Forex trading, or foreign exchange trading, is buying and selling currencies in the global market. We share an outlook and concept of how to find and act on high-probability price turning points as a day trader, swing trader, or longer-term investor.

Forex is the world’s largest and most volatile market, with hundreds of currency combinations.

To simplify things, here are the ten favorite NLT FOREX pairs with real-time data streams we keep in focus:

As a FOREX trader, you want to know about global economic events, and here is an overview of weekly news day by day.

By selecting flexible lot sizes, FOREX of all assets offers the highest flexibility to adjust your trading risk and strive for exceptional returns.

How to adjust the lot size?

Imagine you trade for a 400-tick price change, and one tick is worth $1 on a 100,000 lot; at a 50:50 risk to reward, you would risk $400 to make $400. However, if you traded a 10,000 lot, you only risked $40 to make $40. Most brokers allow flexible lot sizes: a 1.5 lot would represent $150,000 of a standard currency.

Depending on where your account is established, brokers reserve a margin between 1:50 (USA) to 1:200 (EU, e.g.) for each FOREX trade. This means: a 100,000 lot, at $1 per tick, can be managed with a $500 or $2,000 margin reserved for each trade. In addition, many brokers allow you to open parallel long and short positions for the same instrument, which allows for trade repair methods we teach in our mentorships: instead of taking the stop-loss, you adjust the trade. The method of trade repair gave us our brand name; however, never stop loss trading was a bit lengthy.

Currencies are always traded in pairs because when you buy or sell one currency, you automatically sell or buy another. Every currency pair has a base currency and a quote currency – the base currency appears first, and the quote currency is to the right of it.

The price displayed for a currency pair represents the amount of the quote currency you will need to spend to purchase one unit of the base currency.

For example, in the EUR/USD currency pair, EUR is the base currency, and USD is the quote currency. If the quoted price was 1.1000, one euro is worth 1.10 US dollars.

The above table mentions the tick value change and value for a 100,000-unit contract. Tick value is the amount of money gained or lost for each incremental movement in the price of an asset. In the context of forex trading, tick value is used to calculate a trade’s profit or loss based on the trade’s size and the number of pips (price increments) gained or lost.

The exchange rate and the trade’s size determine a FOREX tick value. For example, the tick value of a standard lot (100,000 units) of EUR/USD is $1 per pip: meaning that for every pip gained or lost in the price of EUR/USD, the trader would either gain or lose $1, depending on whether they are buying or selling the pair.

Traders need to understand the tick value of the assets they are trading, as it can help them manage their risk and determine their potential profit or loss on a trade. By calculating the tick value, traders can also determine the appropriate position size for their trades based on their risk tolerance and account size.

In a currency pair, the first currency listed is the base currency, and the second is the quote currency

We specify three different types of Forex pairs:

- Majors

- Commodity currencies

- Cross currencies

Major currencies fulfill the highest number of transactions. Therefore, considering access to data streams and bid/ask spreads, we list AUD/JPY, AUD/USD, EUR/USD, GBP/USD, EUR/GBP, USD/JPY, USD/CHF, and USD/CAD.

Commodity currencies constitute currency pairs that have a value closely tied to a commodity, such as oil, coal, or iron ore. The commodity currencies included in this list are AUD/USD and USD/CAD.

Cross currencies are currency pairs that do not include the US dollar. Two cross-currency pairs with high involvement are EUR/GBP and EUR/JPY.

EUR/USD is the most traded currency pair, with EUR/USD a participation rate of 24.0% of daily forex trades. The high daily volume of EUR/USD transactions ensures that the pair has a lot of liquidity which generally results in tight spreads. Liquidity and tight spreads are enticing for traders because large trades transact with little impact on the market.

Time-based candles can extend above and beyond the system-set maximum risk/reward balance. To cope with this, we developed the NLT Timeless Concept, which only looks at incremental price changes and disregards time.

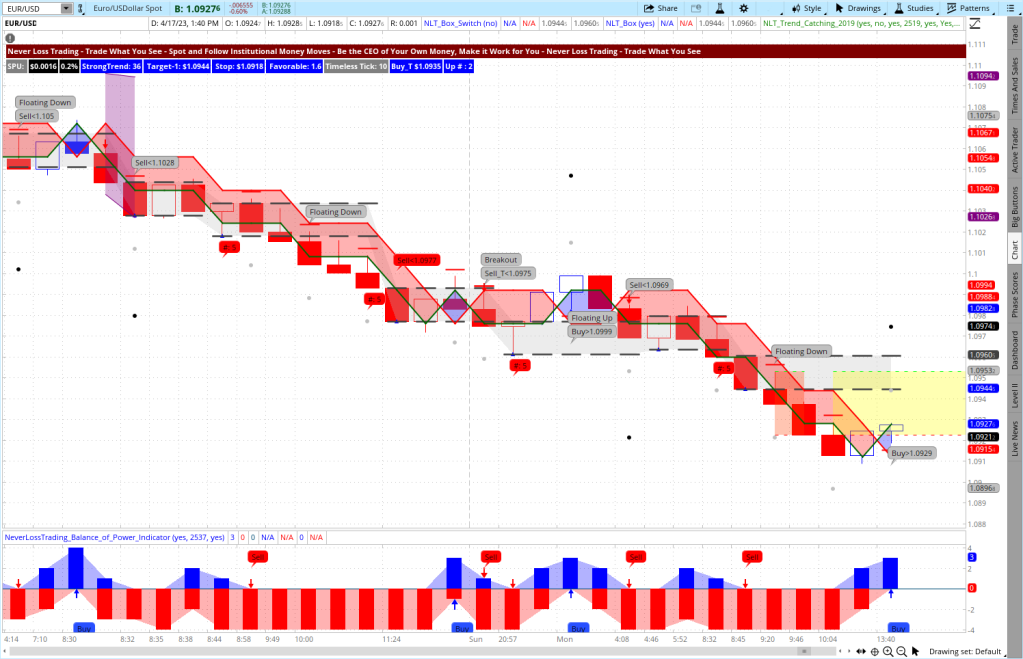

EUR/USD Timeless NLT Day Trading Chart

The chart shows multiple trade examples, consisting of:

- Buy/sell price threshold for setting order entries

- Dots on the chart signify the target

- The stop is at a red crossbar

- Colored channels signify the time of the day supply and demand price levels

We teach the details in our training program.

The advantages of NLT Timeless Trading are:

- You act at high probability price turning points, not apparent to most market participants.

- Candles form by system-defined price increments. When a specified price increment concludes, a new candle starts. This way, you are not trading at apparent support and resistance levels and are much less predictable.

- Every trade indication is acceptable with a pre-specified risk-to-reward level, bringing the odds in your favor

- You have the chance to trade multiple times during a day, either with a slower and a faster pace price change

- We offer two chart types for day traders fast pace and regular pace. In addition, swing traders and longer-term investors are provided with timeless charts, helping them to cut higher price moves into risk-adequate units.

- When trading the market, you do not want to be transparent in your acting, and we are helping you to trade along with significant price moves but always risk adequately.

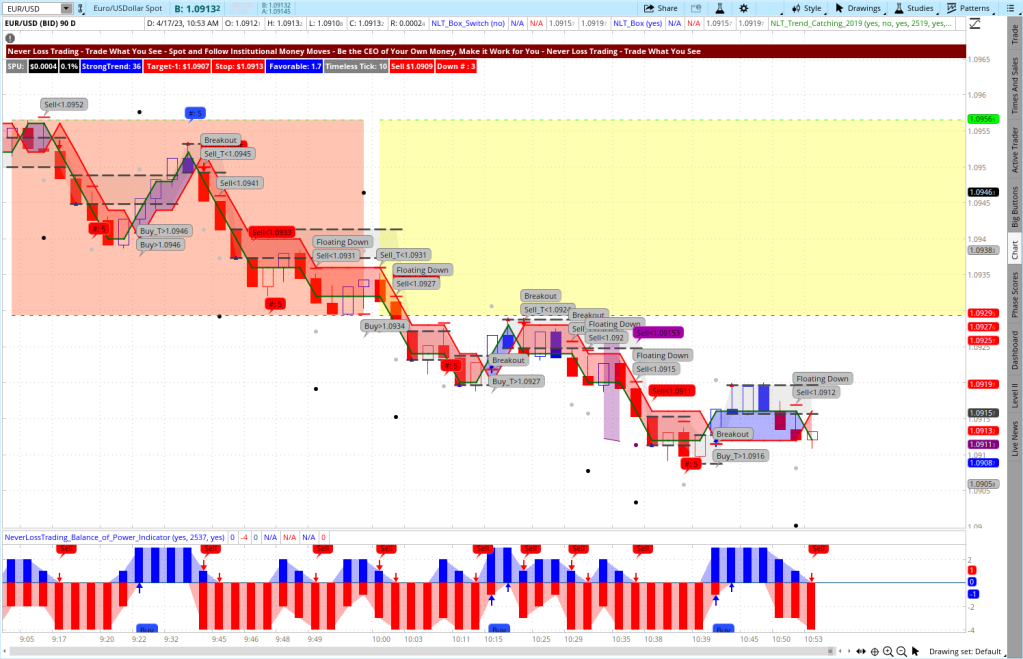

We could add more advantages, but following the Pareto principle, what we shared covers 80%. FOREX trading has no fees, but to cover the bid/ask spread of the trade, our timeless system provides a solid concept that allows entering a trade at a specific threshold, where risk and reward can be entered at the click. Here is an example of EUR/USD fast pace trade on an NLT Timeless Chart. Trades lasted two to twelve minutes.

EUR/USD Timeless NLT Day Trading Chart Fast Pace

Please feel invited to check if you could have followed the indicated directional price move proposal.

If you took a mechanical approach, you had eight trading opportunities, and seven worked in the supported direction.

Our students also learn that the less trading is more concept is – = +, where you strive for a set weekly budget.

If trading were easy, nobody would ever go to work; however, we work with our students on mental and emotional changes toward financial decisions. A life-changing experience is ahead of you. First, however, please consider what Albert Einstein shared with us: Insanity is when you do the same over, expecting a different result. Hence, if you are ready for a change, set up a demo:

contact@NeverLossTrading.com Subj.: Demo

Indeed, our concept works for all asset classes; we picked FOREX in this publication today; however, you can find other examples at Blogger or WordPress.

EUR/USD Timeless Swing Trading Chart

Swing trading EUR/USD, we hold open positions between one and five days and follow the same chart principles. Please check the most recent price move indications and decide if they indicated critical price turning points, where the dot on the chart works as a target and the red crossbar as a stop.

We teach you in one-on-one sessions how to master our concepts, and you learn to analyze trade situations on the spot by letting the chart tell when to buy or sell.

Trading requires an investment in knowledge and skills. Therefore, we offer software and training programs ranging from $2,500 to $15,000. Many NLT clients buy more than one program to increase participation rate and accuracy; however, each program works as a stand-alone or in conjunction with another.

Trading success requires discipline, patience, and a solid, high-probability system. It is also crucial to have a well-defined trading plan and to stick to it, even when the market gets volatile.

NeverLossTrading is a trading education and software company that aims to help traders improve their performance and profitability in the financial markets by:

- Personalized Coaching: in one-on-one sessions, you learn customized trading strategies that fit your unique needs and goals. This personalized approach can help traders better understand the markets and make more informed trading decisions.

- Trading Software: NeverLossTrading offers proprietary software that provides real-time market analysis and trading signals. Our indicators are designed to help traders automate their trading decisions and execute trades with greater accuracy and efficiency.

- Comprehensive Training: We provide extensive training and education materials to help traders learn the fundamentals of trading and develop the skills and knowledge necessary to succeed in the markets.

To succeed in trading, you best work with an experienced coach. Our #1 competitive advantage is the support and customer service we offer. Veteran traders have been through more ups and downs than you can imagine. So, experienced pros have probably experienced whatever you’re going through.

If you are ready to make a difference in your trading: We are happy to share our experiences and help you build your trading business. Trading is not a typical career, and you best learn from those who are long-term in this business to cope with the rollercoaster of the financial markets. We are here to help and provide feedback on what you might be doing right or wrong. Strive for improved trading results, and we will determine which of our systems suits you best. The markets changed, and if you do not change your trading strategies with them, it can be a very costly undertaking. The markets changed, and it can be expensive if you do not change your trading strategies with them. However, you can make a difference with the right skills and tools!

We are here to support you in mastering the markets today. If you are ready to follow our trading systems and principles, check with us, and we will find out what system suits you best.

contact@NeverLossTrading.com Subj.: Demo

Trading success has a structure you can create and follow.

Thomas Barmann (inventor and founder of NeverLossTrading)

Disclaimer, Terms and Conditions, Privacy | Customer Support

No comments:

Post a Comment