Summary: Men and women take a considerably different trading approach, and all of us can learn from this to increase our return expectations by following more probable success principles.

Retail traders show a dominance of men with interest and actual trading: By our analysis, women represent less than 20% of the active traders. There are various theories as to why; however, we want to focus on sharing if we see a considerable difference in the trading approach and what we can learn from it?

Base Hypothesis

The difference in the behavior of men and women produces a discrepancy in the return expectation from trading or investing.

However, can we observe and determine fundamental differences between male and female trading behavior?

Let us relate to some statistics by the University of California and our research of working for more than ten years with individuals, teaching and coaching how to trade with the NeverLossTrading systems:

Men trade with a 45% higher frequency than women and produce lower average returns.

This finding would lead to the following deduction:

The less a person trades, knowing what they do, the more likely they will do well.

Reasons for fundamental differences of men and women in trading:

- In trading, your system is supposed to tell when to buy or sell; however, at times, there is nothing to do, and men feel they done nothing if they did not trade while women more willingly comply with the rules of only trading when the perfect moment is there.

- Women consider more factors in their trading decisions. Opposite to this, men have a higher tendency to act overconfident and impulsively. They take greater risk without looking at the bigger picture and tend to urge revenge trades after they booked a losing trade: now it has to work, period!

- Women traders create greater financial returns by acting less frequently and holding positions to the system-specified target. On the other hand, men often tend to cut their trades to targets short (anticipating, it could turn in the opposite direction).

- Women are more likely to deliberate before placing a trade and don’t enter until their belief in the trade is high, often waiting for multiple indicators to be in sync and then act.

- Generally, women don’t take sub-optimal setups as often as men, producing a higher winning percentage.

- Men are more prone to refusing to admit when they are wrong and hold on to losing trades longer than they should, hoping that they will turn around. On the other hand, women tend to admit mistakes more quickly and are more willing, and they tend to adhere to a strategy more strictly and are better at cutting losses.

- Men tend to seek entertainment in trading, where they like to act on very short-term happenings, not considering that by the pure setup of the trade, considering slippage and commissions, they trade for action and will never make a return. On the other hand, women are faster convinced and apply a meaningful approach to act at situations and setups where the odds are in their favor.

- Conserving capital is essential in trading, and the available data suggests that women tend to be more risk-averse than men. As a result, they trade less often and execute less risky strategies.

- Female traders may also be more likely to focus on a smaller asset base, allowing for more knowledge gathering and better management of trades with fewer areas to watch.

- Some researchers consider men to be more competitive. In contrast, women might avoid getting caught up in the adrenaline rush of the moment and focus instead on their eventual spending goals.

- Trading is a male-dominated arena; women who choose a career in trading are still in the minority and can therefore be more determined to succeed, including to dedicate time to practicing strategies and finding a mentor whose advice they feel comfortable heeding.

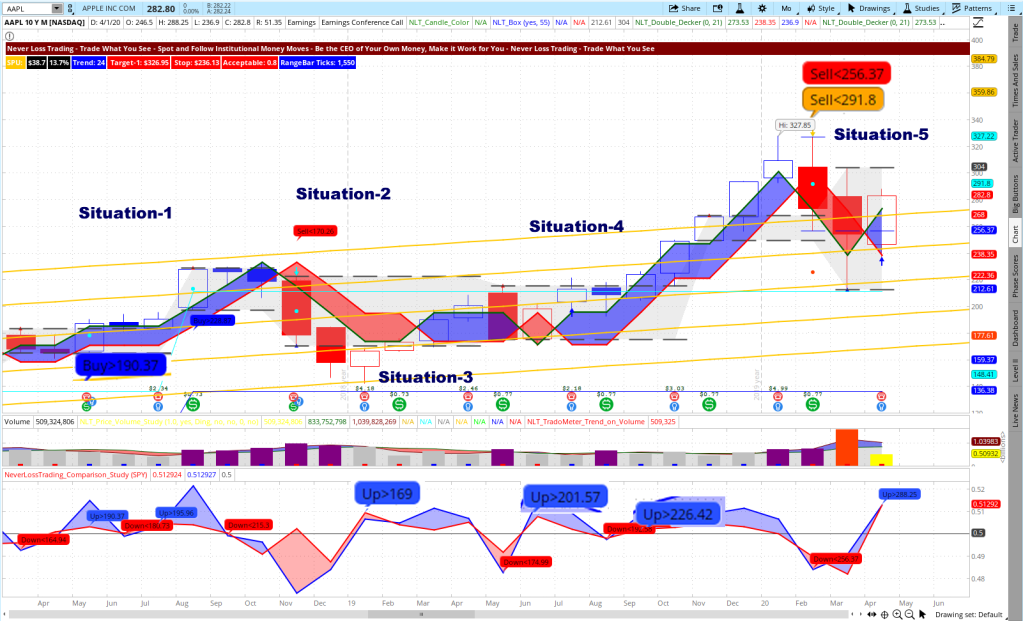

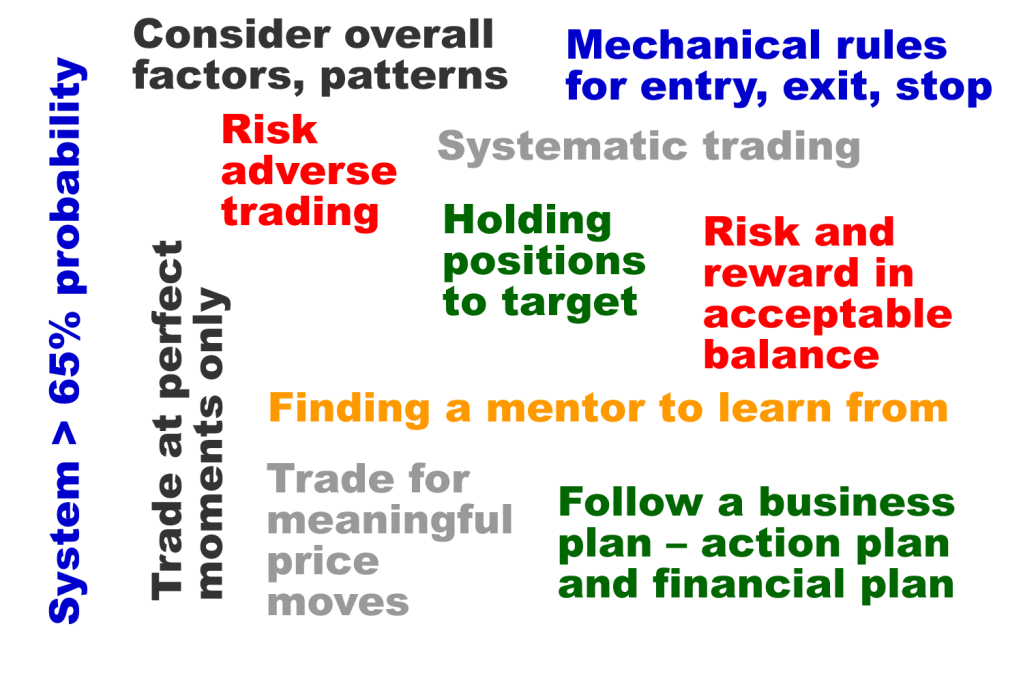

Let us put our findings into a summary graphic:

Crucial Trading Success Factors

Now that we pointed out many differences, the conclusion for you are a reader, male or female, is:

- Trade with a high probability system gives you mechanical rules for trade entry, exit, stop, or adjustment.

- Have a business plan for trading that you stick to, containing an action plan (when and how to trade, when not) and a financial plan (assets, timeframes, return opportunities and the financial goal).

- Analyze the situation well and take fewer and high quality/high probability trades only.

- Do not add to losing positions and hold your winners to target.

In our mentorships, we help you have all this in place, but you still have to work with your inner nature, in particular, when you are a man. Please take a look at the overview of what we want to share with you when you are working with us:

NeverLossTrading Mentorship Program Elements

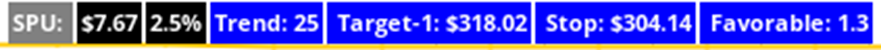

At an algorithmic trading house, we want to quantify the difference in trading behavior and share some trade examples, building an income expectation model based on the NLT Timeless Concept. A concept where we focus on trading for pre-defined price increments rather than deciding on a time-based perspective.

Our goal is to determine with a quantitative model which behavior is more likely to lead to higher returns, and we choose day trading with futures. If you are not considering futures trading by today, let us quickly give you in a short overview the advantages futures trading can provide you:

We hope this simple graphic explains why futures trading is essential as an investment vehicle. However, there is another dimension to it: You can protect your assets using futures contracts for overnight hedging, and we explain all this and more in our mentorships.

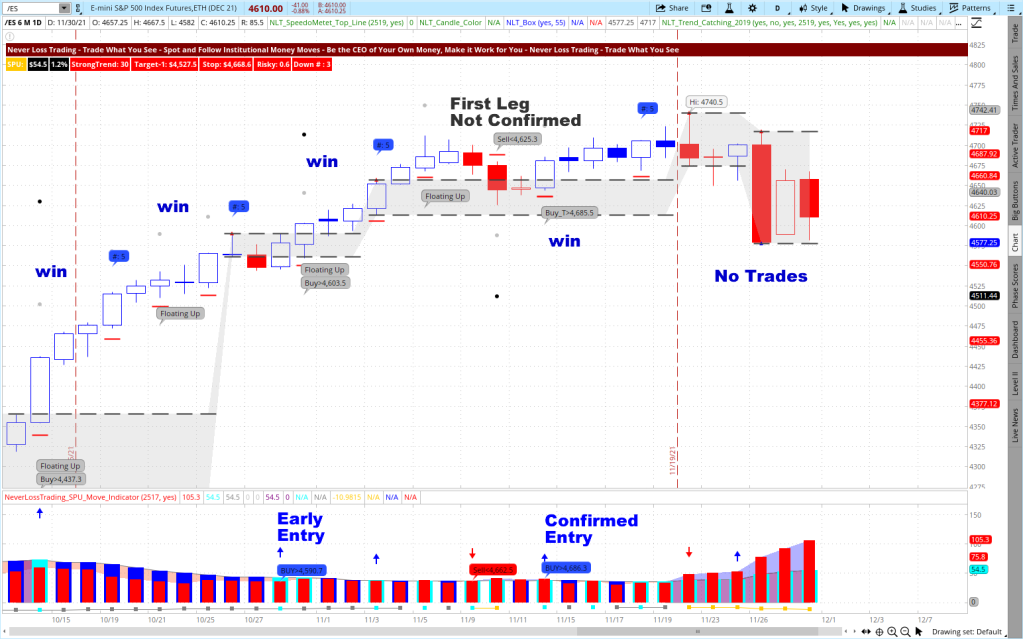

With NLT Timeless Investing, we anticipate holding positions between one to five weeks, striving for targets above 100 Points (a price change of the underlying E-Mini contract ≥ $5,000).

E-Mini S&P 500 Futures, NLT Timeless Investing Chart

From September 2020 to the end of July 2021, the NLT Timeless Indicators painted multiple trade situations on the E-Mini S&P 500 Futures chart. By following the rules, the trade exit was either at target, stop, or close candle #5. The chart shows eight trade situations:

- Seven winners

- One loss

The NLT Timeless trading concept lets you act different, unpredictable and at high probability setups, with pre-specified reward/risk scenarios, providing you with opportunities for:

- Day Trading (multiple trades per day)

- Swing Trading (holding between one and five days)

- and Longer-Term Investing (holding for one to five weeks)

We definitively prefer and recommend taking part in each of those trade perspectives, producing multiple streams of income.

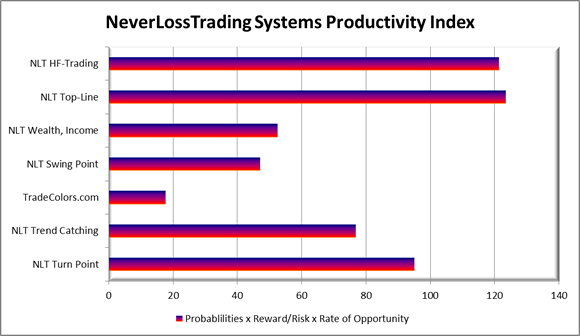

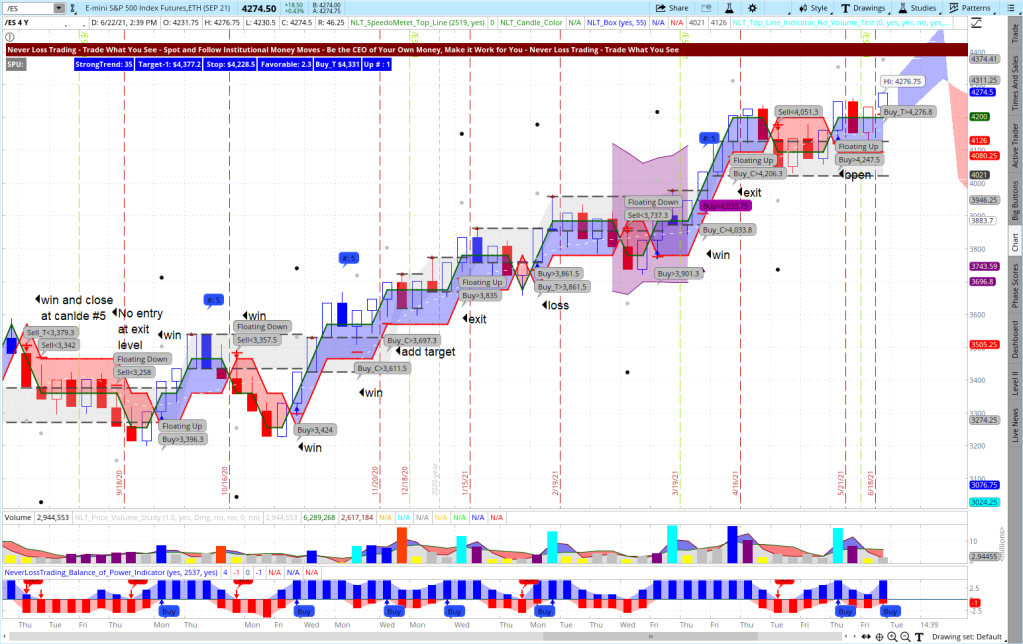

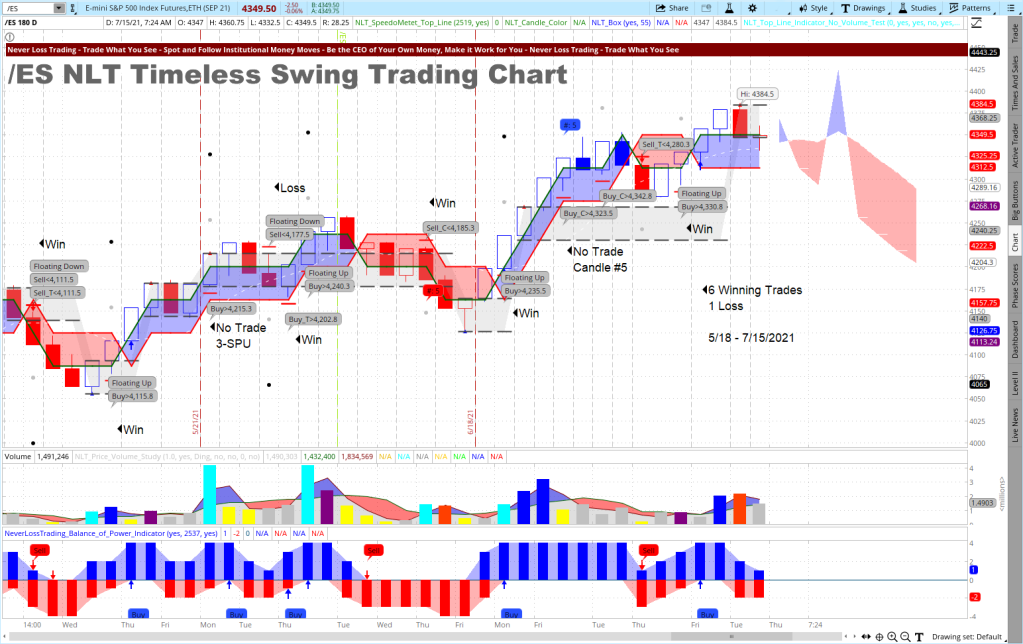

NLT Timeless Swing Trading Example

The NLT Timeless Swing trading example shows seven trading opportunities in the observed timeframe of May 8 to July 15, 2021. Six of them came out winners and one loss: definitively high probability.

The average value change of the underlying futures contract in our example was around $2,000. When the associated risk would be outside your risk definition, you could also work with a micro contract, reducing your risk to 10% of the E-Mini contract which trades we share.

There are several rules in making sound trading decisions, and we share those with you in our mentorships. So let me invite you into some:

- The dot on the chart specifies the target, but you can also read the target from a dashboard on our charts.

- Stops are indicated by red crossbars.

- On the chart dashboard, you will also find an indication of where to place your buy-stop or sell-stop order and your trade will only be filled if the price of the underlying reaches the critical price threshold.

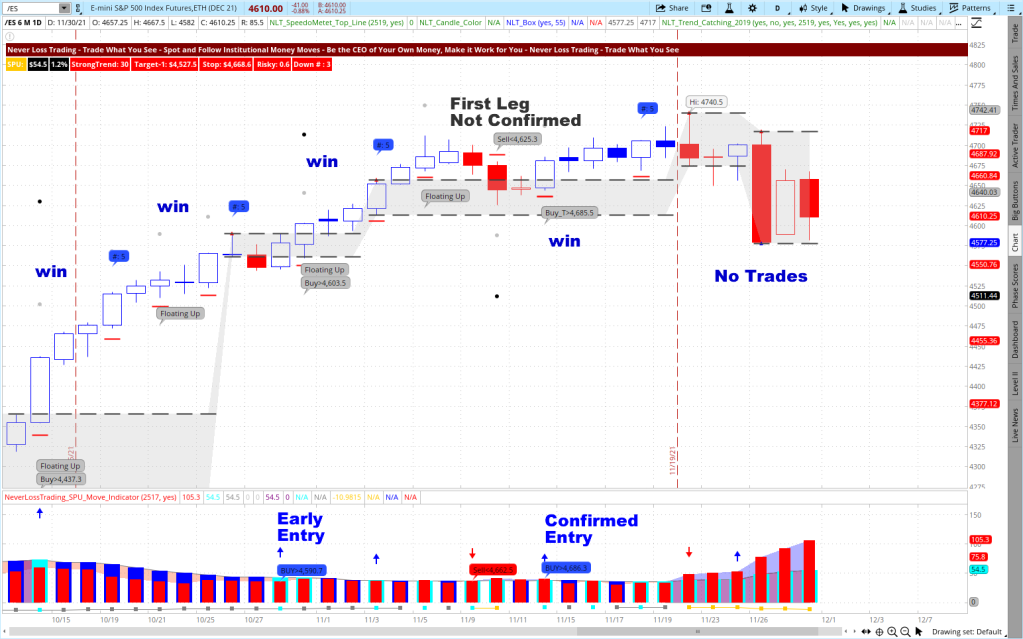

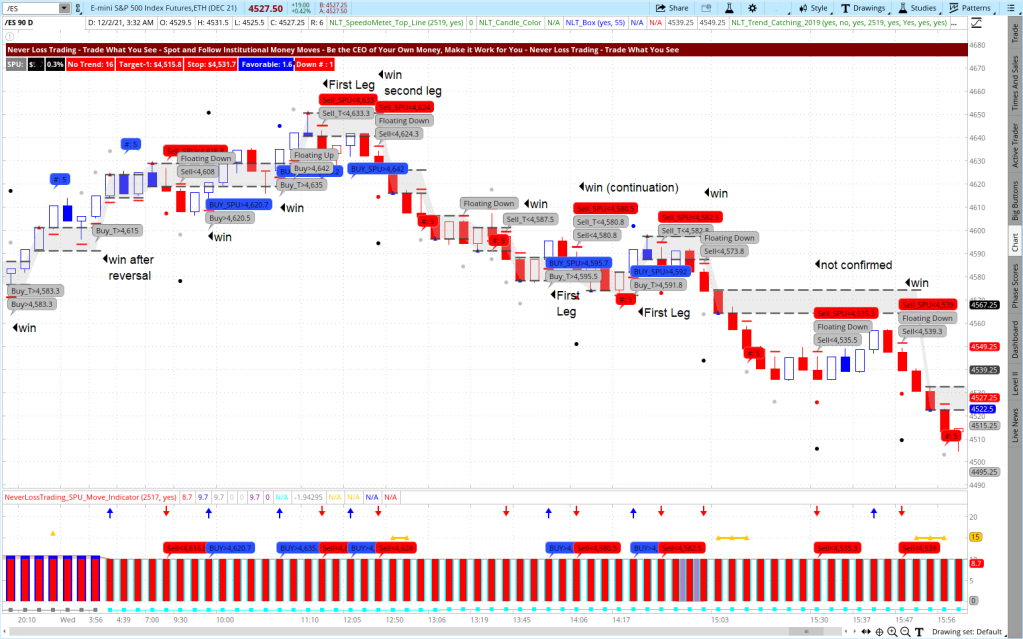

NLT Timeless Day Trading Example

In a 24h period, the system produced six trading opportunities, and when focusing on multiple futures contracts, you can decide from a sound basis for day trading.

NLT Timeless Trading is only one way of putting our systems in action. We work one-on-one with our clients and develop tailored strategies around the use of our systems that fit your circumstances, wants, and needs. To experience how our systems work real-time, schedule an online meeting with us:

contact@NeverLossTrading.com, Subj.: Demonstration.

After a short demonstration of how our systems work, let us continue in calculating the effect of a behavior difference in trading:

Base Behavior Expectation

Do not come to trading with a work attitude. Making money in trading requires an intelligent attitude: Cash in your profits and leave the risk to somebody else!

Base Hypothesis

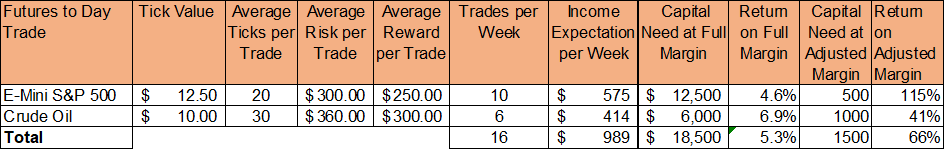

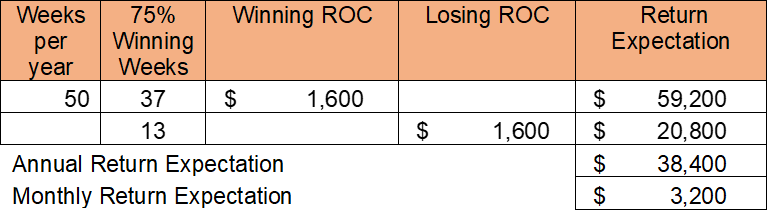

An average expectation of 5% ROC per week on the full margin allocation is feasible, and we want to calculate the difference between more and less frequent trading.

Calculation Model

If you reach 5% ROC per week 75% out of 50 trading weeks, this will result in an annual return expectation of 107% ROC. Based on our model, you are looking at $1,500 of income per month when trading one contract.

To increase the income from trading, you have these choices:

- Add more capital to the full margin broker account

- Move to a budget broker account that allows day trading at reduced margins with multiple contracts

In addition, you can change behavior with a focus on trading less by reaching just one winner per day with the E-Mini S&P 500 contract (four per week) and two winners with Crude Oil Futures per week.

Just spot perfect setups, react, and be good.

Acting like this will increase your earnings expectation by 60%.

Hence, close the trading day after one winner in each category based on the weekly budget, trading one contract.

If you get this done 75% of the time and budget a maximum loss of the same amount 25% of the weeks, it will result in a 2.3-times or 230% increased earnings expectation:

By trading less and with more accuracy, you increase your return expectations, and you still can increase the number of contracts to trade by adding money or moving to a reduced margin broker.

What we shared in our day trading futures example also counts for stock trading, options trading, and FOREX trading.

We are more than 10-years in the trading education business, teaching one-on-one at your best available days and times.

Trading our own account day-by-day and helping clients lets us provide long-term experiences and support.

Customer service and tailored mentorships are our virtue. Following this principle, we provide:

- Server-installed Software

- Real-Time Data

- System-Defined Entries, Exits, and Stops

- Position-Sizing

- Time-in-a-Trade

- Trading-Strategies

- Risk-Handling

- Business Plan (financial- and action plan)

- Own scanners to find investment opportunities

- Watch list indicators for finding changes in supply and demand on multiple time frames

Basing your trading and investing decisions on defined rules is learnable, and we are here to support you!

Schedule your consulting hour! Working one-on-one spots are extremely limited: Do not miss out!

+1 866 455 4520 or contact@NeverLossTrading.com

Five Dimensions of Trading and Investing Decisions

Follow our free publications and webinars…sign up here, and we are looking forward to hearing back from you,

Thomas

Disclaimer, Terms and Conditions, Privacy | Customer Support