Weather forecasts and market analysis might appear separate from the sun and the stock market ticker. However, delving into the intricacies of predicting weather patterns and price movements reveals intriguing parallels between these seemingly disparate domains. While forecasting rain and predicting price moves might not be an obvious pairing, both disciplines share underlying principles of data analysis, pattern recognition, and managing uncertainty. In this article, we’ll journey through weather prediction and trading, exploring their similarities and differences and uncovering how NeverLossTrading indicators can shed light on potential price move forecasts.

Predicting and forecasting are related terms often used interchangeably, but they have distinct nuances in meaning:

- Predicting involves estimating or projecting a future event or outcome based on available information and data. It often implies a degree of uncertainty and is not always based on in-depth analysis or formal methodologies. Predictions can be intuitive, speculative, or informed guesses.

- Forecasting, however, typically refers to a more structured and systematic prediction process. It involves using historical data, statistical models, and analytical tools to anticipate future trends, outcomes, or events. Forecasts aim to provide a more accurate and reliable perspective on future developments by considering a broader range of factors and using established methodologies.

In essence, predicting is a broader term that encompasses any attempt to anticipate what might happen in the future. At the same time, forecasting implies explicitly a more rigorous and data-driven approach to making predictions.

Weather forecasters and traders rely heavily on actual data to produce high-probability forecasts; however, there is never a 100% certainty. Meteorologists study weather patterns to anticipate future atmospheric conditions, while traders scrutinize price movements to gauge potential market directions. In both cases, data analysis acts as the compass guiding decisions. Like meteorologists assess temperature trends and wind patterns, traders analyze chart formations and underlying price, volume, and volatility indications to uncover trading opportunities.

Navigating Complexity and Uncertainty

Navigating complexity and embracing uncertainty are shared challenges. Weather systems are influenced by many variables—pressure systems, temperature gradients, ocean currents—and traders are similarly swayed by diverse factors like economic indicators, market sentiment, and geopolitical events. Both domains grapple with the reality that outcomes are shaped by a tapestry of variables, often beyond their control.

Parallel to Risk Management

Effective risk management is a cornerstone for both meteorologists and traders. A weather forecast guides people’s decisions: packing an umbrella or planning an outdoor event. Traders, too, employ risk management strategies to protect their investments. Just as an unexpected downpour might catch someone unprepared, market reversals can lead to significant losses if not managed wisely.

We teach our clients, how to cope with trade situations that go against the base assumption of the trade and repair them with the aim of turning potential losers either to winners or exiting them at breakeven.

Diverse Nature of Forecasts

While the comparison between forecasting rain and price moves might raise an eyebrow, the underlying methodologies share a kinship. Weather forecasts typically encompass broad probabilities—rain, snow, temperature ranges—while NeverLossTrading indicators aim for specific forecasts on price direction and potential trading opportunities. The weather forecaster gazes at the sky while the NLT traders act on high-probability indicators, studies, and patterns to chart their course.

Human Impact vs. Financial Influence

The human impact of weather forecasts is immediate: travel plans altered, events rescheduled, and umbrellas readied. Trading predictions, while influencing financial decisions, usually lack direct immediacy. Still, the consequences of both incorrect predictions can be felt across domains—unexpected rain at a picnic or a market reversal that defies an investor’s strategy.

Learning and Adaptation

Both weather forecasts and trading demand perpetual learning and adaptation: New data, emerging trends, and unforeseen events necessitate continuous adjustments to predictive models and strategies. Like meteorologists integrate new atmospheric data, traders integrate fresh market information to refine their forecasts, and this is what we have our systems for; they alarm you to act at crucial price turning points, and we best explain by examples, how our systems take seismic market readings of now to extrapolate potential price moves and trends.

Lessons from Weather Forecasting and NeverLossTrading

The symbiotic relationship between forecasting weather and price moves underscores the importance of data-driven analysis, managing uncertainty, and adapting to change. Both disciplines teach us that a solid foundation of historical data and patterns, coupled with a willingness to embrace unpredictability, can bolster the accuracy of predictions.

Conclusion

As we’ve embarked on this comparative journey between weather forecasts and NeverLossTrading indicators, the unexpected kinship between the two becomes apparent. Both fields stand as a testament to the power of data, the complexities of human behavior, and the challenge of anticipating future outcomes in dynamic systems. Whether forecasting rainclouds or price trends, we are reminded that informed decisions are rooted in thoughtful analysis, pattern recognition, and a willingness to adapt to the future.

Price Move Forecast

How does NeverLossTrading forecast price movement with high predictability? Our algorithms, including AI components, measure underlying changes in supply and demand, extrapolating three critical instances when an appropriate setup is found:

- Entry condition: Price threshold to either buy above or sell below.

- Exit: Take profit when reaching a system-defined price level.

- Stop or Price Adjustment Level: Take a loss or adjust the trade and protect with our no-stop loss methods. Never Stop Loss Trading gave the basis for our brand name but was a bit lengthy.

Best, we demonstrate on some chart examples. Appropriate to the current market conditions, we focus on:

- Swing Trading: holding positions between one and ten days.

- Day Trading: opening and closing positions on the same day.

- Longer-term trading: holding position for multiple weeks.

Swing Trading Example

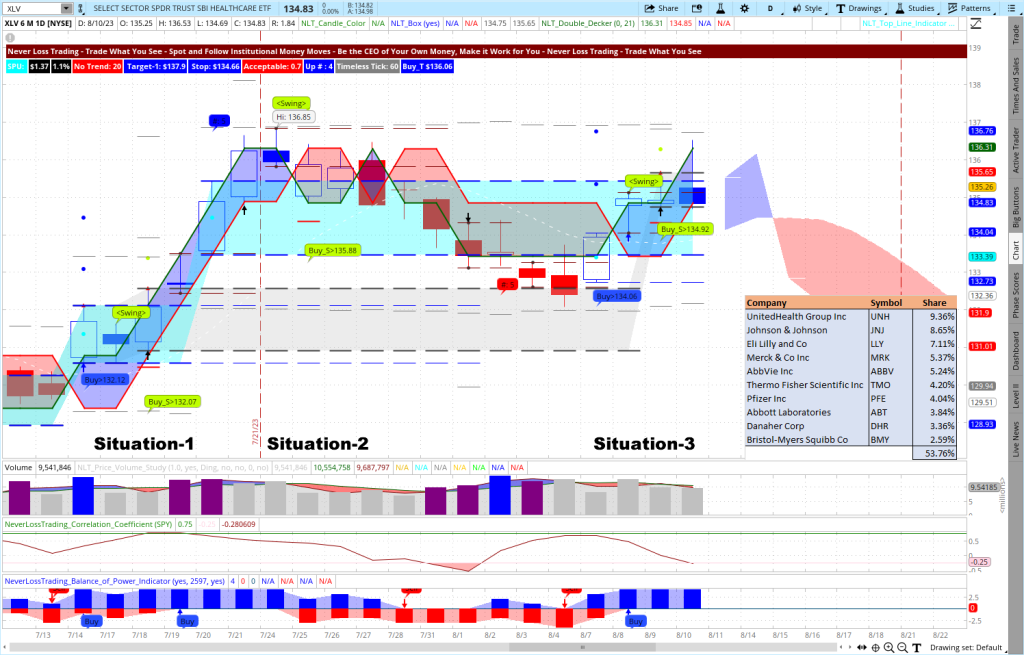

We take XLV, ETF of the healthcare sector. The chart shows three potential trade situations, combining NLT Top-Line and SwingPower indications.

XLV, Daily Chart, 7/12 – 8/10/2023

Situation-1: An NLT Top-Line Buy Signal: Buy > $132.12 (July 14) did not confirm the next candle’s price movement (we only accept signals when their high or low is surpassed in the next candle). A swing trading signal on July 17 indicated the basis for a coming potential price movement, and Buy_S > $123.07 confirmed and led a trade to the upside. By breaking out of a price containment (Cyan Zone), the system proposes to trade for a 2-SPU price move: 2 x $1.37 (you see the indication on the top left dashboard). If you did not want to exit at this point, the blue frame’s red line helped you trail the price movement with a firm exit at a 3-SPU level. We consistently act on learnable rules and teach them one-on-one in our training and coaching sessions.

Situation-2: The NLT SwingPower Buy Signal was not confirmed and did not lead to a trade.

Situation-3: The NLT Top-Line Signal, Buy > $134.06, confirmed and led to a directional trade to target ($134.50), indicated by a blue dot on the chart. The following NLT SwingPower buy signal resulted in a day trade by reaching its target after entry on the same day. The lime color dot on the chart was the target of the trade.

How do we come to those indications?

Like in systemic reading, our algorithms with AI components measure changes in supply and demand to indicate potential price turning points. The indicators on the chart measure happenings independently from each other to provide high-probability signals that work together.

Day Trading Example

A data-based trading approach can offer numerous benefits to traders looking to increase their profitability. Firstly, it provides a clear framework for decision-making, ensuring that all trades are made based on predetermined rules rather than emotional impulses, helping you to eliminate the risk of making impulsive or irrational trades, often leading to losses. Additionally, a structured approach can help traders identify market patterns and trends, allowing them to make more informed decisions about when to enter or exit trades. This leads to more consistent profits over time, as traders can capitalize on opportunities as they arise. Finally, a structured approach can help traders to manage risk more effectively by setting clear stop-loss and take-profit levels for each trade. By doing so, traders can limit their potential losses and maximize their gains, ultimately leading to greater profitability. Adopting a structured trading approach can be a powerful tool for traders looking to progress to profitability.

Let us give you some examples of rule-based or data-based trading:

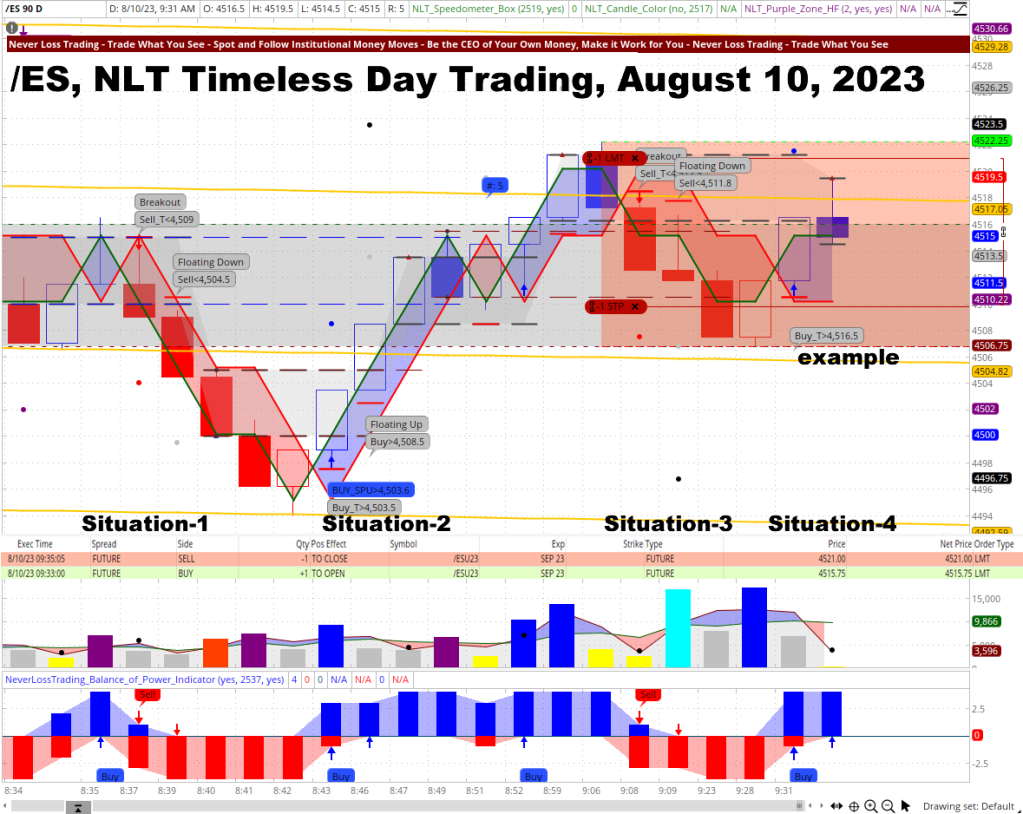

E-Mini S&P 500 Futures Example, August 10, 2023

The chart shows four trade situations; in each, the system spells out the following:

- A price threshold: sell < or buy, a price level to be surpassed in the price movement of the next candle, or else no trade entry

- The trade target: dot on the chart

- Stop: red crossbar on the chart

On our NLT Timeless Day trading chart, we use system-defined price increments to specify the start and end of every candle instead of time, helping you multifold:

- Each setup is in the system-appropriate risk/reward ratio, which is often not given in time-based candles

- Your entries and stops are less predictable by not following time-based patterns

- You trade for meaningful minimum price changes of the underlying instead of being eaten up in volatility

- The system produces multiple trading opportunities in the trading day, while we propose to stop after two winners

On the chart, all four August 10, 2023 trade situations came to their system-defined target. We acted on Situation-4, and opened a long trade at 9:33 that closed at 9:35 a.m. Et, using a buy-stop bracket order, where the stop was at the red crossbar of the candle and the target at the dot. To demonstrate day trading, we always use a one-contract base. In the given example, the trade was good for a 5.25-point price move or an income of $262.50.

We could go on and on, but if you want to experience how our systems perform live:

contact@NeverLossTrading.com Subj.: Demo

Long-Term Investing

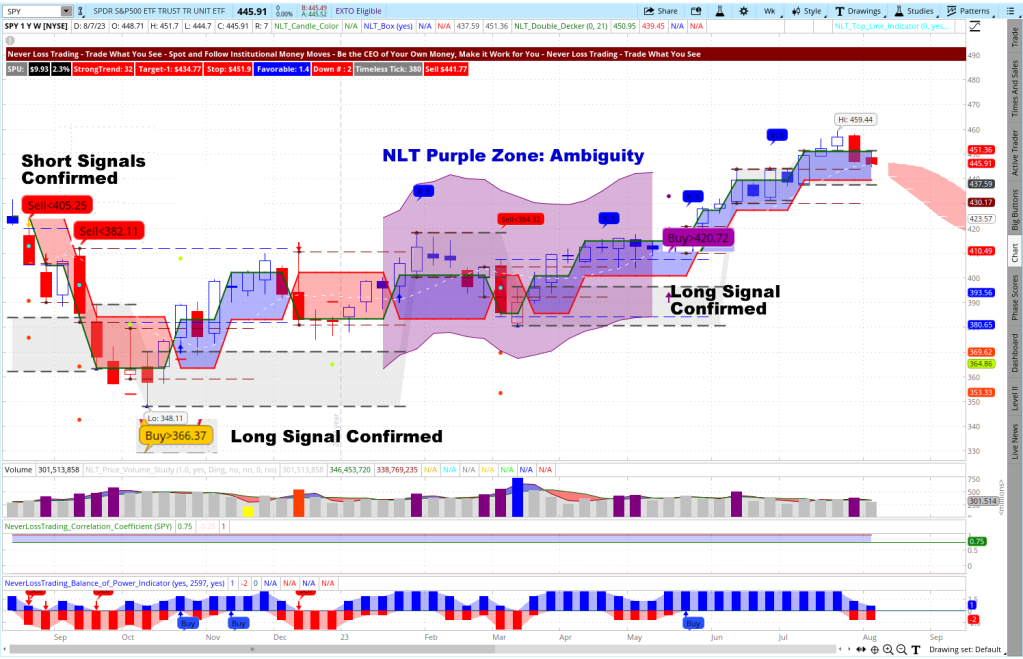

Making sound longer-term trading decisions was not easy in 2023. We like to analyze the overall stock market development of the S&P 500, based on SPY (ETF)—our charts color upwards-moves in blue and down-moves in red. When the price movement has no up or down momentum, when red and blue mix, an NLT Purple zone is painted as a sign of directional price ambiguity: This was the case from the week of 1/16/2023 to the end of May 19, 2023. Hence, we did not commit to longer-term trades, even if we wanted to: day trading and swing trading were appropriate strategies.

NLT Weekly Top-line Chart

The key for traders is to have advanced indications of what is happening and which strategy is applicable. The NLT Purple Zone indication is a great help for traders to choose the right strategy, and it announces when the time of ambiguity is over and directional longer-term trades are applicable. We take weekly charts to make this decision.

Learning from the market and picking the right strategy is essential. The same counts for day traders: when trading short-term, you must be aware of important news events and combine them with the overall market view. We post critical news events on our Instagram channel.

Aside from rule-based trading, NeverLossTrading provides psychological support by emphasizing the importance of discipline, patience, and emotional control. Through its trade repair method, traders can minimize losses and stay focused on objective trading decisions, reducing the influence of emotional biases.

Sign up here to stay connected with our trading tips, articles and webinars.

Our Offer

We help our students simplify technical analysis by providing a holistic approach that combines chart patterns, trend analysis, and market indicators. Traders are equipped with practical tools and methodologies to identify high-probability trade setups, helping them make informed decisions based on market trends and price action.

Executing trades at the right time and price can be challenging, especially in fast-moving markets. NeverLossTrading offers techniques for precise trade entries and exits, allowing traders to capture optimal returns. With its focus on high-probability setups and systematic approach, NeverLossTrading helps traders improve their trade execution and timing, maximizing their profit potential.

The financial markets are dynamic and ever-evolving, requiring traders to stay updated and continuously learn. NeverLossTrading promotes a culture of continuous learning, providing educational resources, webinars, and personalized mentoring. Traders gain access to a wealth of knowledge and expertise, empowering them to adapt to changing market conditions and enhance their trading skills.

Trading challenges are an inherent part of the financial markets, but with the solutions offered by NeverLossTrading, traders can overcome these hurdles and thrive in their trading endeavors. By addressing emotional biases, providing effective risk management techniques, simplifying technical analysis, optimizing trade execution, and fostering continuous learning, NeverLossTrading equips traders with the tools and knowledge needed for success. Embrace the solutions provided by NeverLossTrading and embark on a journey toward consistent profitability and trading excellence.

To succeed in trading, you best work with an experienced coach. Our #1 competitive advantage is the support and customer service we offer. Veteran traders have been through more ups and downs than you can imagine. So, experienced pros have probably experienced whatever you’re going through. If you are ready to make a difference in your trading. We are happy to share our experiences and help you build your trading business. Trading is not a typical career, and you best learn from those who are long-term in this business to cope with the rollercoaster of the financial markets. We are here to help and provide feedback on what you might be doing right or wrong. Strive for improved trading results, and we will determine which of our systems suits you best. The markets changed, and if you do not change your trading strategies with them, it can be a very costly undertaking. Hence, take trading seriously, build the skills, and acquire the tools needed. Trading success has a structure you can learn and follow.

Thomas Barmann (inventor and founder of NeverLossTrading)

Disclaimer, Terms and Conditions, Privacy | Customer Support

No comments:

Post a Comment