The NLT SwingPower Indicator lives up to its name by directly uncovering lucrative swing trading opportunities. We adhere to a principle of trading based on visual cues, allowing the chart to dictate optimal entry and exit points – as stops or trade adjustment levels. This strategy entails holding positions open for extended periods, sometimes days or weeks.

Our innovative indicator operates on the base volatility changes. While acknowledging the inherent unpredictability of financial markets, our indicator has demonstrated remarkable efficacy, boasting a 68% or higher predictive accuracy rate by highlighting crucial price turning points at the start or continuation of a price move.

The traditional “buy and hold” approach no longer guarantees satisfactory returns. We encourage a paradigm shift towards a more dynamic strategy: envision attaining a monthly return of 2% or 5% on cash, irrespective of prevailing market trends. Join us in exploring this alternative perspective and unlocking the potential for financial success.

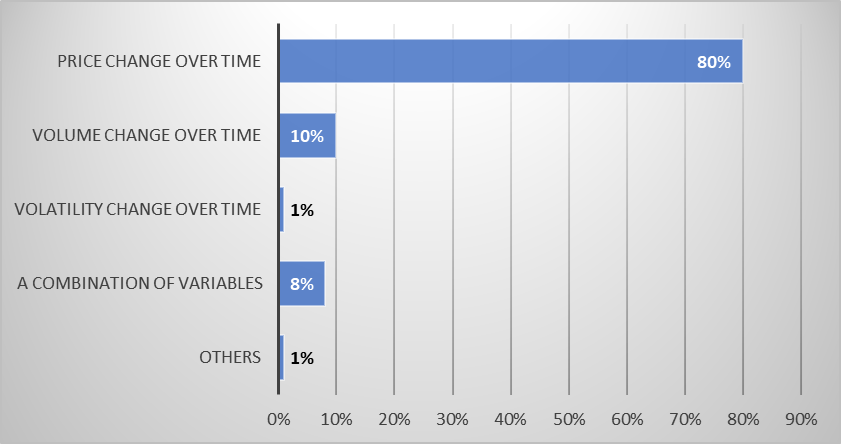

The NeverLossTrading SwingPower uses a dynamic entry, exit, and stop definition to increase your trading accuracy. Here is an overview of the most commonly used trading decision bases.

Share of the Usage of Trading Decision-Making Variables

The NeverLossTrading SwingPower Indicator is a distinctive volatility-based tool for identifying price movements. This indicator operates as a comprehensive price chart analysis tool, capable of functioning autonomously or synergistically with other esteemed NLT systems such as NLT Top-Line, NLT Trend Catching, and TradeColors.com. Its primary function is pinpointing pivotal price inflection points, signaling either the initiation or continuation of a new directional trend.

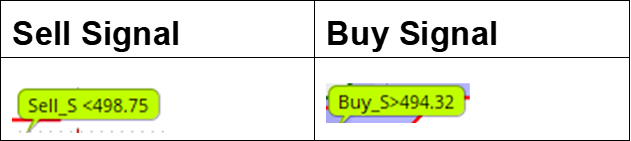

NLT SwingPower Indication

The versatility of SwingPower extends across all asset classes, including stocks, options, futures, and FOREX. Recognizing that asset prices seldom follow linear trajectories, this indicator serves as a reliable tool for pinpointing crucial transition points where market dynamics shift from buyer to seller dominance and vice versa.

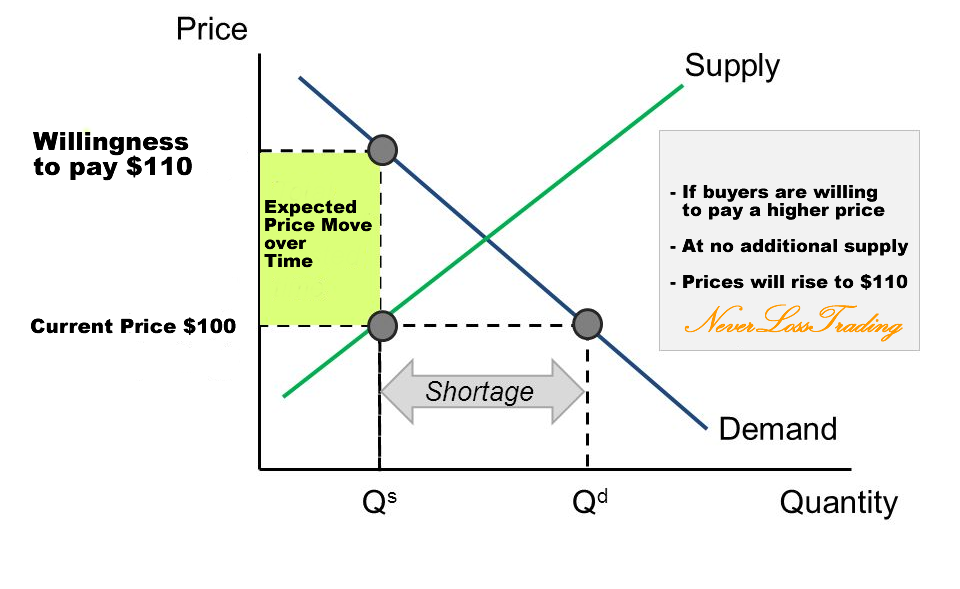

Behind what may seem like mere variables lies a deeper understanding of the underlying shifts in supply and demand dynamics. For instance, the NLT SwingPower Indicator meticulously tracks changes in volatility within the underlying instrument, projecting potential directional price movements in the subsequent candle.

In our commitment to facilitating trading with minimized risk exposure, we integrate this projected price movement with the NLT Delta Force Options Trading framework. This concept is designed to define precise entry conditions and establish maximum price thresholds for selected NLT Delta Force Concept Put or Call options, streamlining the complexities of options trading to deliver optimal outcomes.

Embark with us on an enlightening journey into the economic principle of exchange, where we illuminate the intricacies of market dynamics and empower you with the tools to navigate them confidently and precisely.

Supply and Demand Correlations

The depicted graph illustrates the interplay between quantity offered and resulting price dynamics. A surge in demand for a stock priced at $100 has emerged. Should this heightened demand persist without a corresponding increase in supply, the equilibrium point will adjust upwards to $110 to reconcile the equilibrium between supply and demand.

For traders, the perennial challenge lies in the retrospective analysis: while it’s easy to discern past market movements, the real quest lies in accurately forecasting future price actions. We aim to empower traders with the tools and insights to anticipate future price movements with remarkable precision and frequency.

Through our advanced systems and strategies, we aim to elevate your forecasting accuracy to unprecedented levels. However, adherence to specific rules remains paramount to ensure optimal trading outcomes.

Trade Rules:

- Exiting at a pre-defined target prevents the price from pulling back and takes your profits away before you realize them.

- Choose an adequate stop so you are not taken out of a trade by a too-tight stop and keep reward and risk in a meaningful balance.

- Thus, we help you spell out potential price move setups with clearly defined trading rules.

- With the help of the NLT Delta Force Concept, you are not even operating with a stop.

You let the chart tell when to buy or sell:

- Entry Conditions: Execute buy-stop or sell-stop orders at pre-defined price thresholds

- Exit Condition: When is the target reached

- Stop Condition: When are you wrong and exit

With the NeverLossTrading SwingPower Indicator, we measure a change in volatility for the underlying instrument and such act at crucial price turning points.

Price dynamics serve as the cornerstone of market equilibrium, delineating the delicate balance between buyers and sellers and dictating where asset transactions occur. If buyers are only willing to purchase at $100 while sellers demand $101, no agreement is reached, and no transaction materializes.

In trading parlance, the bid and ask prices encapsulate this two-way price quotation, representing the optimal price points at which securities can be bought or sold at any given moment:

- The bid price denotes the highest price a buyer is willing to pay for a share of stock or other security.

- Conversely, the asking price signifies the lowest price at which a seller is willing to share the same security.

- A trade transpires when a buyer matches the best available offer or when a seller agrees to sell at the highest bid.

- The disparity between the bid and ask prices, known as “The Spread,” is a critical gauge of asset liquidity. Generally, a narrower spread indicates superior liquidity.

Market dynamics constantly animate bid and ask prices, shaping the frequency of price equilibrium shifts and yielding a quantifiable entity. Our algorithms meticulously gauge the frequency and magnitude of these movements to generate directional price indications.

The NLT SwingPower indicator leverages changes in volatility and integrates them with actual price action to anticipate the next move of the observed asset. This newly developed indicator identifies price shifts indicative of buyer or seller dominance, issuing a signal contingent upon confirmation in the subsequent price continuation candle: Buy > or Sell <. In instances of unclear direction, no signal is generated.

This systematic approach governs trading decisions by clearly defined rules, eschewing guesswork. Unfortunately, many retail traders persist in antiquated trading methodologies, akin to employing World War II technology in a Formula One race. This approach lacks the competitive edge necessary for success. Recognizing that seasoned professionals execute most trades is crucial, underscoring the importance of strategic decision-making.

We advocate for strategic trading at pivotal price turning points, preferably employing an investment strategy devoid of stop-loss orders. While our brand name, Never Stop Loss Trading, encapsulates this philosophy, we aim to impart transformative concepts that facilitate consistent income generation from financial markets while adhering to risk-limiting principles and leveraging upside potential.

Operating within this framework enables the use of conditional orders, ensuring that your offers are executed only when price thresholds are met, without necessitating constant monitoring. We introduce a concept where the system anticipates the natural price movement of the observed asset, defining profit-taking and stop-loss levels based on statistical volatility.

Furthermore, we recognize the influence of crucial asset holders in rebalancing inventories, often precipitating directional price movements that can impact profitability. To mitigate this risk, we pre-calculate profit-taking levels, anticipating potential retracements or reversals post-movement initiation.

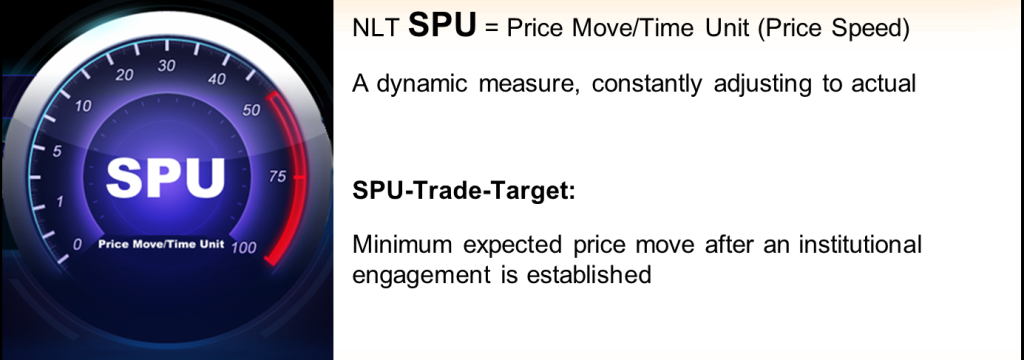

Our tool to calculate the expected price move is the SPU = Speed Unit.

What is your take away:

- By a change in volatility/vibration, we specify indications to act on high probability price turning points, applying mechanical rules rather than leaving room for interpretation.

- The NLT system defines the minimum price movement based on an SPU analysis (Speed Unit), indicating how far a price move shall reach until it ends.

- Operate with conditional buy-stop and sell-stop orders, ensuring that other market participants have the same directional assumption that your system spells out.

How can this be expressed on a chart?

Our approach involves identifying pivotal price turning points through meticulous analysis of volatility and price movements, offering a high probability of anticipating market shifts. The NLT SwingPower indicator represents a specialized offering that is exclusively in conjunction with TradeColors.com or compatible NLT Systems. This unique arrangement ensures that traders receive comprehensive education and training, essential for effectively leveraging our decision-making setups and trading strategies.

Distinguished by its adaptability, the NLT SwingPower Indicator dynamically adjusts to prevailing market conditions, tailoring itself to the specific timeframe and asset under observation. It signals potential directional price changes when momentum shifts and preceding volatility occurs. On price charts, lime-colored signals serve as clear directives, indicating optimal entry points, earliest exit opportunities, and projected price movements from entry. These signals manifest at critical price junctures where buyer dominance transitions to seller dominance and vice versa.

Furthermore, our suite of concepts and strategies empowers traders to capitalize on institutional sector rotations, wherein capital migrates from one asset to another—an insight vividly depicted on our indicators’ price charts. Our options trading strategy offers a distinct advantage, allowing traders to limit risk exposure while maximizing profit potential.

We provide daily market alerts to support our subscribers further, furnishing insights into tradable assets and prospective opportunities. This comprehensive suite of offerings ensures that traders are equipped with the tools, knowledge, and resources to navigate financial markets confidently and precisely.

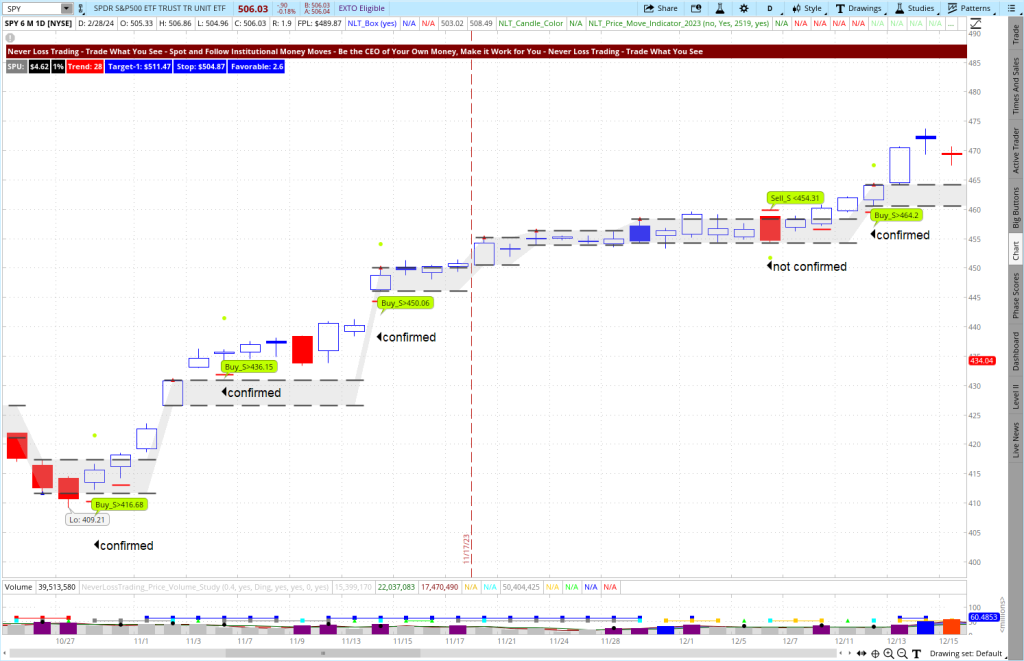

NLT SwingPower Indications

The following example shows five potential trade situations: four confirmed and came to target, and one not confirmed for the time of October 2023 to December 2023.

SPY, NLT SwingPower Example

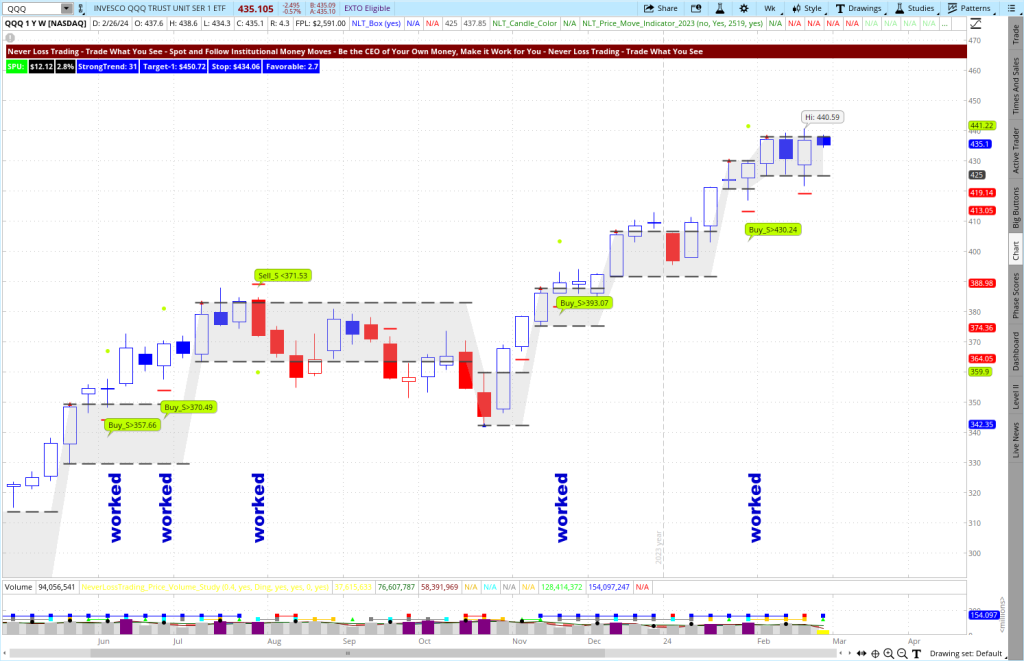

The versatility of the NLT SwingPower Indicator is evident as it seamlessly integrates with other NLT Systems across various timeframes. However, its design was specifically tailored to excel in capturing swing trading positions, particularly on daily and weekly charts.

A compelling illustration of its efficacy unfolds in the weekly chart of QQQ (the ETF tracking the NASDAQ 100 Index) spanning from May 2023 to February 2024. Within this timeframe, five distinct trading opportunities emerged, each meticulously identified and confirmed by the indicator. Notably, all trades reached their pre-defined targets, represented by dots on the chart.

Examining the outcomes, the highlighted price moves yielded an average return on cash of approximately 3%. Furthermore, the average duration of each trade ranged from one to three candles, corresponding to one to three weeks in this instance. These statistics underscore the indicator’s capacity to deliver favorable results within a relatively short timeframe consistently.

QQQ, NLT Weekly SwingPower Example

Five opportunities worked out most recently, but we are never 100% – but offer high probability trading!

Trades will be closed at the pre-defined price-move or after the maximum number of ten candles in the trade: A two-dimensional positive exit strategy.

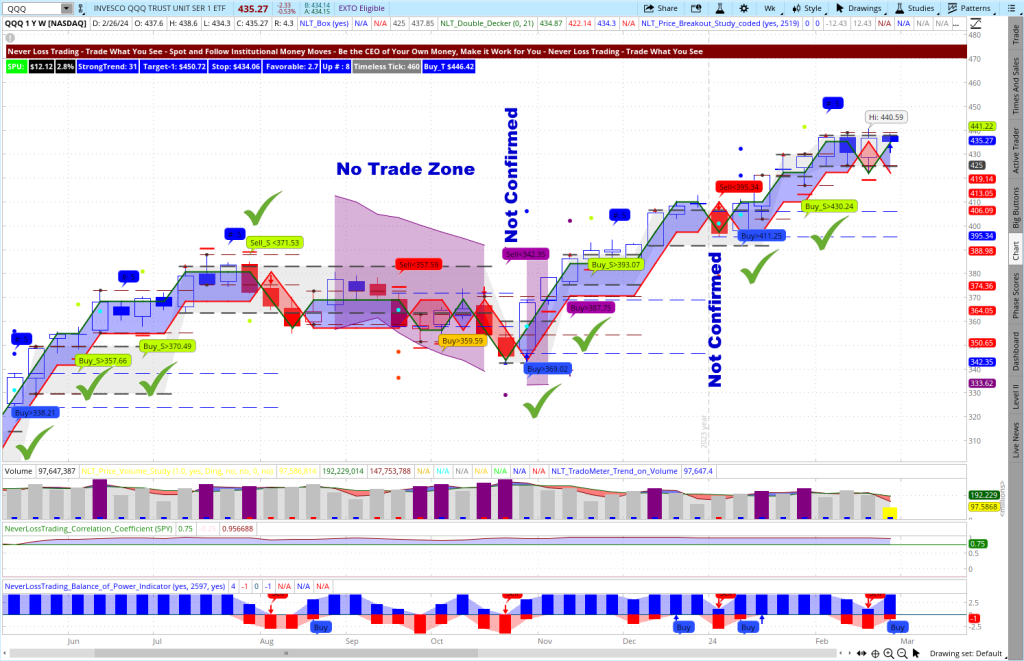

To demonstrate how the systems supplement each other, we take the same period and combine NLT Top-Line and NLT SwingPower signals on the chart.

Check it out and experience how each system highlights crucial price turning points to act upon.

QQQ, Weekly NLT Top-Line and SwingPower Combined

Here is the translation into action:

When you learn how to trade with the NLT Delta Force Options Trading Concept, you can leverage long and short trades, even out of your IRAs, where short-selling stock is not allowed.

For example, the TSLA stock is mostly HTB: hard to borrow, and by that, it only offers options and trading strategies to follow price moves to the downside. In our mentorship, you learn how to risk-limit your trades, leverage your potential income and act at crucial price tuning points.

TSLA, NLT SwingPower Example

Without a solid options trading concept, you would have missed out on one of three recent trading opportunities.

Let us find a couple more examples and make visible what we worked out to support our clients:

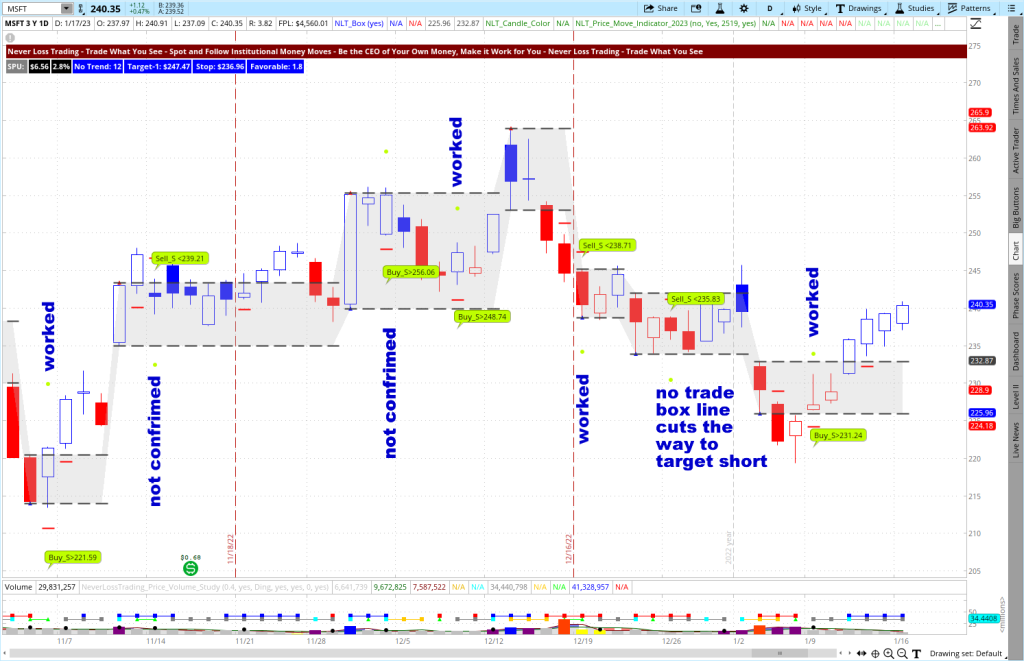

MSFT, NLT SwingPower Example

The MSFT chart showcases multiple distinct trading opportunities, each presenting a unique scenario for potential profit. Remarkably, those confirmed in the observed period successfully reached the system-defined target, as denoted by the lime-colored dots on the chart. Nevertheless, in certain instances, the anticipated price threshold was not attained during the subsequent candle’s price movement, or the target was prematurely truncated by an NLT Box Line, resulting in unrealized trade potential.

Now, envision a scenario where an options trading strategy is employed, eschewing traditional stop-loss mechanisms in favor of a clear directional expectation over the next ten candles. In this context, all four opportunities would have materialized into profitable outcomes, reinforcing our assertion of high-probability trading.

To illustrate, consider situation 2: Rather than shorting the stock on December 19, 2022, one could have purchased Put options, anticipating a downward movement. The expected outcome aligned with the observed trend by holding this position for a maximum of ten candles or until reaching the trade target. Indeed, the target was met on December 22, 2022, validating the efficacy of this options trading strategy.

This concept is particularly potent when applied to assets boasting a robust options chain, facilitating enhanced flexibility and strategic maneuverability. By leveraging options contracts, traders can capitalize on market movements with precision and agility, minimizing risk while maximizing profit potential, supported by:

- Tight bid-ask spreads

- Solid volume for easy fill on opening and closing position

- High open interest for easy order execution

- Weekly options

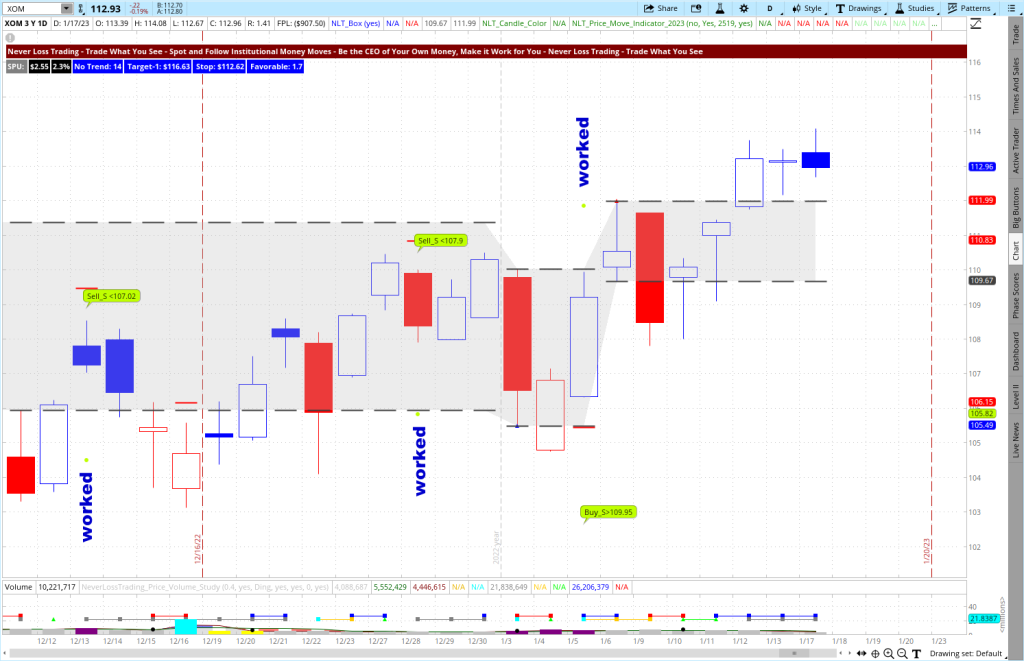

XOM NLT SwingPower Example

The NLT Delta Force Concept offers a streamlined approach to options trading, characterized by the following:

- clear entry conditions

- precise strike price selection

- strategic decisions regarding time to expiration

- concrete exit strategy

- maximum price to pay for an option or minimum premium to receive

By adhering to these specific parameters, traders can position themselves to capitalize on highly predictable trade setups, thus optimizing the risk-reward ratio and maximizing profit potential.

Success in the financial markets hinges on executing trades based on robust and dependable methodologies. We aim to empower traders with the tools and knowledge to identify and act upon such lucrative opportunities.

It’s worth noting that the NLT SwingPower Indicator is exclusively available in conjunction with an NLT System or TradeColors.com. This intentional pairing ensures traders have ample time and training to acclimate to our systems and market approach. In the examples provided, we integrated the indicator with TradeColors.com, our introductory program to algorithmic trading, and NLT Top-Line price chart indications.

The NLT SwingPower Indicator is a profound tool for deciding daily and weekly trading opportunities. It is fully integrated into our suite of price move indications we report by the NLT Alerts.

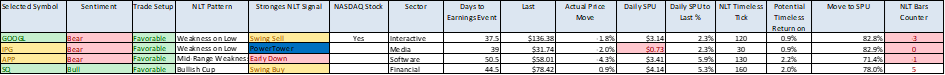

NLT SwingPower Alert Example

Two out of four selected stock trades had NLT SwingPower signals.

Through the NeverLossTrading concepts and educational resources, we aim to streamline trading decisions and facilitate high-probability trading outcomes. By leveraging our systems and methodologies, we empower traders to confidently navigate the complexities of the market, relying on mechanical rules rather than subjective guesswork. Our goal is to provide traders with the tools and knowledge needed to unlock consistent market success.

contact@NeverLossTrading.com Subj.: Demo

Many of our clients combine multiple systems to enhance engagement in trading opportunities. Should you choose this approach, we offer a seamless upgrade process. Elevate your trading portfolio with our assistance; we’re committed to guiding you toward success.

Let us know if you want a PDF write-up on the NLT Swing Power concept, and we will send it to you:

contact@NeverLossTrading.com Subj.: SwingPower PDF

Good trading,

Thomas

Disclaimer, Terms and Conditions, Privacy | Customer Support

No comments:

Post a Comment