Paving your path to profitability can be an intimidating process. However, the power of a structured trading approach can help to make the journey much more manageable. By creating and following a guiding path, you can gain an edge in the market, increase your chances of success, and achieve your financial goals.

Entering the trading world, you compete with professionals prepared to win. However, with the proper knowledge and tools, you can act at crucial price turning points as a retail trader, opening and closing positions faster than the big money can.

1. Introduction

Are you tired of aimlessly wandering through the markets, hoping to stumble upon profitable trades? It is time to take control of your trading approach and pave your path to profitability. The key to success lies in implementing a structured trading approach: Having a clear plan, defined entry and exit points, and a disciplined mindset. By following a structured approach, you can minimize emotional decision-making and increase your chances of success. It is important to remember that trading is a business; just like any other business, it requires a strategic approach. Do not let your trading decisions be based on luck or guesswork. Follow a structured trading plan and stick to it, and we are here to help you, providing:

- High probability system indications for crucial price turning points for day trading, swing trading, and long-term investing

- Straightforward entries, exits, and stops, painted on the charts for you

- One-on-one learning and coaching fitting your circumstances and goals at the best available days and hours

- Jointly developed business plan for trading success, including a financial plan (how often to act and what to expect) and an action plan (when to act and when not)

- Risk-limiting strategies to gauge your exposure per trade and find forms of protection if transactions go wrong

- Review process to strive for constant improvement

- Trade finders in the form of operating your own market scanners and by the NLT Alerts

2. Benefits of a Structured Trading Approach

A structured trading approach can offer numerous benefits to traders looking to increase their profitability. Firstly, it provides a clear framework for decision-making, ensuring that all trades are made based on predetermined rules rather than emotional impulses, helping you to eliminate the risk of making impulsive or irrational trades, often leading to losses. Additionally, a structured approach can help traders identify market patterns and trends, allowing them to make more informed decisions about when to enter or exit trades. This leads to more consistent profits over time, as traders can capitalize on opportunities as they arise. Finally, a structured approach can help traders to manage risk more effectively by setting clear stop-loss and take-profit levels for each trade. By doing so, traders can limit their potential losses and maximize their gains, ultimately leading to greater profitability. Adopting a structured trading approach can be a powerful tool for traders looking to progress to profitability.

Let us give you some examples of rule-based trading:

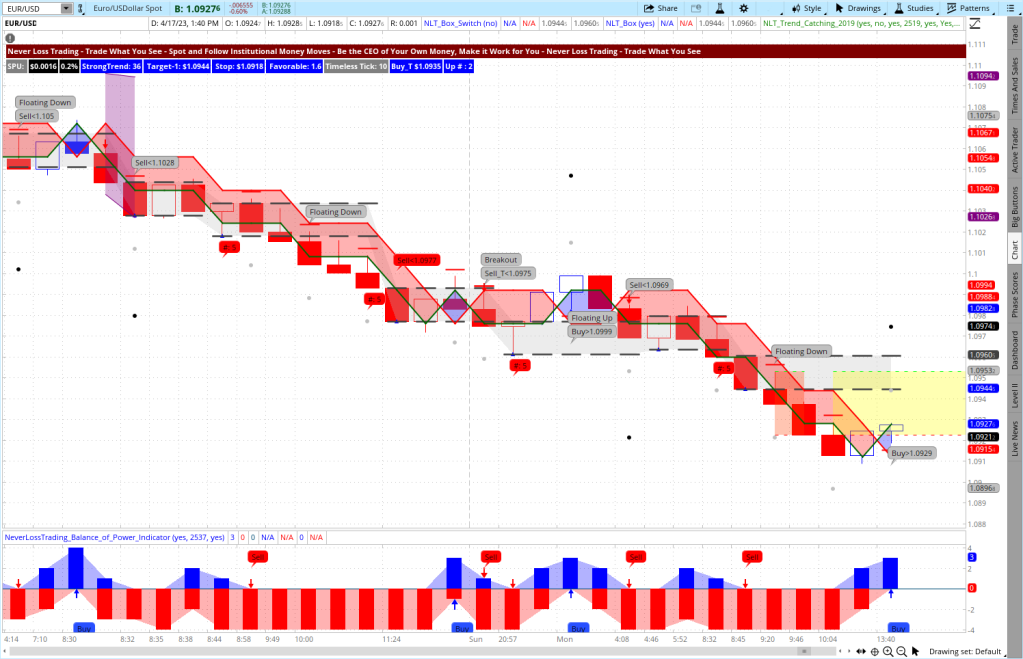

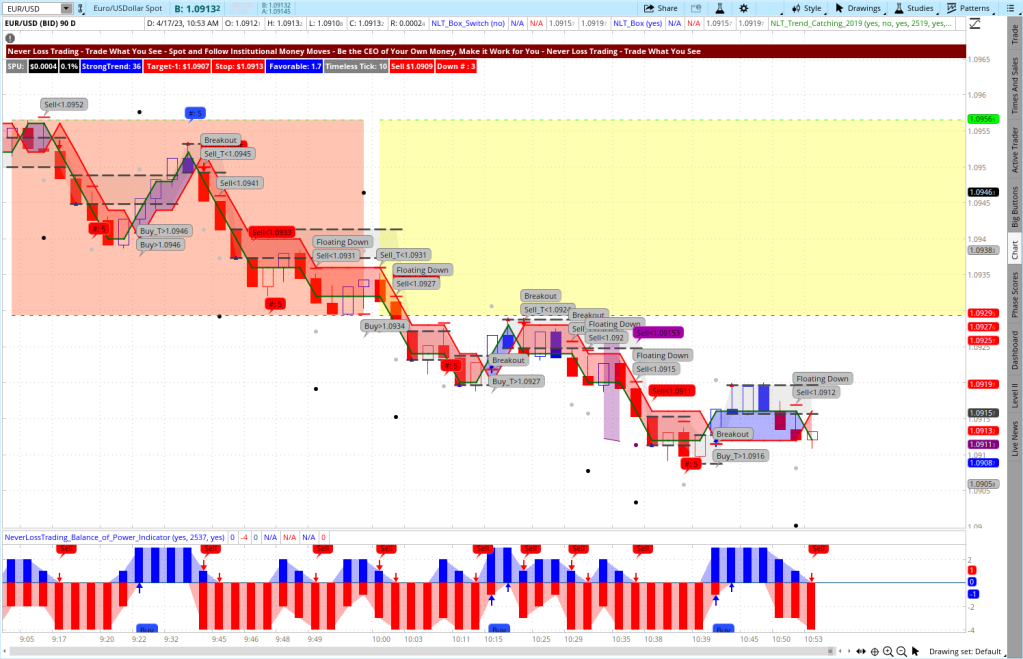

Day Trading Example

The chart shows four trade situations; in each, the system spells out the following:

- A price threshold: sell < or buy, a price level to be surpassed in the price movement of the next candle, or else no trade entry

- The trade target: dot on the chart

- The stop level: red crossbar on the chart

On our NLT Timeless Day trading chart, we use system-defined price increments to specify the start and end of every candle instead of time, helping you multifold:

- Each setup is in the system-appropriate risk/reward ratio, which is often not given in time-based candles

- Your entries and stops are less predictable by not following time-based patterns

- You trade for meaningful minimum price changes of the underlying instead of being eaten up in volatility

- The system produces multiple trading opportunities in the trading day, while we propose to stop after two winners

Swing Trading Example: AAPL Daily

You are looking at a daily chart for AAPL. There are two potential trade situations the short trade was easy to execute with a sell-stop order limit order that came to target on 3/2/23 (red dot on the chart). The Buy > 1151.11 opportunity die not realized directly, the price gapped up for more than ½-SPU. Hence, you worked with a fishing order and picked up the trade when the price retraced to the desired level. The stop-level for each trade was above/below the high/low of the signal-carrying candle.

The price development of the S&P 500 index was in an NLT Purple zone, indicating directional price ambiguity, in such situations we use a volatility-adjusted chart.

Longer-Term Investing Investing Example

What you see here is a volatility-adjusted chart, helping you form sound decisions at crucial price turning points. The system defines price levels, and if they are reached in the continuation of the price movement, you enter into a long or short transaction. With the help of the NLT Delta Force Options Trading Concept, you can do this risk limited, without the fear that gaps add to the risk of holding positions long term. On our chart, all signals except the one on 6/28/22 worked and announced a crucial price turning point. The question at this time is how to define the trade target. Ther are multiple ways actually and it all depends on the trading style you prefer as a longer-term investor:

A) SPU-Based Target

In the upper corner of the chart, the system spells out s SPU $96.50, and at this signal, you would want to aim to take a trade exit after a 2-SPU price move: $198 SPX points.

B) NLT Box Line and NLT Double Decker

Black dashed lines define price gravitation lines where we expect price action and when lines are surpassed and candles close outside, the price move most likely continues.

As you can see, there are rules to learn and strategies to apply for acting risk limiting and with the overall market direction.

You might at this point say, I am not trading the SPX; however, this is the market index of the S&P 500, and 85% of all stocks develop with the index, and aiming for always finding contrarian trades is a risky undertaking, you rather want to make the trend your friend and act along at crucial price turning points.

Let us know your goals, and we will find out which of our systems and education packages best suit you.

contact@NeverLossTrading.com Subj.: Demo

When working together, we develop all the steps to implement a plan for trading success, including the following element we put on a graphic:

Elements of a Business Plan for Trading Success

3. Developing a Business Plan for Trading

Developing a plan is crucial to achieving profitability in the trading world. It is a roadmap that guides you through the market’s ups and downs, helping you make informed decisions and avoid impulsive trades. A well-structured business plan for trading success includes your goals, risk management strategies, entry and exit rules, and a clear understanding of your trading style. Without such a plan, you are essentially gambling with your money, which can lead to significant losses. We develop this plan jointly with you by defining your goals. What do you want to achieve through trading? Is it to generate a steady income or build long-term wealth? Once you have clarity on your goals, you can identify the trading strategies that align with them. You also need to determine your risk tolerance level and establish rules for managing risk, which includes setting stop-loss orders or learning methods of trade adjustment. Adjusting trades instead of accepting the stop loss gave NeverLossTrading the brand; however, Never Stop Loss Trading was a bit lengthy. Indeed, risk management rules are an essential part of such a plan.

In conclusion, developing a trading plan is critical to becoming a successful trader. It provides structure and discipline, which are essential for navigating the complexities of the market. Remember, failing to plan is planning to fail.

4. Analyzing Your Results and Improving Performance

Analyzing your results and improving performance is a crucial step in achieving profitability in trading. Without a structured approach to analyzing your trades, it is impossible to identify patterns and make informed decisions. By keeping a detailed record of your trades, you can identify areas of strength and weakness and adjust your strategy accordingly. We help you with appropriate trading journals where you get detailed feedback. By analyzing your results, you can identify your strengths and weaknesses and work to improve your performance over time.

Day traders deal with probability; there is no 100% winning strategy, but you need to map out what works, and this is what you focus on, leaving aside what did not work, period!

We provide pre-fab journals to our subscribers to enter their trades and review them after a set of twenty transactions to see:

- Did you comply with the rules of your system?

- Which indicator and setup gave you the highest returns and which did not?

- Did you hold your trade to target or bail out early?

Let us share an example of how and what such a statistic can look like. The results are from a trader that uses NLT Top-Line, Trend Catching and Timeless. Journaling a trade takes about 20 seconds on our template. Most people hate documentation and administration; however, you will see that this time is well invested in a moment. We also recommend taking a trade entry screenshot to compare in the aftermath if what you thought you traded was what the chart told you. Trading is a lot about mind control and focus: We see with our brain and all our emotions, past experiences, influences often paint a different picture from what is there. It will get obvious when discussing the results.

NLT Day Trading Journal Example

Feedback from the NLT Day Trading Journal

- The trader conducted 58 Trades and produced $2,303 of income but wasted a lot of profit by exiting trades early and not at the system-defined target.

- The new trader achieved a high winning percentage of 72%, complying with the system’s expectations.

- In 17 trades that went positive, the trader left money on the table by exiting early because of his fear of losing.

- Setting stops tighter than the system proposed and entering late in a trade accounted for 8 out of 58 transactions (14%) and showed room for improvement.

- The overall indicator performance was on spec; however, the Buy/Sell_T performance had a too high average loss compared to the average win by leaving the trade early on winners and accepting the max loss when the trade did not work.

- The highest income-producing indicator was the Floating signal (part of the NLT Timeless Concept).

In summary: The trader still does not trust the system and is scared to follow the set instructions (43% negative performance); the average indicator performance was 72%. Hence, he should walk away after trade entry and return to see the result, keeping his hands off the computer while in a trade.

We hope this example demonstrates how such a scorecard helps analyze where things worked well and where you have room for improvement to achieve solid and constant returns from trading.

5. Conclusion

In conclusion, adopting a structured trading approach can be the key to unlocking market profitability. By creating and sticking to a plan, traders can avoid emotional decision-making and focus on their goals. It is important to remember that a structured approach doesn’t guarantee success but provides a framework for making informed decisions and managing risk. Here is a short overview of what traders base their decisions on and their overall share of decision-making, based on our research:

| Trading Decision | Feedback | Reasons |

| Concluding based on assumed fundamentals 20% | Institutions have the best analyst and your system shall inform you about their buying or selling; making it more likely for you to trade in the predominant direction rather than trusting your home research. | Many retail traders feel they can beat the market based on their superior knowledge; however, institutions employ the best analysts and you have no chance to be better. |

| Past Price Action 28% | Past performance does not mean it replicates actual results. Going 30 years back, checking for the biggest worldwide companies by market capitalization, not one is on the top 20 list today, so past performance is not a guarantee for futures results | Markets change and what worked yesterday does not replicate itself today. Hence this is not a reliable long-term method for trading success. Rather trade what you see by letting the chart tell. |

| Standard Indications 50% | Standard indicators, like moving averages, forecast the future price happening with a 51% to 55% likelihood, not good enough to make money as a retail trader. | Standard indicators or systems are free or require only a minimal investment, not considering the cost of trading losses. |

| High Probability System 2% | Performance of forecasting the future price action ≥ 65%, rarely available and used by retail traders, but a prerequisite for long-term trading success. | Quality requires higher initial investment and the dedication to learn and follow success principles in a disciplined approach. |

By our research, 76% of retail traders are losing money, and if you act the same, why expect different results?

For more details, write us an email and we send you our research findings:

contact@NeverLossTrading.com Subj.: 76%

Additionally, traders should be willing to adapt their approach as market conditions change and continually evaluate their performance to identify areas for improvement. With discipline, patience, and a commitment to continuous learning, traders can progress to profitability and achieve their financial goals. So, if you’re ready to take your trading to the next level, consider implementing a structured approach and see the difference it can make.

contact@NeverLossTrading.com Subj.: Free Consultation

NeverLossTrading is a trading education and software company that aims to help traders improve their performance and profitability in the financial markets by:

- Personalized Coaching: in one-on-one sessions, you learn customized trading strategies that fit your unique needs and goals. This personalized approach can help traders better understand the markets and make more informed trading decisions.

- Trading Software: NeverLossTrading offers proprietary software that provides real-time market analysis and trading signals. Our indicators are designed to help traders automate their trading decisions and execute trades with greater accuracy and efficiency.

- Comprehensive Training: We provide extensive training and education materials to help traders learn the fundamentals of trading and develop the skills and knowledge necessary to succeed in the markets.

To succeed in trading, you best work with an experienced coach. Our #1 competitive advantage is the support and customer service we offer. Veteran traders have been through more ups and downs than you can imagine. So, experienced pros have probably experienced whatever you’re going through.

If you are ready to make a difference in your trading: We are happy to share our experiences and help you build your trading business. Trading is not a typical career, and you best learn from those who are long-term in this business to cope with the rollercoaster of the financial markets. We are here to help and provide feedback on what you might be doing right or wrong. Strive for improved trading results, and we will determine which of our systems suits you best. The markets changed, and if you do not change your trading strategies with them, it can be a very costly undertaking. The markets changed, and it can be an expensive undertaking if you do not change your trading strategies with them. However, you can make a difference with the right skills and tools!

Hence, take trading seriously, build the skills, and acquire the tools needed. Trading success has a structure you can create and follow.

Thomas Barmann (inventor and founder of NeverLossTrading)

Disclaimer, Terms and Conditions, Privacy | Customer Support