Summary: Are we in a bear market environment, and what does it mean for you as a private trader or investor?

What is a bear market?

It is a market showing a lack of confidence, with extended periods in which stock prices drop significantly across most sectors and major indices such as the S&P 500 index.

As an algorithmic trading house, we like to quantify happenings. For example, most market participants recognize a bear market by a decline of 20% or more in about 2-3 months, measured on major indexes like the DOW 30, S&P 500, or NASDAQ 100. Price drops below are interpreted as temporary pullbacks.

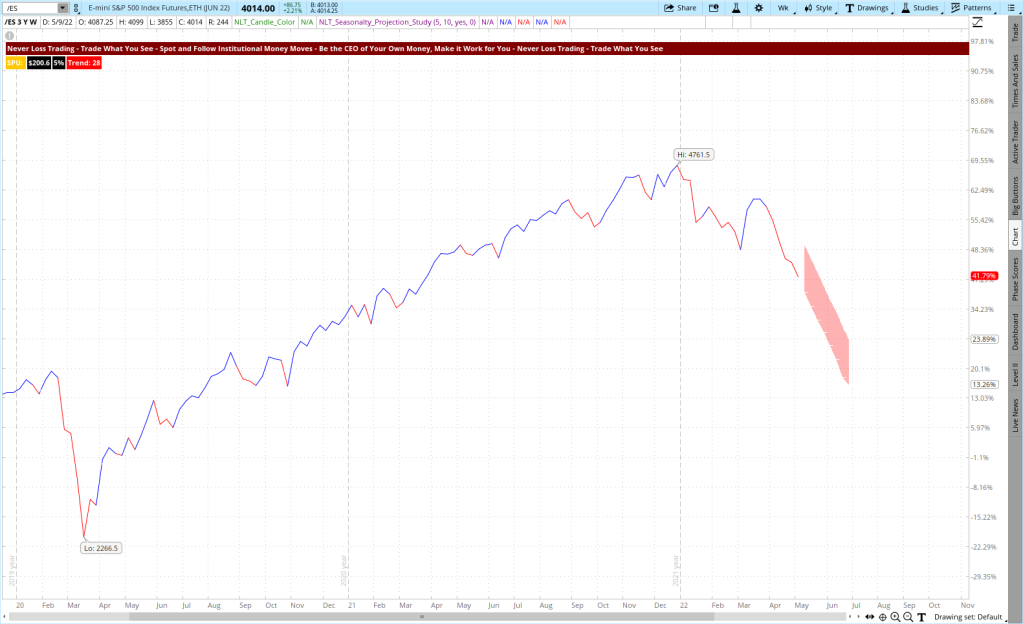

However, we take a different view by looking at a lower lows pattern. The weekly E-Mini S&P 500 Futures Contract shows a bear pattern of making lower lows with radical opposite moves, typical signs for an early bear market.

E-Mini S&P 500 Futures Contract 2022 to Actual, May 2022

The price of the /ES is about 15%, down from the high of $4,761.50: This does not fit the bear market definition of a 20% drop in two to three months but shows a clear bear tendency, which is also expressed by our NLT Proximator Study (red frame), pointing down.

Bear markets in the past occurred when the economy came into a recession, characterized by:

- Corporations missing their sales and earnings forecasts

- Rising unemployment

- Rising inflation

- Uncertainty about the future with a need for change

The most famous bear market in US history was the Great Depression of the 1930s. The 2008 financial crisis was the last example of a bear market, and its impact went around the globe. During the 2020 pandemic, we had a radical market pullback and a quick recovery after; hence, no bear market.

Where do we stand right now, considering those market indications?

Market Indications and Actual Situations

| Indication | Actual Situation |

| Earnings Forecast | Companies like Amazon already forecast less growth than anticipated by consumers having less discretionary income due to high inflation. |

| Employment Situation | Total nonfarm payroll employment rose in the last months, and the unemployment rate declined: Employers experience issues filling job opportunities by a lack of availability of skilled labor. |

| Inflation | We print the highest inflation in 40 years: by continuing supply chain issues and a vastly expanded amount of money floating since the pandemic deficit spending of most world governments; inflation will continue more likely to rise than drop in the next twelve months. |

| Uncertainty | Geopolitical issues remain present with no perspective for an end in mind: Governments and corporations worldwide position themselves short-term rather than following a longer-term strategy. Hence uncertainty is a given and influences the investment world. |

When we strike a balance of the four equally weighted indications, we see a 75% chance for a bear market and expect market conditions to change radically regarding what average investors are used to deciding from.

How to cope with a bear market as a private trader or investor?

Firstly, holding long-term portfolios without a hedge is not advisable in a bear market. The average trader has four times the amount of funds in retirement accounts as they use for trading: Retirement accounts are typically invested in stocks or funds. Now is the time to consider learning how to protect your assets. In 2008 many cut their retirement funds in half in six months by not preparing for the market change. Portfolio values can deteriorate quickly when a bear move starts; hence, get ready for a shift in your investment philosophy, protect what you hold and profit from the change.

There are two ways of profiting from bear markets:

- Have short trading strategies in place when prices tank

- Participate in radical reversals

Both instances allow for short-term gains in both directions.

When you want to short-sell stocks, multiple conditions and restrictions come into play:

- In bear markets, stocks are often classified as HTB (hard to borrow), which means the broker has no shares available for you to borrow, and as such, you cannot participate in falling prices through shorting stocks.

- When shorting stocks, they need to tick up to fill your short order; your orders will not get filled when prices fall straight.

- You need a margin account and minimum holdings of $25,000 to comply with SEC regulations to short stocks.

With all the requirements for short-selling stocks, your best bet is to learn how to trade stock options, and we are solid and experienced in how to do this:

With the NLT Delta Force Concept, you learn:

- Picking the strike price with the highest rate of return

- Choosing an adequate time to expiration

- Knowing the maximum price, you can pay for a single options contract

- If the options price is above the top, how to change the trading strategy to debit or credit spreads

- Decide from the charts of NLT Top-Line and hold positions for one to ten days

When you want to get ready for the bear, build up your trading skill-set, and we are here to help you.

Luis, oneof our clients, is astock trader and enjoys his retirement, investing in the stock market. He holds positions between a couple of days to multiple weeks, working off a margin account. He wants to trade about two times a week and retains a diverse portfolio. For achieving diversification in your investment portfolio, assets must be uncorrelated to the overall market; for example, 75% of the stocks develop according to the S&P 500 index – hence, they are correlated, and no diversity is in them. He wanted to invest a part of his portfolio in those not overall market-related. NLT Top-Line offers market scanners, and with the help of those, he now finds his opportunities, making decisions from daily and weekly happenings. By the NLT Correlation Study (bottom of the charts), he can see which assets are related or move independently from the overall market. He likes to invest 70% of his holdings at what we call a NeverLossTrading Top-Line bottom or top (a combination of early up or down signals) specifying key price turning points and a 2-SPU price move opportunity. In his training with us, he learned to invest, protect, and leverage his investment by applying options strategies on their own and in combination with stocks. He acts mechanically on approved signals and achieves an accuracy above 73%. He did participate in downside moves of stocks like NFLX and UBER. He accepts and is flexible in decision-making and lets the chart tell when to buy or sell.

Here are two chart examples:

NFLX on the Daily NLT Top-Line Chart

The chart indicated by its orange signals to go short on January 3, 2022, long on January 28, 2022, and short again on April 1. Each trade was good for a price move of about $50. The bar-by-bar price move is specified on the top-left dashboard as the SPU reading (Speed Unit). On the orange signal, he trades for a minimum of 2-SPUs or trails the stop by the red line framing the price move.

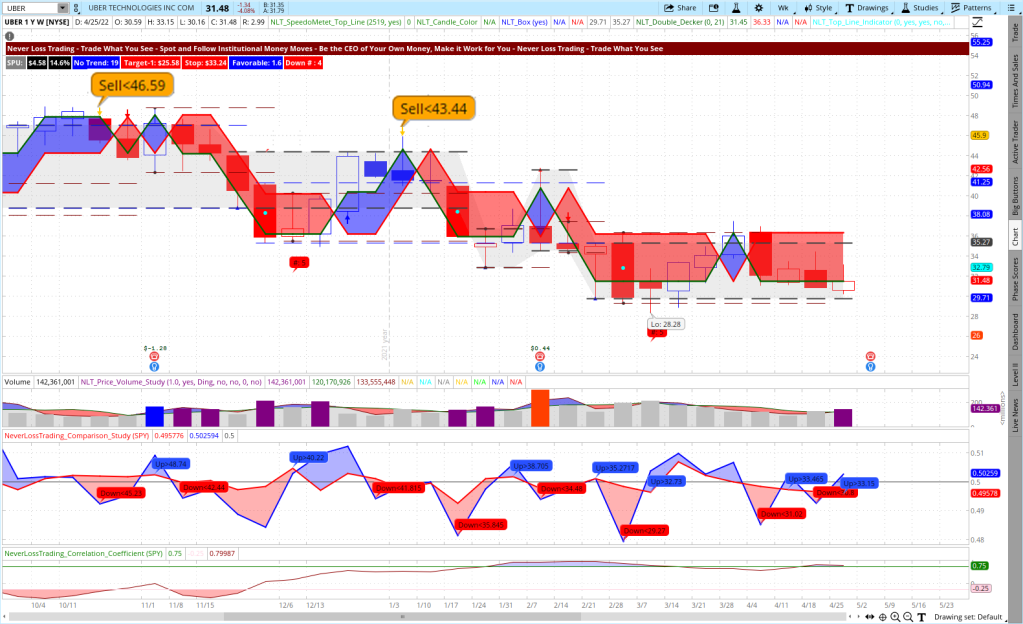

He also decides based on weekly chart happenings. The following example shows UBER, which had two short trading opportunities, each good for a minimum price move of about $10: Check for the orange signals on the chart. He chose NLT Options strategies according to the NLT Delta Force Concept to participate in downside moves as explained above.

Does your today’s chart tell when to buy or sell?

UBER on the Weekly NLT Top-Line Chart

NeverLossTrading is a concept that customers adapt to traders’ affinity, wants, and needs. We focus on acting at crucial price turning points and take our price move indications from several sources or market cuts. We have signals that check for price correlations, others for volatility or volume change. Combining NLT Systems gives traders a higher participation rate: more trades to participate per day, week, or month, where each system works as a standalone.

No trader is the same as another. We offer excellent customer service and adopt our systems to individual wants and needs, teaching and coaching at your best available days and times. We put together an overview of learning elements to take away from our training and coaching sessions:

Summary of learning elements:

- Acting with a system probability > 65%

- Mechanical rules for entry, exit, stop

- Trade at perfect moments only

- Consider overall factors, patterns

- Risk and reward in an acceptable balance

- Risk-averse trading

- Holding positions to target

- Do not add to losers

- Stick with a trading strategy. Follow a business plan – action plan and financial plan

- Trade for meaningful price moves

- Systematic trading

- Having a mentor to learn from

Learning Elements to Trading Success

We also help you to journal your trades. Such a journal provides excellent feedback on how you are developing, and you find a perfect example in this article on our Blog: How to Control Your Trading Results

To succeed in trading, you must work with an experienced coach and learn as much about trading. Our #1 competitive advantage is the support and customer service we offer. We work one-on-one with you to specify what we teach to your specific wants and needs; hence, if your knowledge base is not expanding rapidly, you are doing something wrong.

Ongoing education and mentoring are crucial to longevity in this business.

Veteran traders have been through more ups and downs than you can imagine. So whatever you’re going through, experienced pros have probably experienced it already.

If you are ready to learn, meet us in a one-on-one session where we find out which learning program suits you best:

contact@NeverLossTrading.com Subj: Demo.

We are ready to share our experiences and help you build up your trading business. Trading is not a typical career, and you best learn from those who are long-term in this business to cope with the rollercoaster of the financial markets. We are here to help and provide feedback on what you might be doing right or wrong.

Make a change to your trading results, and we will find out which of our systems suits you best.

We are happy to hear back from you,

Thomas Barmann (inventor and founder of NeverLossTrading)

Disclaimer, Terms and Conditions, Privacy | Customer Support

No comments:

Post a Comment