Successful trading in the dynamic world of financial markets requires a unique combination of skills and mindset. While technical analysis and market knowledge are essential, the skills and attitudes of traders play a pivotal role in achieving long-term profitability. This article will delve into the key attributes defining the most successful traders, providing insights into the qualities necessary for trading excellence.

- Discipline

Discipline is the bedrock of successful trading. Top traders possess the ability to follow their trading plans rigorously and adhere to established rules. They understand that discipline is essential to minimize emotional decision-making, control risk, and maintain strategy consistency. By exercising discipline, successful traders avoid impulsive actions and stay focused on their long-term goals.

The hidden message is to have a plan that spells out when to trade, how often, and what meaningful financial results to strive for: together with our students, we write such a plan as a leading guideline for their trading decisions. Without a written plan, the likelihood of being successful diminishes.

“If you fail to plan, you plan to fail.”

2. System

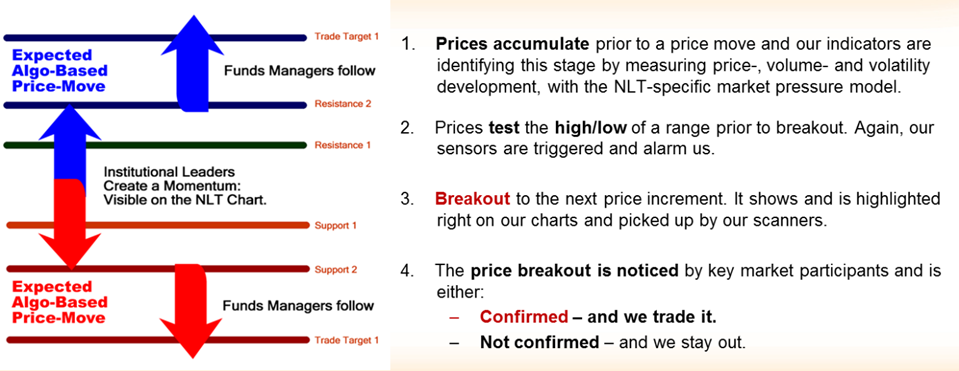

Solid trading decisions are system-based, where multiple indications work together to spell out high-probability trade setups.

Let’s start with a day trading example to demonstrate aligning at first the trade mechanics:

- System-specified price thresholds to enter trades so that you can operate with buy-stop and sell-stop orders in the development of a price move

- Forecasting high probable exit points where your trades close with limit-orders

- Set risk/reward-adequate stops to bring your trade to target and not violate risk acceptance rules

- Having multiple indicators confirm crucial price turning points to increase the probability of success by combining strong price move indications with channel breaks and no hindrance to the target.

NLT Timeless Day Trading at Channel Breaks

On the above day trading chart, you see two channels: gray and yellow. High probability setups are when price moves breakout of the channels or revert to the channel.

Situation-1: Buy > $1,0808, breaking out of the channel and reaching its target (gray dot)

Situation-2: Sell_T < $1,0822, moving towards the gray channel, reaching its target (gray dot)

Situation-3: Buy > $1.0819, passing the yellow channel and reaching its target.

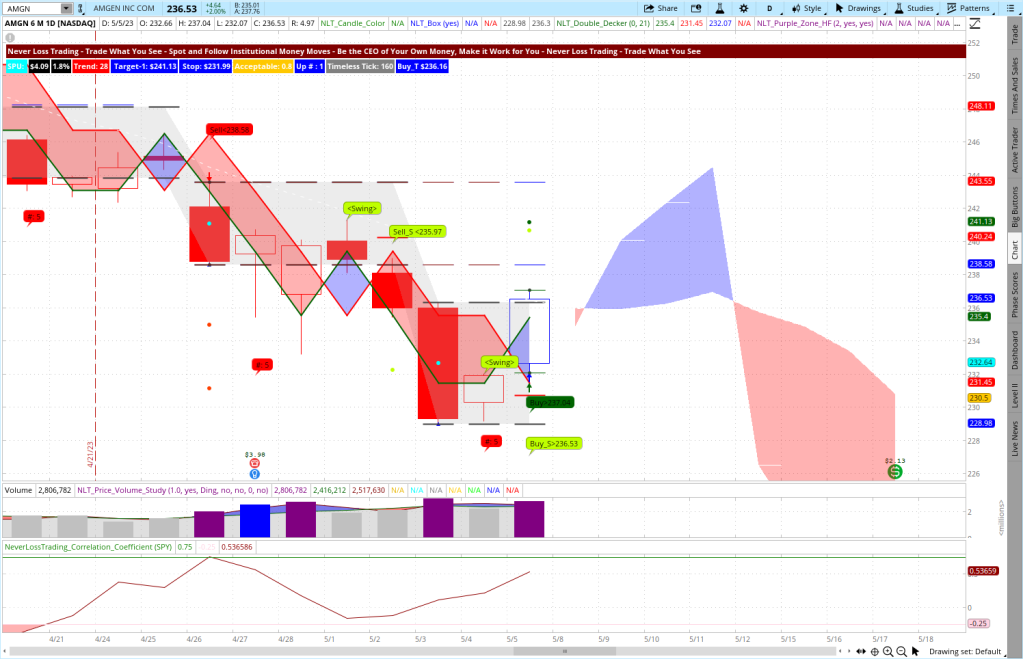

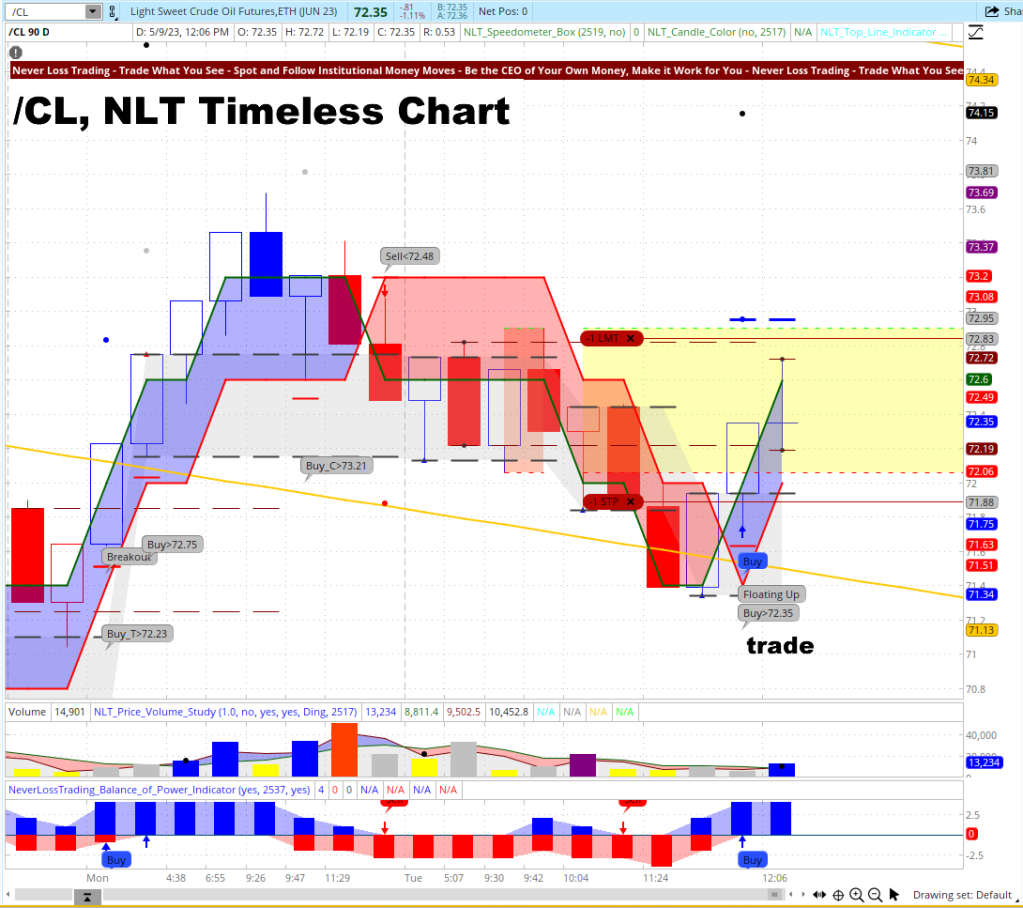

Next, you see a live trade on the NLT Timeless Crude Oil Futures chart to the opposite side of the channel with Buy > $72.35. The trade was good for a price change of the underlying contract of about $600.

NLT Timeless Day Trading at Channel Breaks

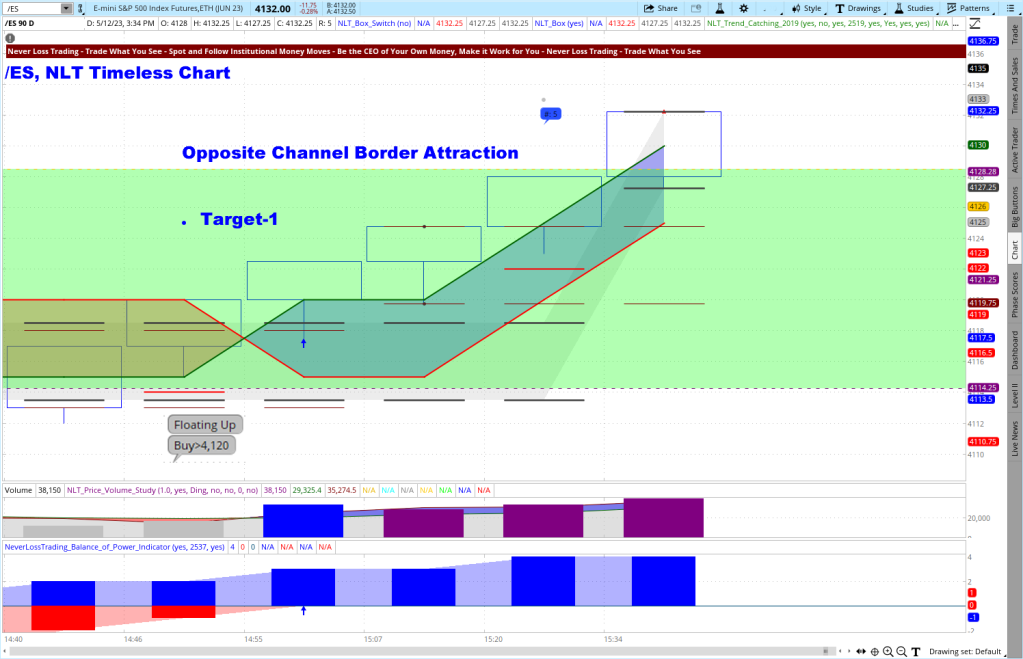

Futures offer solid day trading instruments where the /ES, E-mini S&P 500 Futures Contract is the most favored.

NLT Timeless Day Trading at Channel Breaks

The trade was good for a $262.50 price move per contract.

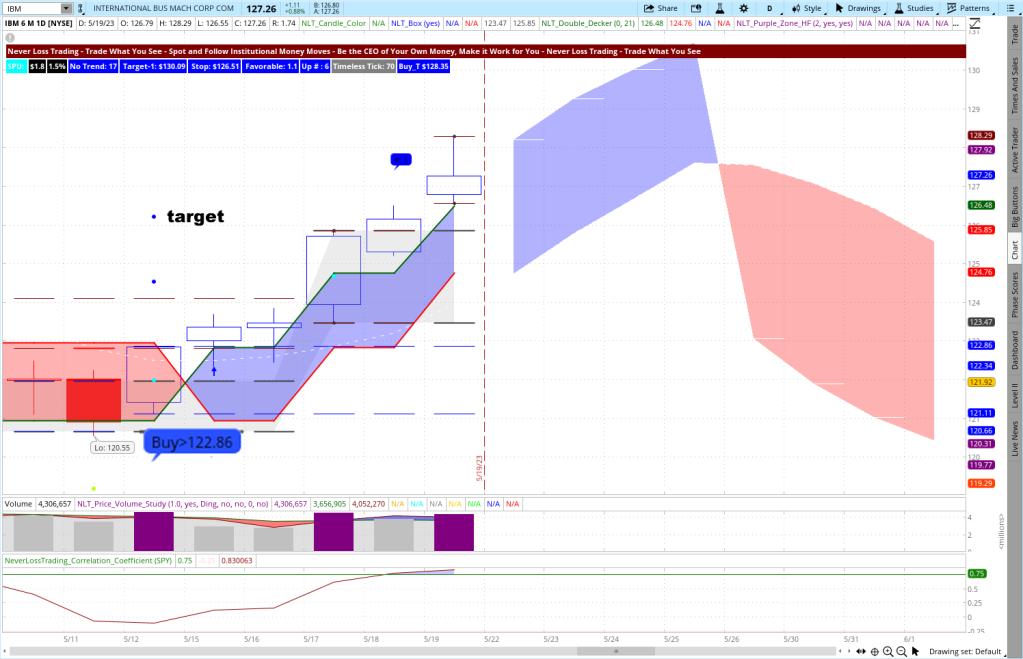

If you prefer to swing trading stocks, here is an example of a swing trading chart, where we are looking for a firm price indication and an independent or uncorrelated price move, which was the case for IBM with the signal: Buy > $122.86, on May 12, 2023, which came to target on May 18, 2023. Of course, the price went higher on May 19, 2023, but we follow a discipline and exit trades when the system specifies it. The bottom of the chart shows the correlation study: blue caps show stocks that are highly correlated to the overall market movements, and red caps identify opposite correlated movers (market goes up, they go down, or vice versa). We prefer to trade uncorrelated instruments (indications ranging between correlated and opposite correlated).

NLT Uncorrelated Price Move (IBM)

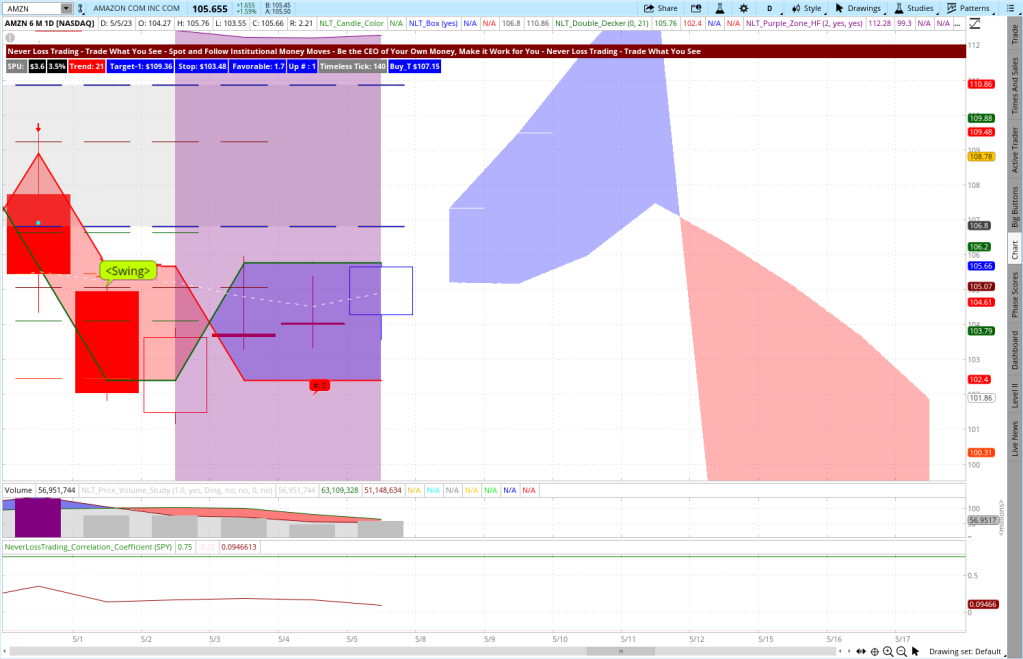

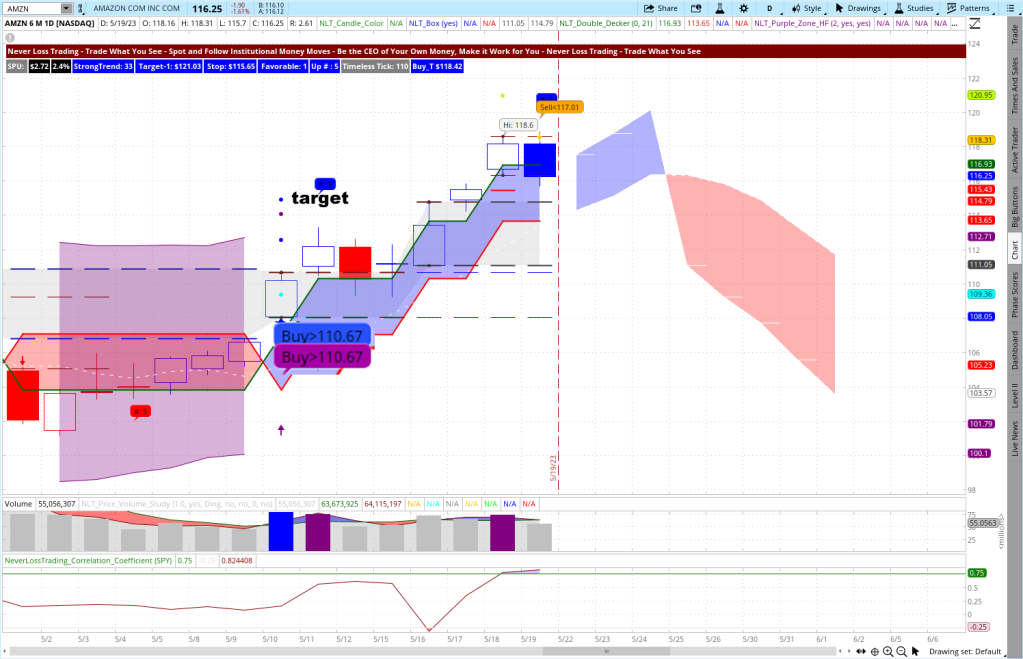

NLT Uncorrelated Price Move (AMZN)

AMZN, after going through a time of indecision (NLT Purple Zone), combined two strong buy signals (Buy > $110.66) and made a price move to its target.

When you operate with NLT Top-Line, you can find those opportunities to analyze the markets with your scanners or subscribe to the NLT Alerts and never be late for a trade.

Email us, and we will send you a week of free swing trading alerts.

contact@NeverLossTrading.com Subj.: Swing Trading Alerts

3. Patience

Patience is a virtue in trading. The most accomplished traders understand that waiting for the right opportunity is often more rewarding than chasing every trade. As a result, they possess the patience to wait for high-probability setups, allowing them to enter positions with a better risk-reward ratio. Patience also helps traders withstand temporary market fluctuations without succumbing to fear or greed.

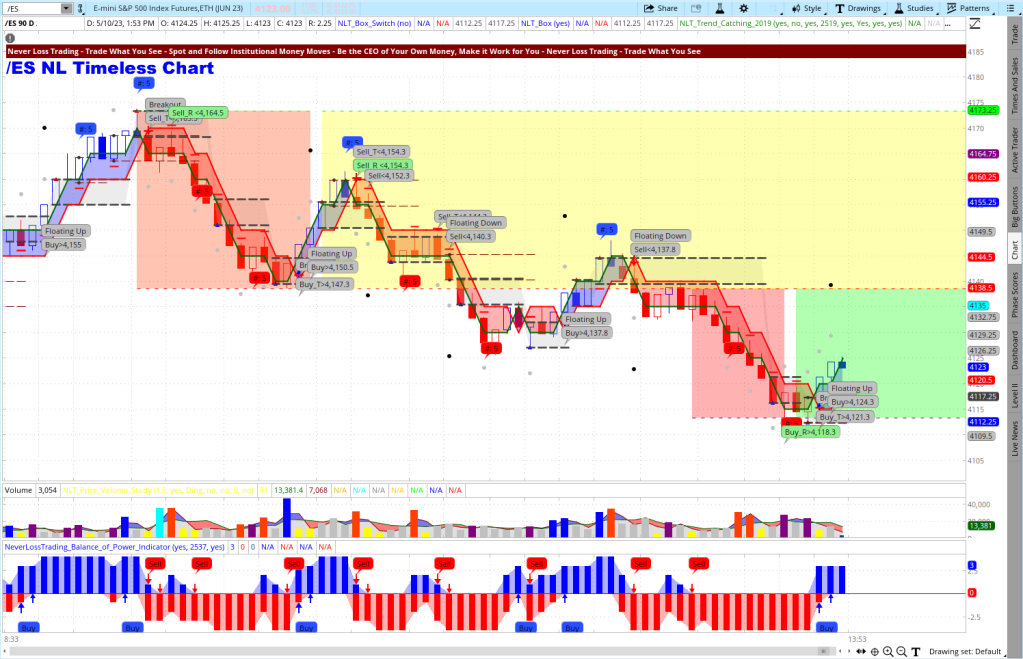

Traders are probability thinkers; they act when it is highly probable to win. We help our subscribers to specify those action points with odds-based decision-making models. We again pick a day trading model which combines NLT TrendCatching and Timeless Indicators:

Odds Based Trading

Following the model, solid traders wait for NLT Floating signals at a channel-breaks to act. In addition, they check for volume support and ensure no hindrance is in the way of an evolving price move. It is also essential to consider the statistics of a series: when your first instance has a 70% chance of winning, winning two in a row has a 49% chance, and three in a row only has a 34% chance. So when do you best stop trading?

The highest likelihood of making money long-term is when trade number one is a winner. Therefore, we teach our day-trading students to strive to obtain a budget with a weekly goal of producing $1,000 by winning three to four trades and then folding – done for the week.

The patience to wait for the right moment bends the odds in your favor; widespread trading is not a successful model.

4. Risk Management

Effective risk management is paramount to long-term success in trading. The best traders understand the importance of preserving capital and protecting against potential losses. Accordingly, they employ strict risk management techniques such as setting appropriate stop-loss levels, diversifying their portfolios, and sizing their positions according to risk tolerance. By managing risk prudently, successful traders can weather market volatility and avoid catastrophic losses.

On our NLT Timeless charts, we use system-defined price increments to specify the start and end of every candle, helping you multifold:

- Each setup is in the system-appropriate risk/reward ratio, which is often not given in time-based candles

- Your entries and stops are less predictable by not following time-based patterns

- You trade for meaningful minimum price changes of the underlying instead of being eaten up in volatility

On day trading charts, we work with solid stops, while on swing-trading positions, we teach you methods of trade repairs. The concept of repairing a trade instead of accepting the stop was the basis for our brand name: Never Stop Loss Trading, but we found it a bit lengthy. Hence, when a stop is triggered on a stock trade, you protect the trade with options strategies, living through times of trouble by collecting premiums. Imagine when you work with a high probability of 70% and the 30% trades you lose, you can exit at breakeven; what would that do to your expected result?

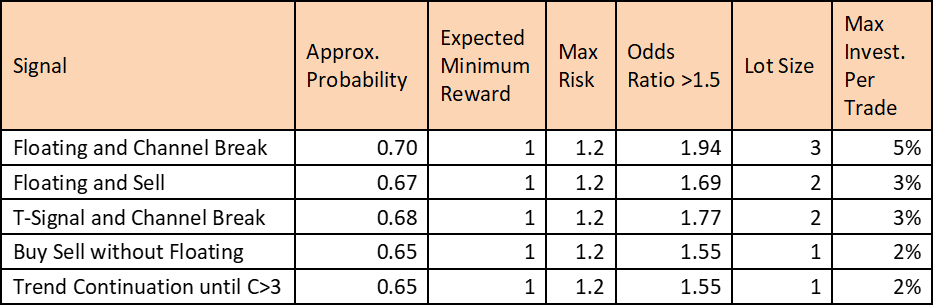

Calculation Example of Working with Protection

The table shows when you manage to exit losing trades at breakeven, the expectation value of your profitability increases by 100%. If you can cut losers in half by protecting your trades, your profit expectation increases by 39%. Hence, a valuable piece of knowledge only a few traders possess, and we teach the details in our trading programs.

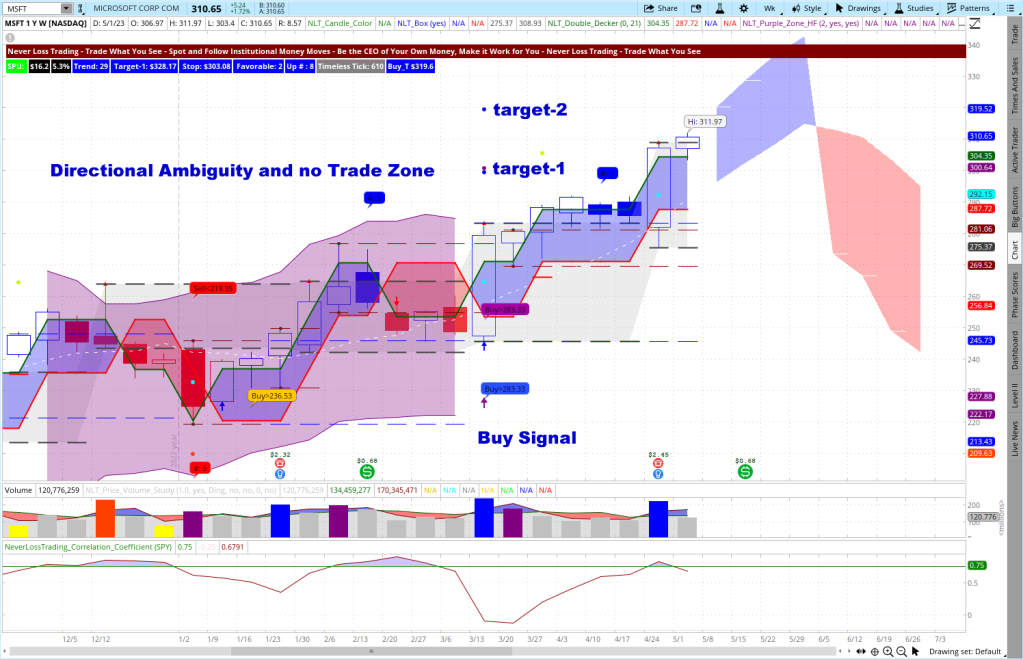

5. Continuous Learning

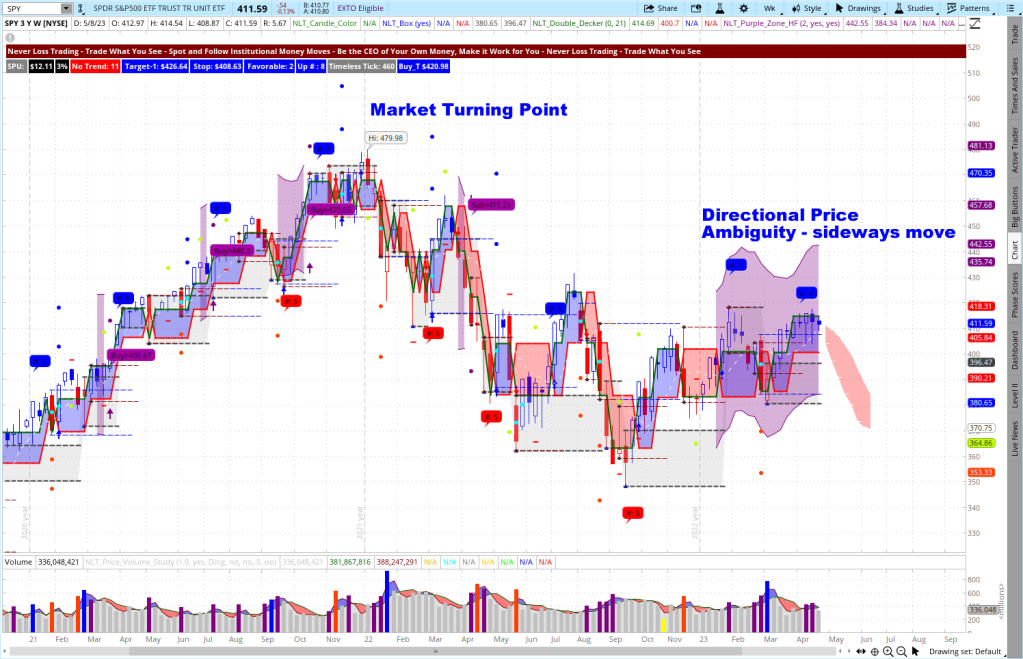

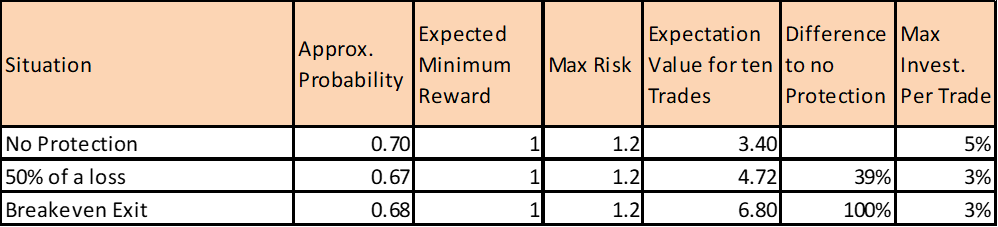

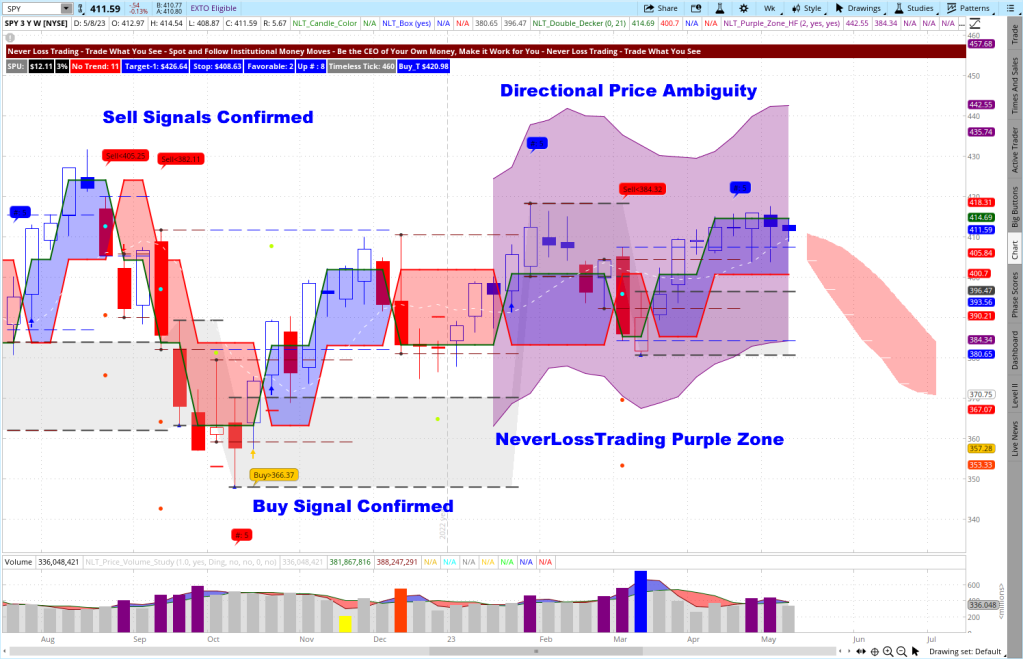

The financial markets are ever-evolving, and the most successful traders never stop learning. They have a thirst for knowledge and stay updated with market trends, economic indicators, and trading strategies. Continuous learning enables traders to adapt to changing market conditions, identify new opportunities, and refine their skills. In addition, successful traders are committed to improving their expertise through books, courses, mentorship, and networking with other professionals. They constantly check the market for what is possible instead of focusing on what they want to do: The S&P 500, based on SPY (ETF), showed expanding purple zone (directional price ambiguity), reaching from the week of 1/16/2023 to today (May 19, 2023). Hence, we do not commit to longer-term trades, even if we wanted to.

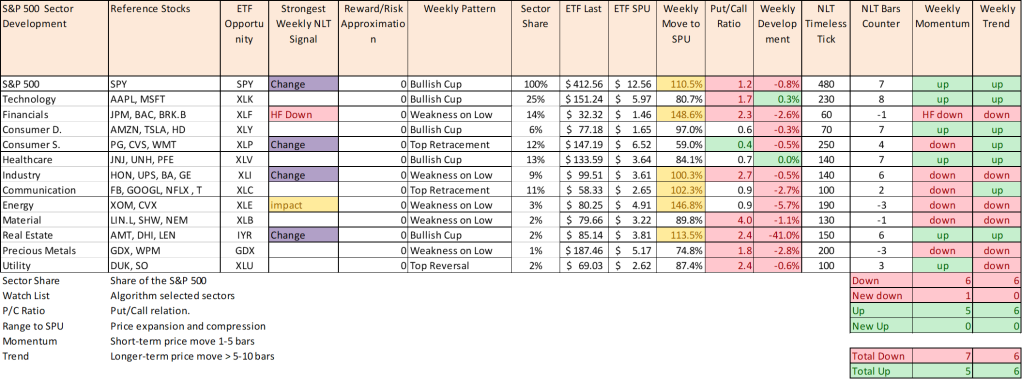

Stock Market Development 2020 to 2023

Taking a narrow indicator-based view makes the sideways price move of the stock market more visible.

Learning from the market and picking the right strategy is essential. The same counts for day traders: when trading short-term, you must be aware of important news events and combine them with the overall market view. We post critical news events on our Instagram channel.

6. Emotional Intelligence

Emotional intelligence plays a crucial role in trading success. Top traders deeply understand their emotions and how they can influence decision-making. As a result, they can manage stress, remain calm during market turbulence, and avoid making impulsive decisions driven by fear or greed. Emotional intelligence lets traders stay objective and rational, leading to more informed and consistent trading outcomes. Trading can be a challenging endeavor, with both wins and losses along the way. Successful traders possess resilience and mental fortitude to bounce back from setbacks. They view losses as learning opportunities and do not let temporary setbacks discourage them, stay committed to their strategies, learn from their mistakes, and keep pushing forward despite obstacles. Financial markets are dynamic and constantly evolving, and successful traders quickly adapt, stay flexible and open-minded, and are willing to adjust their approaches based on changing market conditions. They embrace new technologies, incorporate new trading tools, and remain adaptable in their methods to stay ahead of the curve.

7. Conclusion

Becoming a successful trader requires skills, attitude, and relentless dedication. Discipline, patience, risk management, continuous learning, and emotional intelligence are vital attributes shared by the most accomplished traders. While technical analysis and market knowledge are essential, cultivating these qualities is equally important to navigate the complexities of financial markets. By embodying these skills and adopting the right mindset, aspiring traders can position themselves for long-term success in the highly competitive world of trading.

You best learn from experience, and we are happy to show you what our systems and strategies can do in a live session.

contact@NeverLossTrading.com Subj. Demo

NeverLossTrading is a trading education and software company that aims to help traders improve their performance and profitability in the financial markets by:

- Personalized Coaching: in one-on-one sessions, you learn customized trading strategies that fit your unique needs and goals. This personalized approach can help traders better understand the markets and make more informed trading decisions.

- Trading Software: NeverLossTrading offers proprietary software that provides real-time market analysis and trading signals. Our indicators are designed to help traders automate their trading decisions and execute trades with greater accuracy and efficiency.

- Comprehensive Training: We provide extensive training and education materials to help traders learn the fundamentals of trading and develop the skills and knowledge necessary to succeed in the markets.

To succeed in trading, you best work with an experienced coach. Our #1 competitive advantage is the support and customer service we offer. Veteran traders have been through more ups and downs than you can imagine. So, experienced pros have probably experienced whatever you’re going through.

If you are ready to make a difference in your trading: We are happy to share our experiences and help you build your trading business. Trading is not a typical career, and you best learn from those who are long-term in this business to cope with the rollercoaster of the financial markets. We are here to help and provide feedback on what you might be doing right or wrong. Strive for improved trading results, and we will determine which of our systems suits you best. The markets changed, and if you do not change your trading strategies with them, it can be a very costly undertaking. The markets changed, and it can be expensive if you do not change your trading strategies with them. However, you can make a difference with the right skills and tools!

Hence, take trading seriously, build the skills, and acquire the tools needed. Trading success has a structure you can create and follow.

Thomas Barmann (inventor and founder of NeverLossTrading)

Disclaimer, Terms and Conditions, Privacy | Customer Support