We invite you into probability thinking. Trading is about controlling the risk and estimating the probability of winning. Read on to learn what is needed.

Recently, a gambler explained a winning roulette-playing strategy in a promotional video on my Facebook account. Based on an American wheel, his bet was $25 per column, choosing two columns and repeating the bet. Following the Martingale principle, he doubled his bet when losing and folded his game when he was winning $200, with a maximum risk to take of $650. Let us now validate the base assumptions made to get to the desired $200 income and the probability of this happening. Then, to validate if this can be a winning strategy, we look at what is needed to achieve the goal and what happens in case everything goes wrong.

In the first step, we will check the base assumptions of this strategy to see if it will lead to positive expectations.

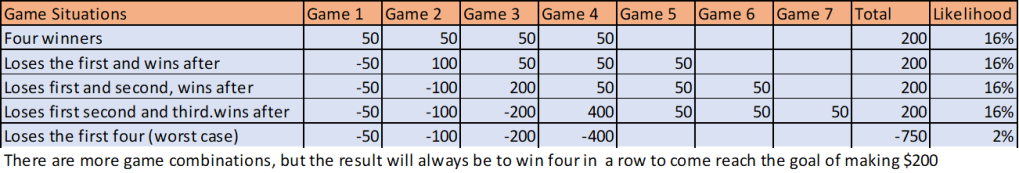

Roulette Strategy Probability Table Example

Here is what we calculate with simple math:

- When you lose, you waste $700 or $750 and not $650, as assumed

- Betting on 24 out of 38 numbers gives you a winning probability of 63%, and the odds seem to be in your favor. However, to produce an income of $200, you need to win either three or four times in a row, and the likelihood of such a winning series is only 16% or 25%

Taking a shortcut: the shared video did not offer a winning strategy but was well presented. If this worked, everybody would break the bank.

How can we translate this as being a trader instead of a gambler?

The roulette example invited you into the world of probability thinking, and in trading, you can find ways to bend the odds in your favor by acting at high probable price turning points. Your advantage in trading or investing is that individual happenings are not random; they are connected or correlated to underlying structures that we can measure and forecasted with a substantial probability.

We use the words trading or investing synonymously, behaviorwise the same is required:

- Traders hold open positions for shorter periods (day trading, swing trading)

- Investors keep open positions for weeks, months, years

Trading decisions are, mathematically speaking, a Markov chain and not a Finetty happening (random price move). Hence, with the right system, you have an edge in producing income from the financial markets with a high likelihood.

Using a high-probability system and appropriate strategies, you can act with the odds in your favor. Opposite of gambling, where the house always wins. Bring your computer to the casino and count the minutes until you are asked to leave. In trading, you can use computers and AI technology to form sound decisions and act from the comfort of your home. Trading and gambling mentality drastically differentiate:

Most gamblers have insufficient knowledge of probabilities and overextend risk (like in the example we shared).

Trading success comes from a sound knowledge of complex ways of trading or investing, with stringent money management, risk control, and following a business plan (action plan and financial plan). Even though this sounds challenging, we will help you take shortcuts, simplifying the undertaking to reach reasonable conclusions to complex trading problems quickly.

In a short overview, this is what is needed to succeed:

Critical Elements for Trading Success

| Usual | Success Factor | Needed |

| Average 50% – 55% or no system with interpretation on entry and exit | System | High probability ≥65% with hard-coded entry and exit rules |

| Trading at free will with open decisions of when and how to trade | Discipline | Following a plan of when to trade, how often, and minimum expectations to accept a trade |

| One trading strategy to follow and strategy change when losing trades | Strategies | Multiple risk-limiting strategies related to chart setups and the assets |

| Equal risk allocation or high-risk acceptance without rules | Money Management | Allocation rules for the risk to take and trade repair ability |

| Focus on limited assets, regardless of the stage of a price move they are in | Trade Finder | Own a market scanner or subscription to system-based market alerts |

| No performance measure in fear of making transparent to yourself what does not work | Score Card | Keep a record of what worked and what did not. Continue what worked and strive for constant improvement |

If you like to read the details of how to implement the trading success elements in a free PDF document:

contact@NeverLossTrading.com Subj.: Path to Success

Our article shares multiple ways of identifying and extrapolating critical price turns for day trading, swing trading, and longer-term investing.

The name NeverLossTrading derives from the concept of repairing trades: never stop loss trading was a bit lengthy. In no way do we want to promise never to lose a trade, but we propagate high probability trading for retail traders. We have been in business since 2008, helping individuals master the challenges of the financial markets.

Rate yourself where you stand in the six critical success factors for trading:

If you can put a checkmark on each success factor in the column: Need, there is little we can add to your trading; if not, get ready to make a change.

In the past, algorithmic trading was solely available to institutional investors, but we put in the work and effort to offer adequate systems to retail traders at affordable rates. Our offering for NLT systems ranges from about $2,500 for TradeColors.com to $15,500 for the combination of NLT Top-Line and Trend Catching, and we work one-on-one with you to apply our systems for your decision-making best.

With NeverLossTrading, all financial markets can be traded, while we mainly focus on liquid markets in the arena of stocks, options, futures, and FOREX. We offer a robust framework of constantly adjusting to actual algorithms that contain an AI component and, with that, recalibrate constantly. Our systems provide broad flexibility because they allow us to scale up and react quickly in different products and markets. The most practical approach for us is to use algorithms to process data and then leave it to humans to make the decisions. Price, volume, and volatility are our data inputs to mathematical models. In addition, we teach various strategies to act on price changes, limiting the risk and leveraging profit opportunities.

The advantage of NeverLossTrading is that it allows for the optimal use of available data and reduces or eliminates the emotional decision-making that can occur during trading.

Our algorithms collect underlying changes in supply and demand to extrapolate potential price moves with system-defined entry, exit, and stop decisions.

Trading is learnable: we take a holistic approach considering all crucial elements needed to succeed: It takes multiple dimensions to turn yourself into the trader or investor you want to be, and we support you in acquiring the knowledge and skills needed.

Success Factors for Trading and Investing

NeverLossTrading stands for high-probability algorithmic trading, where you stay in command of pushing the trade opening button: target and exit are systems defined, and you will only act in situations where risk and reward are in a meaningful balance. We are happy to share our experiences and help you build your trading business. Trading is not a typical career, and you best learn from those who are long-term in this business to cope with the rollercoaster of the financial markets. We are here to help and provide feedback on what you might be doing right or wrong.

Strive for improved trading results, and we will find out which of our systems suits you best.

The markets changed, and if you do not change your trading strategies with them, it can be a very costly undertaking.

We are looking forward to hearing back from you,

Thomas Barmann (inventor and founder of NeverLossTrading)

Disclaimer, Terms and Conditions, Privacy | Customer Support

No comments:

Post a Comment