Only what you can measure you can control; hence, you want to control the final result and the process to success.

Trading allows you a fresh start on an everyday basis. But if you want to make a fresh start, you need a reality check.

The worst trader has winners, but it is not wise to praise winners and disregard losers; you are only successful when you strike a positive balance.

For controlling your trading process, create a point of reference. Unfortunately, most traders do not journal their trades; it takes about 20 seconds to record a transaction, and it is worth it. However, if you do not pocess such records, take your broker statement, and it will tell a story.

If you are day trading, take the last 12 weeks as a swing trader or longer-term investor, the last 12 months of trade data and put them on a spreadsheet.

What was your P&L for each month, and how did your average winners and losers compare?

What were your five best and worst five worst trades, and what was the decision-making base?

Here is an example of how we propose journaling day trades:

As a trader, you are working with probabilities; there is no 100% winning strategy, but you need to map out what works, and this is what you focus on, leaving aside what did not work, period!

We provide pre-fab journals to our subscribers to enter their trades and review them after a set of twenty transactions to see:

- Did you comply with the rules of your system?

- Which indicator and setup gave you the highest returns and which did not?

- Did you hold your trade to target or bail out early?

Let us share an example of how and what such a statistic can look like. The results are from a trader that uses NLT Top-Line, Trend Catching and Timeless. Journaling a trade takes about 20 seconds on our template. Most people hate documentation and administration; however, you will see that this time is well invested. We also recommend taking a trade entry screenshot to compare in the aftermath if what you thought you traded was what the chart was telling. Trading is a lot about mind control and focus. We see with our brain: our emotions, past experiences, and other influences often paint a different picture from what is there. It will get obvious when discussing the results.

The following spreadsheet shows the results of a day trading journal.

NLT Day Trading Journal Example

Feedback from the NLT Day Trading Journal

- The trader conducted 58 Trades and produced $2,303 of income but wasted a lot of profit by exiting trades early and not at the system-defined target.

- The new trader achieved a high winning percentage of 72%, complying with the system expectations.

- In 17 trades that went positive, the trader left money on the table by exiting early because of his fear of losing.

- Setting stops tighter than the system proposed and entering late in a trade accounted for 8 out of 58 transactions (14%) and showed some room for improvement.

- The overall indicator performance was on spec; however, the Buy/Sell_T performance had a too high average loss compared to the average win by leaving the trade early on winners and accepting the max loss when the trade did not work.

- The highest income-producing indicator was the Floating signal (part of the NLT Timeless Concept).

In summary: The trader does still not trust the system and is scared to follow the set instructions (43% negative performance); even so, the average indicator performance was 72%. Hence, he should walk away after trade entry and come back to see the result, keeping his hands off the computer while being in a trade.

We hope this example demonstrates how such a scorecard helps analyze where things worked well and where you have room for improvement to achieve solid and constant returns from trading.

However, a scorecard alone does not make you a successful trader. You need a high probability trading system to follow, and the scorecard example shows that controlling behavior is crucial too.

Trading is not an easy career: when you add up what it costs you to not act at high probability price turning points, you might be open to investing in a high probability system and appropriate education.

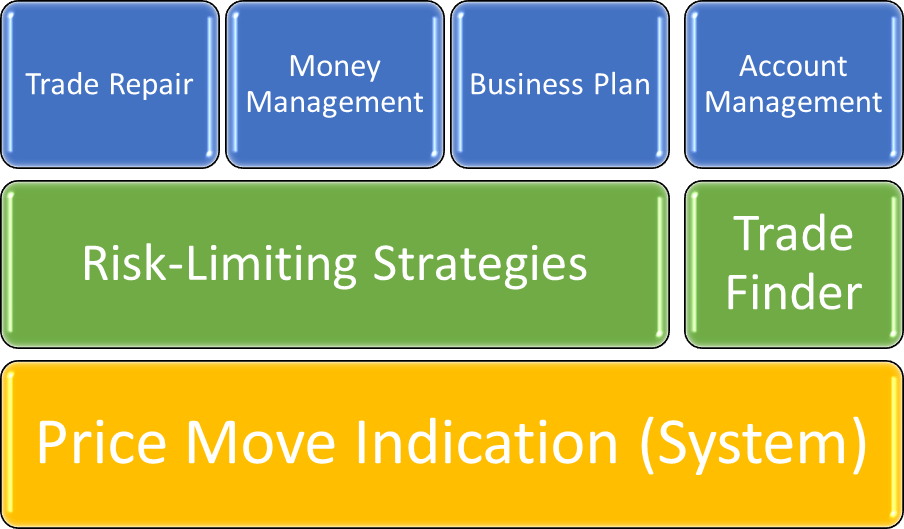

We highly propose following a business plan for trading success that shall entail:

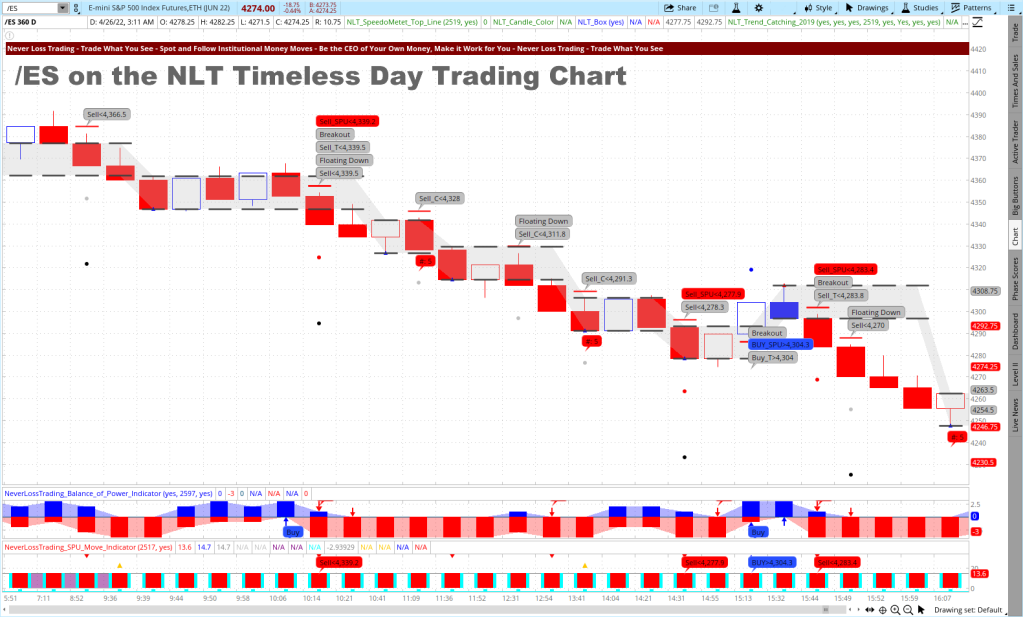

Let us give you a chart example for a high probability system and the decision-making process:

The first example we pick shows the E-Mini S&P 500 Futures contract on the NLT Timeless Chart: timeless because if purely based on a decision on price moves, defined by an algorithm.

You see five trade situations highlighted, and we apply simple rules:

- A trade signal leads to a transaction when the price threshold of buy> or sell < is validated in the price movement of the next candle. This way, you can operate with buy-stop and sell-stop orders.

- Red crossbars specify the stop for the trade

- Gray dots on the chart print the target level to exit the trade

- We do not enter at the exit level when another signal prints.

- We use NLT Trend Catching, and NLT SPU Move signals on the chart to identify trade potentials. In some instances, they occur on the same candle and point towards a strong price move potential.

ES on the NLT Timeless Swing Trading Example

Situation-1: Buy>$4314,4 led to a transaction on 3/16/22, and it came to target at the end of the same day, producing a value gain of $3750 per contract. The print: Floating tells you that the price moved outside a price-containment area and has a solid potential to go higher.

Situation-2: Buy_C>$4490 also led to a trade that came to target (gray dot). All other buy signals were disregarded because we do not enter at the exit level. The trade was a winner—entry on 3/18/22 and exit on 4/24/22. The letter C signifies a continuation signal in the up series.

Situation-3: Sell_SPU<4452,20 led to a short trade on 4/6/22 and reached its target on 4/12/22.

Situation-4: Sell_C<$4380.8 was stopped and a losing trade.

Situation-5: Sell_T<$4369.80 led to a short trade on 4/21/22 and came to target on 4/22/22. The letter T stands for an early price turning point of the NLT Timeless Indicator.

As you can see, we live by explained and learnable rules. Therefore, algorithmic trading is rule-based trading!

Here is a day trading example; we also pick the E-Mini S&P 500 contract for April 22, 2022. Of course, the system also works for stocks, options, and FOREX.

/ES Day Trading Chart Example

The chart shows multiple day trading opportunities, each good for a value change of $750, and it is evident that we have or winning than losing trades. We would not have selected the potential losing trade at 15:30, but by taking a mechanical approach, we still had five winning and one losing trade between 6 a.m. and market close.

Now that we shared how to work with a solid decision-making base, let us work on risk and money management to build a budget example for day trading:

Your first goal is $1,000 in income per week.

Our statistics say that trading less produces a 60% higher income; hence, we divide the $1,000 by 2.6, giving you $385 risk or reward. Setting risk and reward at the same base, you settle either at two winners or two losing trades each day.

Essential for your trading budget is that you set your maximum risk tolerance to either 2% or 5%, and it tells you:

- At a 5% risk tolerance, you need a minimum holding of $7,700

- At a 2% risk tolerance $19,250

It is crucial to control your maximum risk. Risk control is a simple undertaking as a day trader: you set your stop, taking care of the issue. However, when you hold positions overnight, prices can gap and create higher than expected drawdowns that can only be prevented by combining stock trades with options or trading the options.

Back to the example:

When you make budget, you stop trading. Simple, isn’t it?

We set the expected return per week at $1,000. Hence we need to calculate the number of trades at a 1:1 risk/reward relation that your system has to produce:

| Probability | Trades per Week | Risk or Reward | Income Expectation |

| 65% | 4 | $ 385 | $ 462 |

| 65% | 5 | $ 385 | $ 578 |

| 65% | 6 | $ 385 | $ 693 |

| 65% | 7 | $ 385 | $ 809 |

| 65% | 8 | $ 385 | $ 924 |

| 65% | 9 | $ 385 | $ 1,040 |

By the table, you need nine trades a week, on average, two a day, and when your system is 65% right, you get to budget.

When you give yourself the condition to stop trading at one win or two losses, you get a maximum win or loss of $1,155 per week.

Trading is probability thinking, and we help you set your mind on the proper focus.

The expectation value of the return is directly related to the probability of your system forecasting the price move.

Hence, a broad knowledge base and skill set are needed. You best find a mentor sharing the details with you: if trading could be learned from a book, the statistics would not state that 76% of the retail traders are losing money: You need a system, a plan to follow, process control, and more to make money off the financial markets constantly and this is what we teach.

Here is an overview of learning elements we will go through in our coaching and training sessions:

Learning Elements to Trading Success

Contact us to experience what we can do for you:

contact@NeverLossTrading.com Subj: Demo.

We are ready to share our experiences and help you build up your trading business. Trading is not a typical career, and you best learn from those who are long-term in this business to cope with the rollercoaster of the financial markets. We are here to help and provide feedback on what you might be doing right or wrong.

Make a change to your trading results, and we will find out which of our systems suits you best.

We are happy to hear back from you,

Thomas Barmann (inventor and founder of NeverLossTrading)

Disclaimer, Terms and Conditions, Privacy | Customer Support