Day trading has one beauty: You are not exposed to any overnight risk; however, you also do not participate in potential favorable and predictable price breakouts on higher time frames.

Commodities like crude Oil have weekly decision making points (once a week inventories are reported on a worldwide basis), where institutions decide to buy or sell by investing in futures or the spots of the commodities.

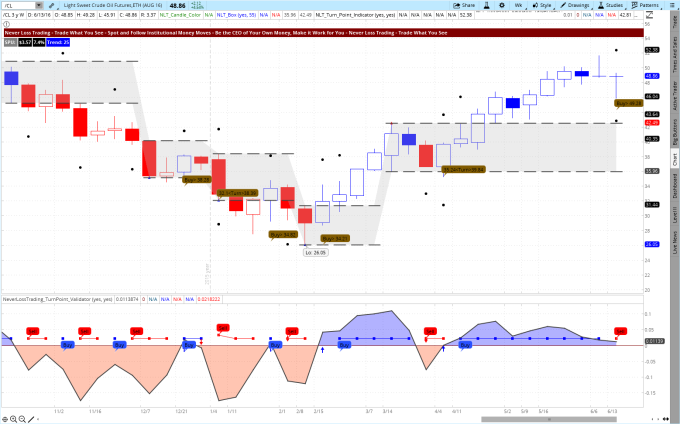

Chart-1: Crude Oil Futures on a Weekly Chart

Imagine, you had an algorithm, helping you to set the target for a trade that shall be reached in 1-4 bars (dots on the chart), when the signal is confirmed by the next candle surpassing the spelled out price threshold: Would this support your trading?

How do we capture a new trade direction?

When institutional leaders make a motion, others recognize the directional trades taken and either confirm or trade opposite to the new direction. If a new strong directional price move is confirmed, you do the most ingenious; you trade with the new price direction, following the NeverLossTrading price move model:

Chart-3: NeverLossTrading Price Move Model

In a simple summary: with the help of multiple algorithms, pre-stages of a change in supply and demand that might lead to a directional price move are detected and reported; however, trades are only accepted when other market participants confirm the new price direction.

Chart-2: Crude Oil Futures on a Weekly Chart with Highlighted Confirmed Trade Signals

Circled-in are confirmed price moves:

- The next candle surpassed the low of a selling opportunity.

- The next candle surpassed the high of a buying opportunity.

- Dots on the chart are calculated price exit points, with the assumption that those are reached in 1-4 bars.

When you are familiar with Crude Oil Futures, you might immediately reply: I am not ready to take the necessary risk associated with entry to stop, to participate in such trade: here, about $3,600 per contract.

How to solve this issue?

What you control the most in trading is the risk you take per trade.

If you have the ability limit your maximum risk on trades that you hold for multiple days or weeks, by trading a derivative that moves with the direction of Crude Oil; but, limiting your risk in $50-increments, then you can participate in longer-term directional price moves without violating your maximum risk tolerance. We share in our mentorships how to put this in action.

Incorporating multiple time frames into your financial plan for trading helps you to build multiple streams of income:

- Weekly income: 1-4 week returns.

- Daily income: 1-4 day returns.

- 4-hour income: 1-2 day returns.

- Day trading income: same day returns.

We just used crude oil as an example; you surely can do the same for currencies, stocks, indexes, other commodities, and basically every tradable instrument.

When you pair longer-term trades with the ability repair a trade, in case it goes against you and you harvest on the leverage, when the trade goes right; do you feel this could make a difference for your trading?

We are launching a new concept: NeverLossTrading TurnPoint Trading (above charts), which is positioned between NLT WealthBuilding and NLT Top-Line.

See our general overview…click.

Our systems work for all asset classes and time frames. If you like a personal demonstration:

Call: +1 866 455 4520 or contact@NeverLossTrading.com

If you are not already part of our free trading tips, reports, and webinars, sign up here…click.

We teach one-on-one and have limited capacity, so do not miss out.

Good trading,

Thomas

See our Disclaimer

No comments:

Post a Comment