trade will work your way. Do not confuse winning and losing trades with good and bad trades, according to plan or not. A good trade can lose money, and a bad trade can make money; what determines good and bad is if you apply and stick with clear-cut principles.

You need a trading plan to wade through the treacherous waters of a volatile market and come out with your P&L and dignity intact.

A trading plan can help you to take advantage of market volatility. However, there is no guarantee that a trading plan will make you successful. But you will almost certainly fail if you do not have one.

Having and following a plan is an ambiguous topic that many people struggle with, and we want to share some examples of how you can plan your trade and trade your plan.

Most people are terrified to make a trading plan because you are accountable and responsible for the results once you commit to a plan. After all, as humans, we prefer to avoid taking responsibility when things don’t go our way. However, when you have a plan that tells you what you can and cannot do, you have no choice but to take responsibility.

A plan is essential to reach your trading goals long-term. Having a plan will allow you to move forward systematically:

- You will be able to notice what is working and do more of it.

- You will also detect and eliminate what isn’t working from your trading.

In essence: what you can measure, you can control.

Does that not mean you need to document or journal your trades: an administrative effort many shy off, but a necessary evil. We will also give you an example of this.

We help our clients to have two critical plan elements in place for their trading:

An Action Plan, which is a real case, is more specific, but let us focus on critical elements:

- Define the markets, Instruments and time frames to trade: I trade the liquid futures market preferred as a day trader focused on the E-Mini S&P 500 Contract and Crude Oil futures.

- The Basis of Your Decision Making (system and indicators):

I am using and following the NLT Timeless Concept and Indicators from NLT Top-Line and Trend Catching that help me find key price turning points. My preferred trades are momentum changes, indicated by the NLT Double Decker Change with pre-ceding volume and strong NLT Signals like PowerTower, Floating, and T-Signal.

During the hours of 3 a.m. to 3 p.m. EST, I will use the NLT main-hour timeless increment and, at other times, the off-hour increment. When an NLT Purple Zone appears, no new trades will be opened, and existing orders will be closed. This way, I have no bios when I start in the market; I let the chart tell when to buy or sell and trade what I see!

- Trade Mechanics: For order entry, I will use Buy-Stop and Sell-Stop bracket orders with system-specified price intervals that are either closed at target or stop. This way, I follow system-specific entry, exit, and stop conditions.

A Financial Plan which spells out:

- By my system, I want to achieve a minimum of 65% winners and journal my trades to ensure that I stick to the action plan and financial plan. Then, after every 20 transactions, I do a revision to check and balance the plan to actual.

- Validated goals and objectives: I want to make $1,000 per week, day trading one contract of the /ES.

- Define money and risk management: my average income per trade is $500, and my maximum risk per trade is $600.

- When I achieve two winners in a row, I fold for the day, the same when I have two losing trades.

Those plans we write with our clients, and in more than ten years in business, those plans never were the same.

Why is that?

The affinity to assets, the available time, the risk tolerance, the mix of trades, and so on have never been the same. So when you consider that you can trade Stocks, Options, Futures, and FOREX with our systems and then combine this with individual wants and needs, it gives the answer and why we work one-on-one with our clients at their best available times.

Let us share two trade examples for day traders, one where the trader prefers to trade the hours between 2 p.m. and 10 p.m. EST. Another for a trader who focuses on 7 a.m. to noon. In both cases, you will see an NLT Timeless Chart with NLT Trend Catching, and NLT SPU Move Indicators. The traders combine systems for a higher participation rate. Time-based charts focus on system-defined price increments that keep risk and reward in an acceptable balance; you trade at crucial price turning points that offer enough time to set your buy-stop and sell-stop orders. Orders only go to the exchange when your system formulated price threshold is surpassed in the next candle: You see the crucial price threshold on the NLT Dashboard in the development of the candle.

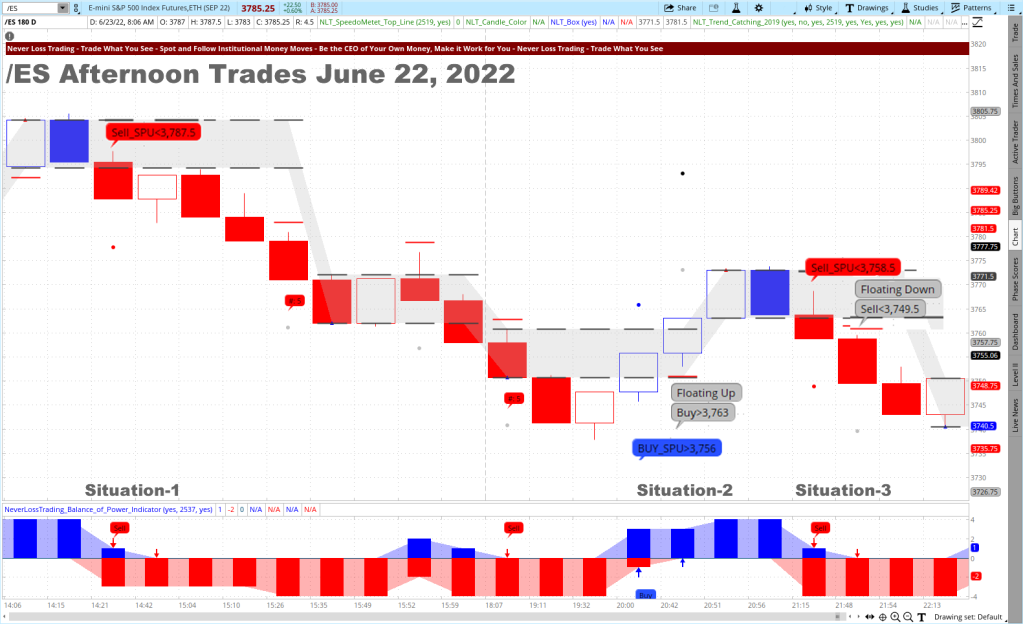

E-Mini S&P 500 Futures Example for June 22, 2022

The observed time had three trade situations, and each came to target.

Situation-1: The entry-level price threshold of Sell_SPU < $3787.50 was confirmed in the price movement of the next candle and led to a trade to target, red dot on the chart. Trading for a price change of about $450 per contract.

Situation-2: Buy SPU > $3756 led to a trade and was followed by a Floating Buy-Signal that allowed to increase the target to the gray dot on the chart, trading for an $850 price change per contract.

Situation-3: Sell_SPU < $3758.50 was confirmed in the price movement of the next candle. The floating sell signal allowed for a target increase for a price change of $850.

In the following example, we find the early morning hours of June 22 and show four trade situations: three winners and one loss.

/ES on the NLT Timeless Day Trading Chart

How did the day continue?

We take the chart from 10 a.m. to 4 p.m. and map out winning and losing trades, accepting trades purely mechanical, while you will learn in our mentorships how to qualify them. On the records for June 22, 2022, were eight trades; seven were winners.

ES on the NLT Timeless Day Trading Chart

In retrospect, this all looks simple, but trust our experience, executing these trades and bringing them to target without the need to interfere is a challenge for every trader.

One of our clients said: “since I trade with NLT Top-Line, Trend Catching and Timeless, I can execute the trade, walk away and let the system do its thing; prior, I had to control every transaction by my fear of losing taking over my emotions.”

When you are a stock trader, let us share an example of a widely liked and well tradable stock: AAPL. We put AAPL on the NLT Daily chart and leave it up to you to find the buy and sell signals and think about if you had invested the way the chart spelled out the opportunities and your results. In case you trade out of an IRA, short selling strategies are not applicable, but you can produce gains to the short side by the NLT Delta Force concept, where you learn how you can benefit from trading options.

AAPL, Daily NLT Top-Line Chart March – June 2022

Consider that the spelled out price threshold had to be confirmed in the price movement of the next candle. Hence, the chart had six trading opportunities, where one got stopped and made a loss (Buy signal on 4-28-22).

Options trading with the NLT Delta Force concept is a solid opportunity for risk-limiting and high-leverage trade participation.

With the NLT Delta Force Concept, you learn:

- Picking the strike price with the highest rate of return

- Choosing an adequate time to expiration

- Knowing the maximum price, you can pay for a single options contract

- If the options price is above the top, how to change the trading strategy to debit or credit spreads

- Decide from the charts of NLT Top-Line and hold positions for one to ten days

When you want to get ready for the bear, build up your trading skill-set, and we are here to help you.

contact@NeverLossTrading.com, Demo.

Here is an example of a day trading journal that gives feedback on how a trader using our systems performed:

You can only control what you can measure: The worst trader has winning trades, and some celebrate those rather than managing their average wins and overall profitability.

Day traders deal with a probability; there is no 100% winning strategy, but you need to map out what works, and this is what you focus on, leaving aside what did not work, period!

We provide pre-fab journals to our subscribers to enter their trades and review them after a set of twenty transactions to see:

- Did you comply with the rules of your system?

- Which indicator and setup gave you the highest returns and which did not?

- Did you hold your trade to target or bail out early?

Let us share an example of how and what such a statistic can look like. The results are from a trader that uses NLT Top-Line, Trend Catching and Timeless. Journaling a trade takes about 30 seconds on our template. Most people hate documentation and administration; however, you will see that this time is well invested in a moment. We also recommend taking a trade entry screenshot to compare in the aftermath if what you thought you traded was what the chart was telling. Trading is a lot about mind control and focus: We see with our brain: all our emotions, past experiences, and influences often paint a different picture from what is there. It will get obvious when discussing the results.

NLT Day Trading Journal Example

Feedback from the NLT Day Trading Journal

- The trader conducted 58 Trades and produced $2,303 of income but wasted a lot of profit by exiting trades early and not at the system-defined target. The trader fell into the typical trap of overwriting the system, which gave him less income than not touching the trade during its duration.

- The new trader achieved a high winning percentage of 72%, complying with the system expectations.

- In 17 trades that went positive, the trader left money on the table by exiting early because of his fear of losing.

- Setting stops tighter than the system proposed and entering late in a trade accounted for 8 out of 58 transactions (14%) and showed room for improvement.

- The overall indicator performance was on spec; however, the Buy/Sell_T performance had a too high average loss compared to the average win by leaving the trade early on winners and accepting the max loss when the trade did not work.

- The highest income-producing indicator was the Floating signal (part of the NLT Timeless Concept).

In summary: The trader still does not trust the system and is scared to follow the set instructions (43% negative performance); even so, the average indicator performance was 72%. Hence, he should walk away after trade entry and come back to see the result, keeping his hands off the computer while being in a trade.

We hope this example demonstrates how a scorecard helps to analyze that you trade your plan to achieve solid and constant returns.

The examples we picked hopefully give you an insight into rule-based trading, where the system formulates specific entry, exit, and stop conditions.

For our subscribers, we create the NLT Alerts where you can find potential trading opportunities for Stocks, Options, Futures, and FOREX. Subscribers receive those in the early morning hours of the approaching day to be ready for trades that day.

Many of our traders combine systems for a higher participation rate: more trades per time unit for higher productivity in their trading endeavors.

Our most popular systems are:

| Type Trader | Program | Focus |

| Beginners | TradeColors.com | Confirmed Price Moves |

| Advanced | NLT Top-Line | Early Price Turning Points |

| Frequent Trader | NLT Trend Catching and SPU Move NLT Timeless | Momentum and Trend |

contact@NeverLossTrading.com, Demo, and find out which system suits you best.

Here are some success principles:

- Trading is about finding opportunities for solid price movements of assets.

- You will not be 100% right in your judgment, and your way of making money is that you are more often right than wrong in your appraisal.

- You want to follow a high probability system and participate in multiple opportunities with pre-specified entry and exit conditions (including the stops)

We offer you knowledge, systems, concepts, strategies, coaching, and training programs to help you develop into the trader or investor you want to be.

TradeColors.com is our entry-level system and offers day traders, swing traders, or longer-term investors a basis for trading at crucial price turning points.

TradeColors.com Daily chart May 20 to June 17, 2022

The chart shows that the system, which trades at two new same-color candles and the high of the second candle ticked out in the price development of the next candle: this was the fact and led to a trade on 5-27-22, which came to target June 2. Next came a short signal on 6-9-22, which came to target on 6-13-22.

Get ready to change your decision-making or system and investment strategies. Ongoing education and mentoring are crucial to longevity in this business. Veteran traders have been through more ups and downs than you can imagine. So, experienced pros have probably experienced whatever you’re going through.

If you are ready to learn, meet us in a one-on-one session where we find out which learning program suits you best:

contact@NeverLossTrading.com Subj: Demo.

We share our experiences and help you build up your trading business.

Trading is not a typical career, and you best learn from those who are long-term in this business to cope with the rollercoaster of the financial markets. We are here to help and provide feedback on what you might be doing right or wrong.

Make a change to your trading results, and we will find out which of our systems suits you best.

Whether the bulls or bears dominate, commit to high probability setups and strategies applicable to every market condition. Limit your risk and follow a business plan for trading success, including an action plan (in which situations to trade and in which not) and a financial plan (how many trades, maximum risk and time in transactions).

Trading success has a structure!

| Assets & Time | Stocks | Options | Futures | FOREX |

| Day Trading | -Timeless -Time-Based | X | -Timeless -Time-Based | -Timeless -Time-Based |

| Swing Trading | -Timeless -Time-Based | NLT Delta Force Concept | -Timeless -Time-Based | -Timeless -Time-Based |

| Investing | -Weekly Decisions -Timeless | -Weekly Decisions -Timeless | -Weekly Decisions -Timeless | -Weekly Decisions -Timeless |

Make a change to your way of trading; we are here to contribute with our education to help you trade in any market condition,

Thomas Barmann (inventor and founder of NeverLossTrading)

Disclaimer, Terms and Conditions, Privacy | Customer Support

No comments:

Post a Comment