The word constellation in astronomy specifies a grouping of stars. However, we do not want to trade by predicting price moves on the base of the moon or the stars; even so, it is a tempting idea. So instead, we focus on using modern techniques and algorithms to combine and filter signals that lead to a high probability of predicting price movements.

Successful traders find signal combinations or constellations that forecast the future price movements of assets with a high likelihood and apply strategies to harvest on those situations. They focus on what they do best and repeat proven success.

After we wrote this complicated sentence, let us dissect it in its elements for trading success:

- Signals derive from systems that print critical price turning points on the chart to act upon, and you have a way to find them.

- By combining signals when analyzing a price projection (forecast), you increase the likelihood of an accurate prediction.

- Act on mechanical rules for entry and exit

- By choosing risk-limiting strategies, you prevent drawdowns.

- Combining risk limiting and leveraging strategies allows trading for extra income.

- Working with strategies that let you participate in price moves to the up and downside allows you to trade in any market environment.

- Chosen decision-making times or strategies need to fit your life circumstances and the account type.

- Act less predictable and independent to not making obvious choices by being in and out of positions faster than other market participants.

Let us spin a matrix of these variables to specify what it can mean for you:

| Variable | Evaluation |

| Participation Rate | How many trading opportunities can you be part of by combining signals? |

Decision Making Time | How much time do you require for a sound trading or investing decision? |

| Risk Limiting | Risk-limiting strategies vary from bracket orders of day trading to portfolio diversification and hedging, depending on your trading perspective. |

| Independent from Market Direction | Operate with strategies that allow you to make income in bull and bear markets. |

| Act with low predictability | When your next move is highly predictable, you might see counteractions and risk getting your stops taken. |

| Mechanical Rules | Have your system spell out entry and exit conditions and follow them strictly. |

| Leverage | Strive for extra income by leveraging your opportunities through the strategy, account type, or trade constellation you choose. |

Now that we defined critical variables for trading success let us specify a diagram of how we can measure those and put them into action.

Ideal Diagram of Trading Success Variables

The diagram shows an ideal combination of scoring on the highest level in all dimensions; however, reality often looks like this:

- Traders only know about 20% of the opportunities and miss four out of five trades by not having an opportunity finder in place

- Trade decisions are discretionary and not hardcoded mechanical

- Trading with leverage is not a known strategy

- Decisions are discretionary rather than mechanical

- Your stops are predictable

- Risk limiting strategies are not practiced or known aside from bracket orders

- You give yourself too little time for sound decisions

- You participate in too many opportunities by not being able to filter out high predictable ones

Actual Diagram of Trading Success Variables

In our more than ten years in the trading education business, we have not had two clients with the same base and affinity. Hence, we teach one-on-one and tune our systems to the specific wants and needs of our clients; let us share some examples:

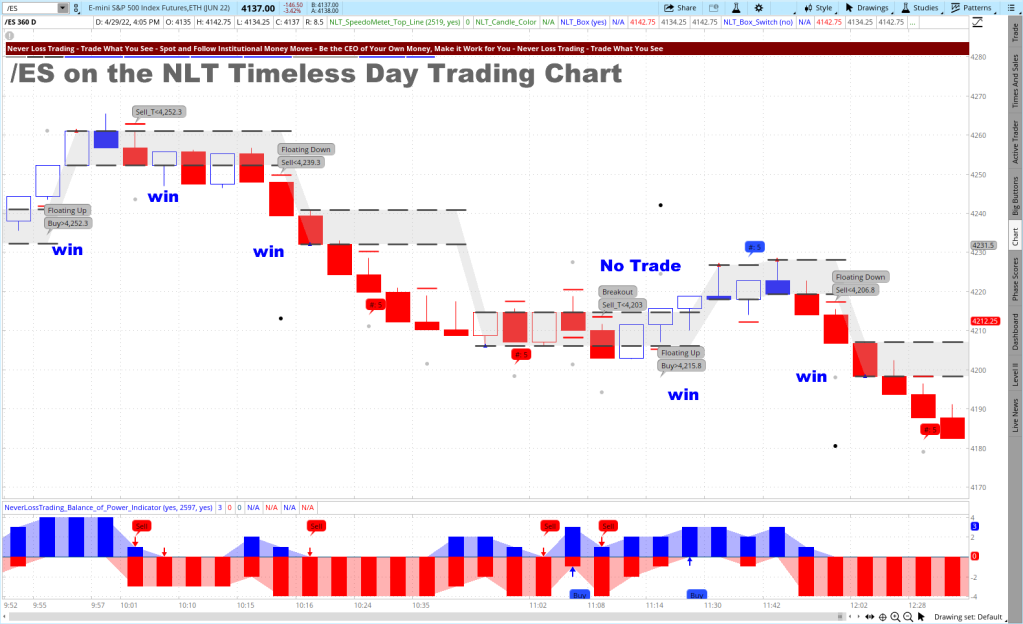

Mike is a day trader; he focuses on trading the E-Mini S&P 500 Futures and the Crude Oil Futures Contract. His preferred trading time is 10 a.m. to noon. He is passionate about conducting his other business for the rest of his day. He was used to trading very short time-frames, acting on about eight to ten trade constellations per day, and was constantly monitoring and working with open positions. His success was random. We introduced him to the NLT Timeless Concept combined with NLT Trend Catching to better his trading. We kept his focus on trading those two futures contracts daily, where he had his experience (why bend an arm when the preferred asset to trade provides enough trading opportunities). Instead of monitoring each transaction, he now walks away and lets the trade come to target or, at times, stop (losing is part of winning). He, on average, conducts a maximum of four transactions per day and finishes his trading day around noon, winning 70% of his trades, he journals and controls. You find a specific article on measuring and controlling trading success on our blog.

His focus is on two signal combinations:

- NLT Buy, Sell with Floating, which reports when a price leaves a prior price containment area.

- NLT Buy_T, Sell_T, which indicates an early price turning point.

- He sets bracket orders two ticks above/below the set price threshold: Sell < $4203 will only lead to a trade when the price reaches two ticks below; hence, he can operate with a sell-stop at $4202.50. This price level was not reached in the next candle, and no trade was initiated in the specific case.

- A gray dot specifies the trade exit on the chart, the stop by a red crossbar.

Let us show the chart he uses to form his decisions. His average income per contract and trade in the last 12 months was $350, and he trades multiple contracts of the /ES and /CL with a broker that allows a reduced margin for bracket orders. By following the rules and concentrating on what works, he quickly reached the payback of his tuition and now basically trades with a free system for life.

E-Mini S&P 500 Timeless NLT Chart April 28, 2022

The chart shows five potential trade indications: four led to winning trades, and one was not confirmed.

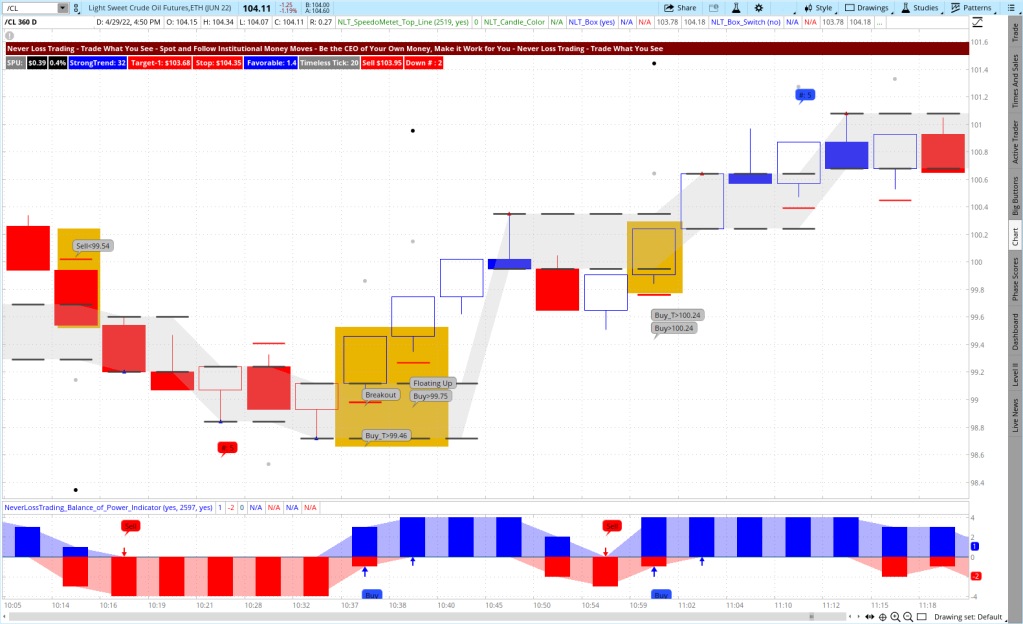

Here is a crude oil futures chart:

Crude Oil Futures Timeless NLT Chart April 26, 2022

The chart shows three highlighted trade situations (orange) that were confirmed and came to target (gray dot).

Luis is a stock trader and enjoys his retirement, investing in the stock market. He holds positions between a couple of days to multiple weeks, working off a margin account. He wants to trade about two times a week and retains a diverse portfolio. For achieving diversity in your investment portfolio, assets must be uncorrelated to the overall market; for example, 75% of the stocks develop according to the S&P 500 index – hence, they are correlated, and no diversity is in them. He wanted to invest a part of his portfolio in those not overall market-related. NLT Top-Line offers market scanners, and with the help of those, he now finds his opportunities, making decisions from daily and weekly happenings. He likes to invest 70% of his holdings at what we call a NeverLossTrading Top-Line bottom or top (a combination of early up or down signals) specifying key price turning points and a 2-SPU price move opportunity. In his training with us, he learned to invest, protect, and leverage his investment by applying options strategies on their own and in combination with stocks. He acts mechanical and only on approved signals and achieves an accuracy above 73%. Here is a chart example.

NFLX on the Daily NLT Top-Line Chart

The chart indicated by its orang signals to go short on January 3, 2022, long on January 28, 2022, and short again on April 1. Each trade was good for a price move of about $50. The bar-by-bar price move is specified on the top-left dashboard as the SPU reading (Speed Unit). On the orange signal, he trades for a minimum of 2-SPUs or trails the stop by the red line framing the price move.

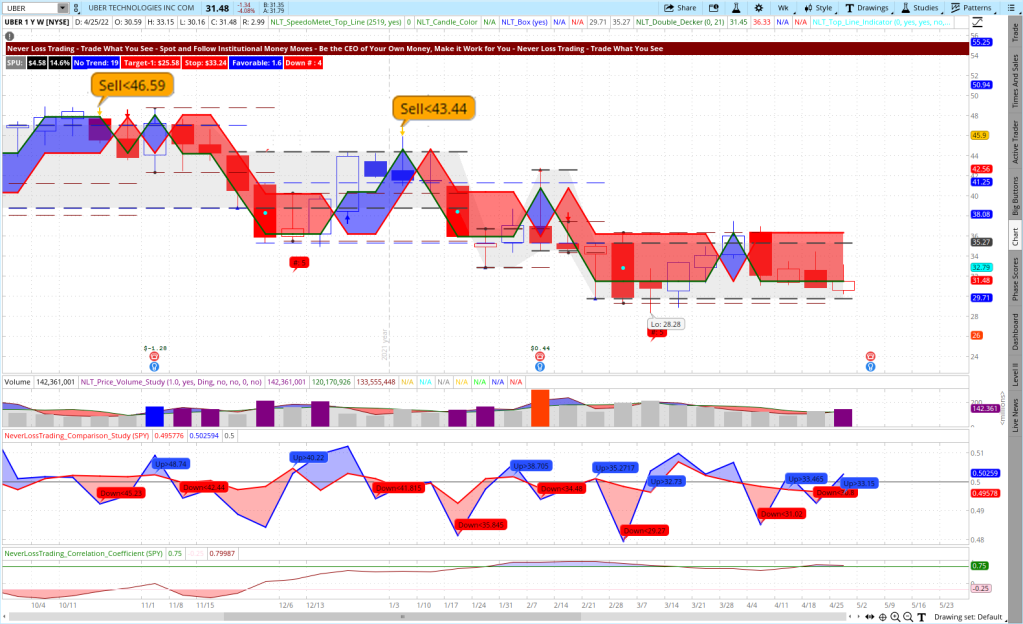

He also decides based on weekly chart happenings. The following example shows UBER, which had two short trading opportunities, each good for a minimum price move of about $10. He chose NLT Options strategies according to the NLT Delta Force Concept to participate in transactions and participated well. We explain this method in a bit more detail in the example of Charles.

UBER on the Weekly NLT Top-Line Chart

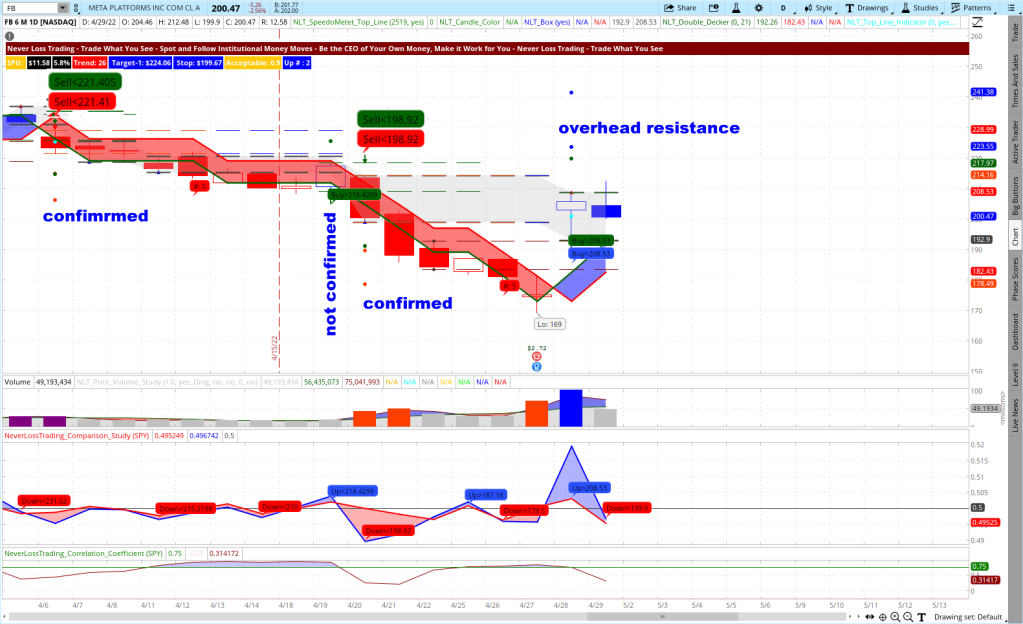

Jeff is a short and mid-term trader with many years of experience. He trades from an IRA and learned to operate with options and reverse to market ETFs to also participate in downside moves. He picks his investment with the help of scanners and combines NLT Top-Line, HF, and Trend Catching signals. On his trades, he likes to trail the directional price move by the red NLT Double Decker and takes profit after a 3-SPU price move, acting mechanical. As a result, he achieves very high accuracy and has constantly produced above-market income since 2014. Jeff likes when two independent signals of NLT HF (dark green) and NLT Top-Line (red and blue) agree.

FB on Jeffs Daily Charts

Charles trades stock options and learned to apply the NLT Delta Force concept, which helps to decide on:

- the strike price with the highest rate of return

- the adequate time to expiration

- the maximum price you can pay for a single options contract

- if the options price is above the top, he changes the trading strategy to debit or credit spreads.

- He makes his decisions based on NLT Top-Line and holds positions for one to ten days.

- He worked in a factory prior and now is an independent trader

Catherine came to us as a FOREX trader, enjoying the 24-hour market to cope with her work shifts. She started with TradeColors.com, where you trade at two candle color combinations:

TradeColors.com Day Trading Example

She likes trading in the very early hours of the day, and her chart showed three solid trading opportunities that were confirmed on April 28, 2022.

After starting with TradeColors.com, she upgraded to NLT Trend Catching and Timeless (and only paid the difference of the tuition), where she learned to trade futures and quit her job to only trade the financial markets: She now sees trade constellations the way Mike does.

Ken is a futures trader with focus on day- and swing trading. He works with NLT Top-Line, NLT Trend Catching and NLT Timeless. He waits for the following signal combination:

- Strong price chart signals (Floating, Breakout, Power Tower)

- Momentum change of the NLT Double Decker

- Highlighted price volume bar in the prior candles, indicating a handover from buyers to sellers and vice versa.

- He considers NLT Time Based Price Channels for potential support and resistance and does not trade in NLT Purple Zones.

He achieves solid returns on an above 70% accuracy.

As you can see, no trader is the same as another. We offer excellent customer service and adopt our systems to individual wants and needs, teaching and coaching at your best available days and times. We put together an overview of learning elements to take away from our training and coaching sessions:

Summary of learning elements:

- Acting with a system probability > 65%

- Mechanical rules for entry, exit, stop

- Trade at perfect moments only

- Consider overall factors, patterns

- Risk and reward in an acceptable balance

- Risk-averse trading

- Holding positions to target

- Do not add to losers

- Stick with a trading strategy. Follow a business plan – action plan and financial plan

- Trade for meaningful price moves

- Systematic trading

- Having a mentor to learn from

Learning Elements to Trading Success

We also help you to journal your trades. Such a journal provides excellent feedback on how you are developing, and you find a perfect example in this article on our Blog: How to Control Your Trading Results

To succeed in trading, you must work with an experienced coach and learn as much about trading. Our #1 competitive advantage is the support and customer service we offer. We work one-on-one with you to specify what we teach to your specific wants and needs; hence, if your knowledge base is not expanding rapidly, you are doing something wrong.

Ongoing education and mentoring are crucial to longevity in this business.

Veteran traders have been through more ups and downs than you can imagine. So whatever you’re going through, experienced pros have probably experienced it already.

If you are ready to learn, meet us in a one-on-one session where we find out which learning program suits you best:

contact@NeverLossTrading.com Subj: Demo.

We are ready to share our experiences and help you build up your trading business. Trading is not a typical career, and you best learn from those who are long-term in this business to cope with the rollercoaster of the financial markets. We are here to help and provide feedback on what you might be doing right or wrong.

Make a change to your trading results, and we will find out which of our systems suits you best.

We are happy to hear back from you,

Thomas Barmann (inventor and founder of NeverLossTrading)

Disclaimer, Terms and Conditions, Privacy | Customer Support

No comments:

Post a Comment