A strong stock market year comes to an end: how will 2018 continue?

Read on and watch the movie...click

Trade condition to:

Our systems work on all time-frames, tick-charts, range-bars.

E-Mini-S&P 500 Futures 1-Hour NLT Top-Line Chart for December 7, 2017

E-Mini-S&P 500 Futures 30-Minute NLT Top-Line Chart for December 11/12, 2017

You use the lower red line when trailing your stop.

With the help of our trading systems, training, and coaching, you experience:

Call +1 866 455 4520 or contact@NeverLossTrading.com

Sign up for our free trading tips, reports, and webinars…click

We are looking forward to hearing back from you,

Thomas

www.NeverLossTrading.com

Disclaimer, Terms and Conditions, Privacy

Read on and watch the movie...click

- Do you have a system that tells you where prices move?

- Let the chart tell when to buy or sell.

- Can you make money, when the market goes sideways?

- Are you prepared to make gains if the market goes down?

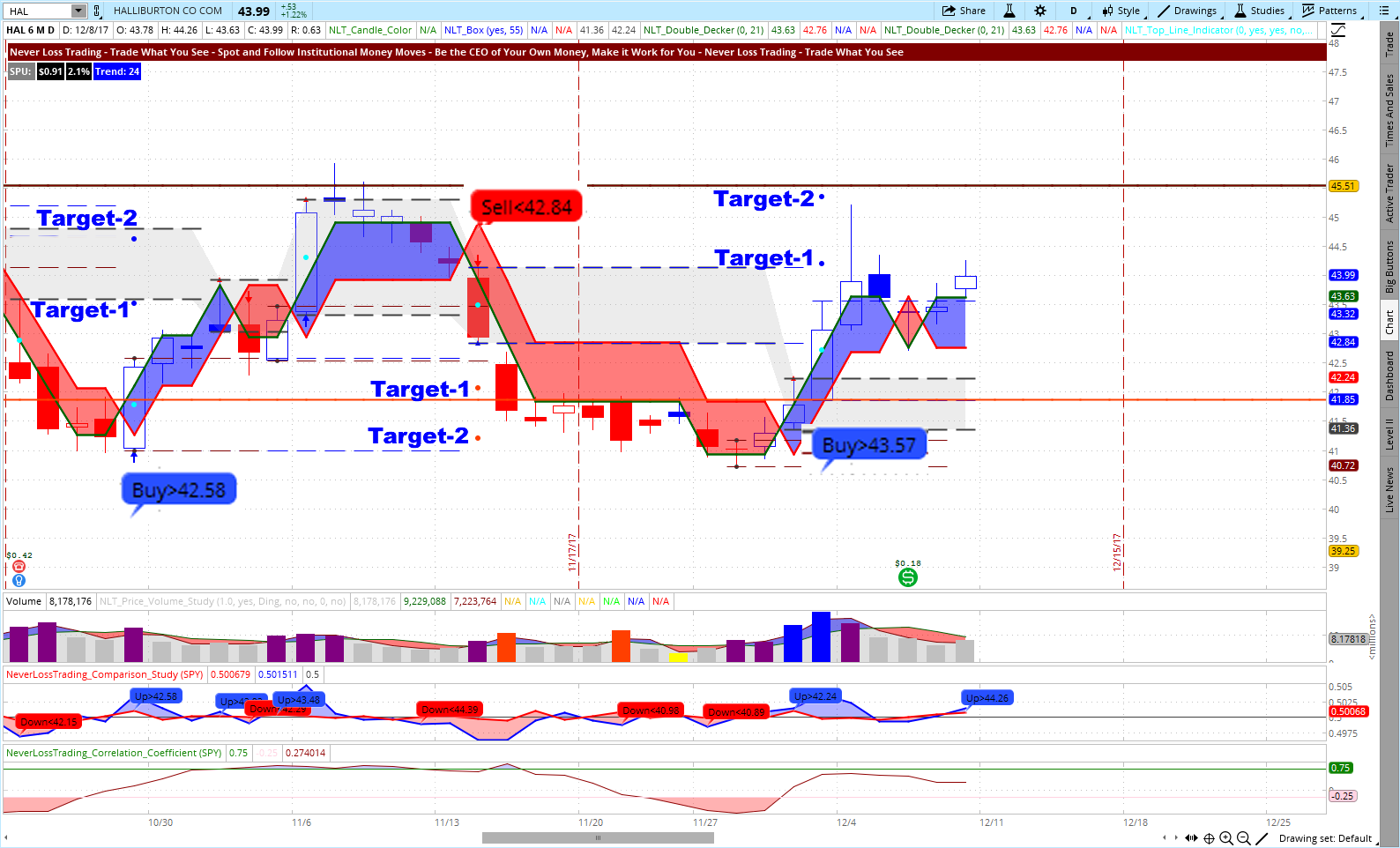

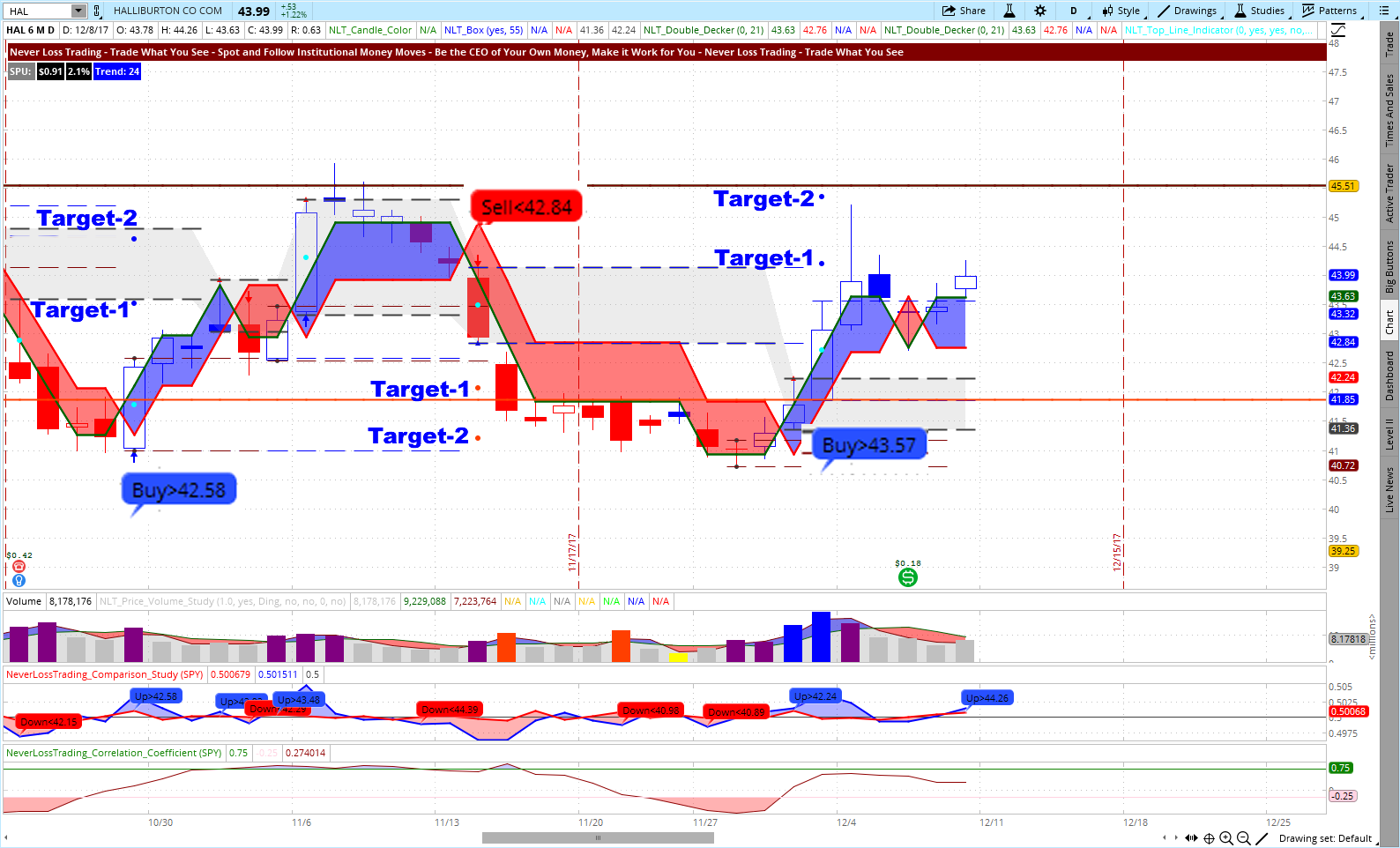

HAL Daily NLT Top-Line Chart

Trade condition to:

- The next candle on the chart hast to surpass the set price threshold for us to enter long or short.

- Target-1 and target-2 are spelled out on the chart; expecting an 85% likelihood that the price development, halters, retraces, or reverses after target-2.

- Knowing the maximum time in the trade at entry.

- Applying specific options strategies so you can leverage your investments and short from IRA or other cash accounts.

Our systems work on all time-frames, tick-charts, range-bars.

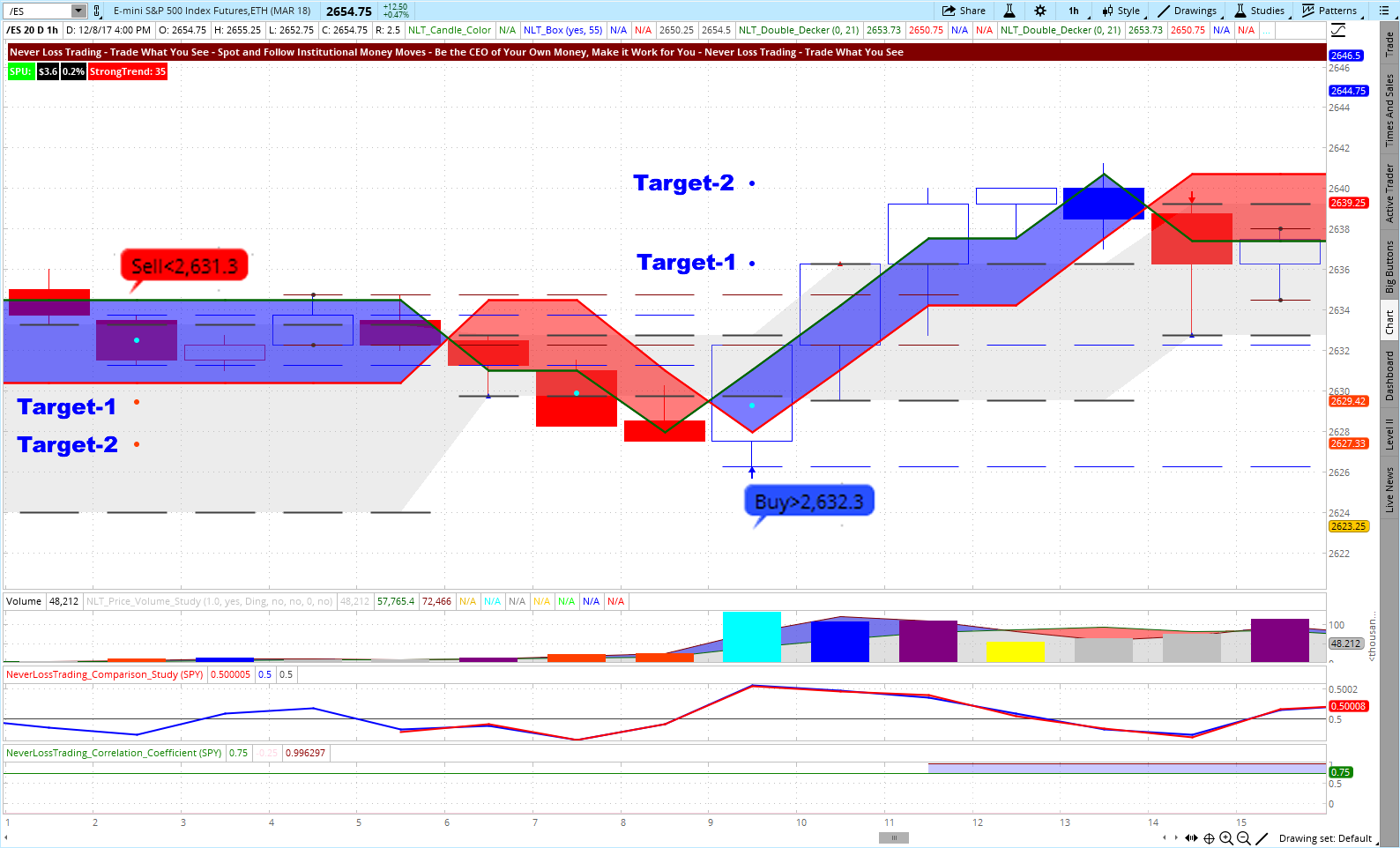

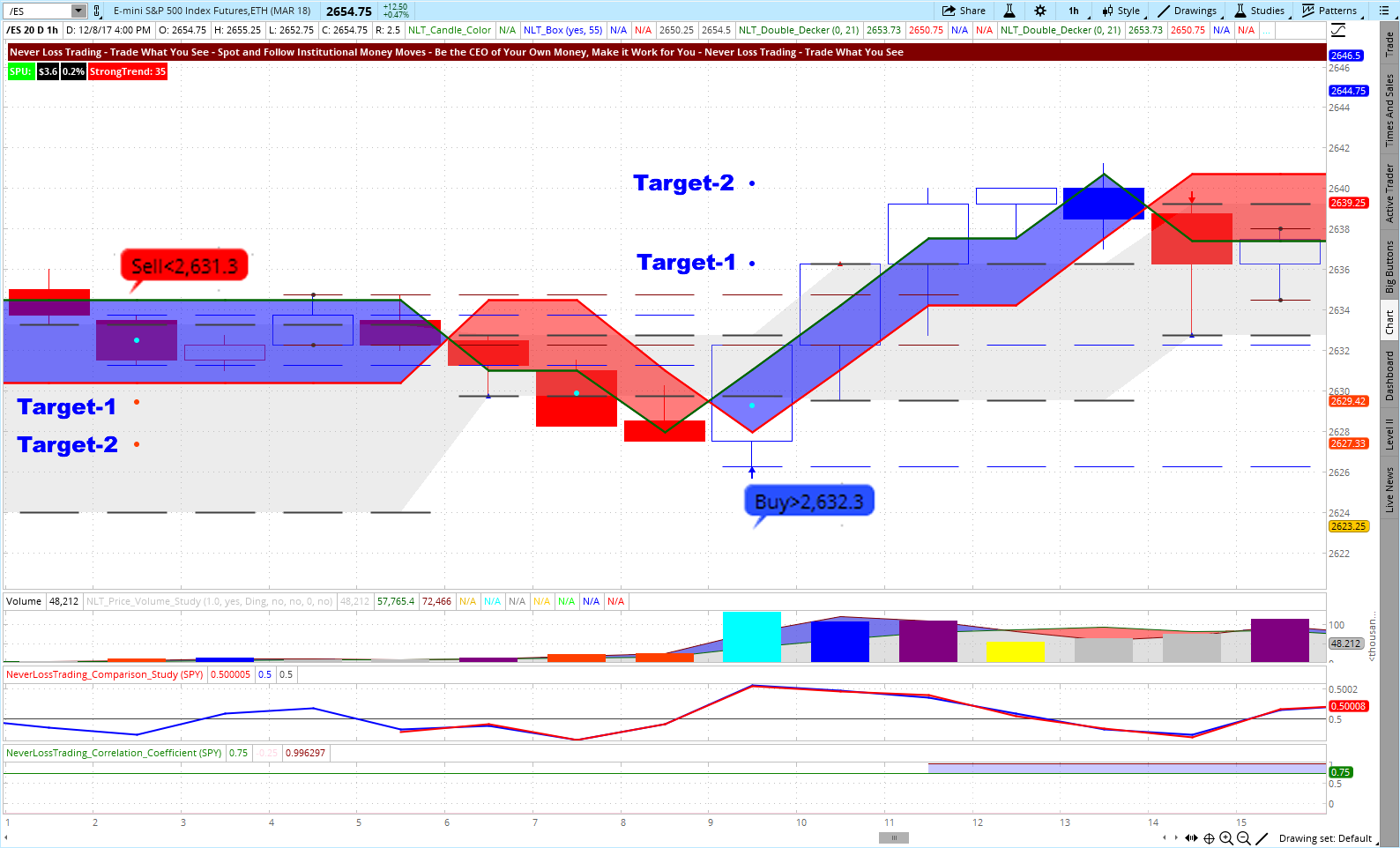

E-Mini-S&P 500 Futures 1-Hour NLT Top-Line Chart for December 7, 2017

E-Mini-S&P 500 Futures 30-Minute NLT Top-Line Chart for December 11/12, 2017

You use the lower red line when trailing your stop.

With the help of our trading systems, training, and coaching, you experience:

- How high probability trade setups can be found based on the underlying pre-stage of a price move.

- The importance of projecting at entry how far the price move shall reach and where to put a key action stop, to stay out of the natural volatility of an asset - combining the two for trading with the odds in your favor?

- To apply multiple trading strategies for hedging and leveraging positions.

- The power of position sizing, considering the strength of your trade setup by a minimum and maximum risk assessment.

- Having and operating with a business plan for trading success: Financial Plan (what to expect) and Action Plan (how to act).

Call +1 866 455 4520 or contact@NeverLossTrading.com

Sign up for our free trading tips, reports, and webinars…click

We are looking forward to hearing back from you,

Thomas

www.NeverLossTrading.com

Disclaimer, Terms and Conditions, Privacy

No comments:

Post a Comment