Summary: Follow a sound path of acting at crucial price turning points as a day trader, swing trader, or longer-term investor.

Our headline question: “Is there Always Something to Trade?” reflects an inherent problem embedded in trading. People from different careers enter the world of trading with a work attitude – wanting to get things done, with a need to trade to feel comfortable that they accomplished something. However, pros propose only acting at moments and assets with price moves.

Read on and watch the video.

When trading the financial markets, you invest your money for a certain period to yield a return:

- Day trading (opening and closing positions on the same day)

- Swing trading (holding positions for multiple days)

- Longer-term holding, like for weeks and months, we define as investing

Behaviorwise, the action of trading or investing is the same. However, trading leaves you less time to form decisions. In essence: You need a sound decision-making basis to yield repetitive returns from the financial markets. Unfortunately, the ones accepting your offer to buy or sell an asset are ready to take your money. Thus, there is no risk-free return in the financial markets, which spins a multidimensional challenge:

- Find assets with a high probability chance for a return

- Limit the risk so the risk and reward remain in a meaningful relation to yield a return

- Only act when the odds are in your favor

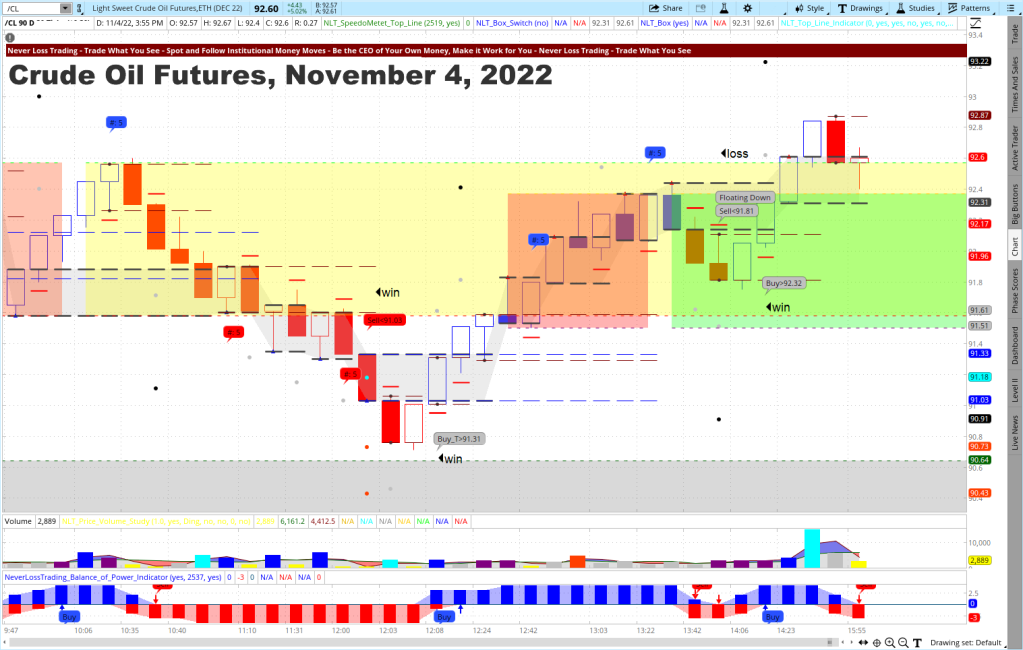

As a trader, you are a probability thinker, making financial decisions by calculating the odds for you to come out favorably.

A simple formula for trading with the odds in your favor would be

If you operated by this imperative, you would not risk your money if the formula equation is not fulfilled.

Institutions appraise balance sheets, management ability, sector strength, competitive advantages and a long list of specifics to which private investors have either no or very late access. Hence, we recommend not competing on fundamentals, but spot and following price moves when they occur. Invest or trade when others have done the groundwork for you and show their cards for you to follow their actions. As a private investor, you can open and close entire positions where institutions have to scale in and out, not drastically to change underlying asset prices.

A recent example: Warren Buffet just swapped GM shares in his portfolio against TSN, and the BRK/B stock had a positive development. So let us check how our indicators put critical price turning points for Berkshire Hatheway on a weekly NLT chart composed of NLT Top-Line and NLT Trend Catching indicators.

The chart shows six potential trade situations: two with a no-trade indication. In the no-trade situations, the price threshold formulated by the indicator: buy > was not surpassed in the price movement of the next candle. As such, the entry condition for executing a trade was not fulfilled. On the other hand, four situations led to trades and came to target (dot on the chart). All trade situations fulfilled the desired risks/reward conditions and allowed the placing of buy-stop or sell-stop orders. This way, you did not need to be in front of your computer at market openings.

BRK/B, Weekly NLT Top-Line and Trend Catching Chart

Of the four situations, two were long-trading opportunities and two asked for trades to the downside. The BRK/B stock is HTB (hard to borrow); by this classification, the stock is unavailable mainly to borrow from your broker for short-selling. Short selling is not allowed if you trade from an IRA; however, we have a solution: operating with an options strategy. BRK/B has a solid options chain, and we share in our mentorships the NLT Delta Force concept: a simple options trading strategy that defines:

- The options delta to operate with

- The time to expiration to choose

- The maximum price to pay or swap to a different strategy

This way, we are de-complexing options trading strategies and allowing you to limit the risk and leverage returns from each type of trading account. The average time to Target-1 was between one and two weeks, and the average return of an options trade was 100%.

The chart shows that half of the opportunities were short-selling situations, asking you as an investor to have an adequate strategy to follow the market direction.

If this is something you want to learn, talk to us about what our systems can do for you:contact@NeverLossTrading.com Subj.: Demo, and ask for our year-end special.

The example also showed no need to stay engaged in BRK/B after reaching the trade target. Instead, you had the chance to invest your money in another asset.

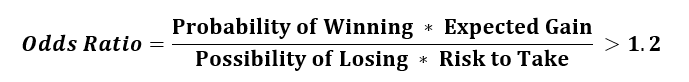

Our TSLA example shows how important it is to have strategies on hand that help you to follow the price direction to the downside: TSLA as BRK/B is hard to borrow as a stock, but our NLT Delta Force Options concept keeps you in business!

TSLA, Weekly NLT Top-Line and Trend Catching Chart

Aside from weekly charts that function more for longer-term investments, our indicators also work for swing and day trading.

The XOM daily chart shows multiple trading opportunities along with the up-trend development we follow with our NLT Trend Catching concept.

XOM, Daily NLT Top-Line and Trend Catching Chart

How to find those opportunities?

NLT Top-Line offers market scanners that help you find and act on assets with crucial price turning points. In addition, we offer a subscription to the NLT Alerts, highlighting assets ready for a price move: Stocks, Options, Futures, and FOREX. Our NLT Alerts are excel-based, so you can modify them to your specific needs, and we highlight assets based on monthly, weekly, daily, and 4-hour price developments.

Our headline question was: “Is there Always Something to Trade?” If you are a longer-term investor or swing trader: Let your system pick when it is time to trade, and when there is nothing to trade, stay in cash and ready for the next price move by letting the chart tell when to buy or sell.

If you like day trading, pick assets that are easy to trade long and short without HTB restrictions: Futures are excellent assets that fulfill this requirement. For day trading, aside from following time-based happenings, we apply the concept of NLT Timeless Trading, where we purely follow price action. Helping you to act at crucial price turning points with less predictability. Here is a chart example for the E-Mini S&P 500 Futures Contract:

/ES, NLT Timeless Day Trading Chart

The chart shows three trading opportunities between 9 a.m. and noon ET; all came to target. Each trading opportunity was good for a price move of about $400 per unit traded and complied with the demanded risk/reward definition of trading with the odds in your favor. Acting on crucial price turning points is essential for you as a trader to achieve long-term profitability. However, you are dealing with risk in each situation, and there is no 100% certainty that the trade will come to your desired target. We focus on high-probability trade setups; our brand name does not mean you never lose a trade; it derives from the concept of trade repair instead of accepting the stop-loss.

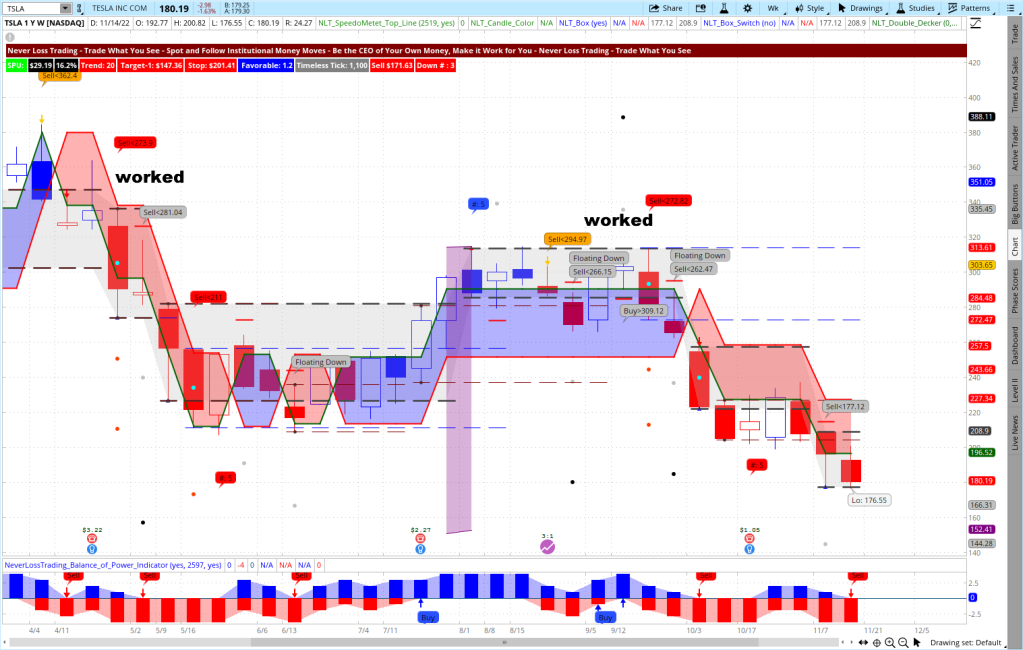

Crude Oil Futures, NLT Timeless Day Trading Chart

The Crude Oil Futures Example shows four trading opportunities; three were winners, and one lost trade. Each situation was good for a value change of the underlying contract of about $300. When you add the opportunities of the E-Mini S&P 500 and Crude Oil Futures Contract, it gives you many opportunities to participate in directional trades at crucial price turning points.

If you want to see more of this:

contact@NeverLossTraidng.com, Subj.: Demo, and ask for our year-end special.

To succeed in trading, you best work with an experienced coach and learn much about trading. Our #1 competitive advantage is the support and customer service we offer. We work one-on-one with you to specify what we teach to your specific wants and needs; hence, if your knowledge base is not expanding rapidly, you are doing something wrong.

Ongoing education and mentoring are crucial to longevity in this business. Veteran traders have been through more ups and downs than you can imagine. So, experienced pros have probably experienced whatever you’re going through.

If you are ready to make a difference in your trading:

We are happy to share our experiences and help you build your trading business. Trading is not a typical career, and you best learn from those who are long-term in this business to cope with the rollercoaster of the financial markets. We are here to help and provide feedback on what you might be doing right or wrong.

Strive for improved trading results, and we will find out which of our systems suits you best.

The markets changed, and if you do not change your trading strategies with them, it can be a very costly undertaking.

We are happy to hear back from you,

Thomas Barmann (inventor and founder of NeverLossTrading)

Disclaimer, Terms and Conditions, Privacy | Customer Support

No comments:

Post a Comment