Summary: By the example of AAPL, we demonstrate how to follow a risk-limiting strategy to trade stocks over earnings.

There are multiple ways to decide for a trade:

- Fundamental

- Technical

- News Based

Buy the

Rumor, Sell the News, is a simple saying, but what do we do with it as a trader

or investor?

Apple inc. is

reporting first-quarter earnings today, April 28, 2021, after the stock market

close. It is always exciting to hear what Apple has to say; however, today, we

will experience a leading impact on the stock markets overall. The focal point

of attention will be the introduction of the new generation of 5G capable

phones. By 2025, 5G networks are likely to cover one-third of the world’s

population and trigger a demand for at least 1.2 billion new phones. The impact

on the mobile industry and its customers will be profound. 5G is more than a

new generation of technologies; it denotes a new era in which connectivity will

become increasingly fluid and flexible. Compare it to going from dial-up

internet to broadband or high-speed internet: a significant change in

capabilities.

AAPL stopped

reporting units of iPhones sold in 2018. The iPhone segment accounts for about

50% of Apple's revenue. We still were able to get some insights and into the

market shares of units sold of the key players:

AAPL: 21 % market

share, Samsung 16%, Xiaomi 11%, Oppo 9%, Huawei 9% and a wide variety of others

covering the rest.

With the

roll-out of 5G, communication companies, smartphone producers, and chip manufacturers

are looking for profitable growth in the years to come.

All of this

sounds just positive, but we still let the chart tell when to buy or sell:

AAPL

Weekly Top-Line Chart, Nov. 2020 to April 2021

Chart Analysis:

Situation-1: After a time of ambiguity (NLT

Purple Zone), where the price direction was uncertain, we had an end of purple

zone signal with a buy-threshold > $134.40. The buy-stop order was filled in

the price development of the next candle (week of 12/28/2020) and carried out to

the target (dot on the chart), not considering further confirming signals. When

the target price was reached, the share price pulled back, but we were out of

the trade!

Situation-2: The NLT Top-Line signal of the week

of 4/5/2021: Buy > $133.04 was confirmed in the price development of the

week 4/12/2021, and such, we are long in AAPL with two potential targets:

$139.89 (Target-1 to be reached on 1-5 candles) and $146.78 (Target-2 to be

reached in max ten candles).

Trading over

earnings has an uncontrollable risk; hence, we chose a limited-risk strategy,

where we know at entry the max loss of the trade, regardless of the price

development of AAPL. Most importantly, we will participate in potential upside

opportunities and keep the ability to repair the trade if it goes wrong (the

concept of never stop loss trading gave us our name, but we shortened it a

little)

With the NLT

concept, we simplify life for you and let the chart tell when to buy or sell,

specifying all decision-making dimensions at once:

· Entry Conditions: Execute buy-stop or sell-stop orders

at pre-defined price thresholds at assumed probability

· Exit Condition: When is the target reached

· Stop Condition: By not controlling the stop in the

AAPL trade over earnings, we work without a stop but with a risk-limiting options

trading strategy.

· Risk Management: Operating with limited-risk strategies

only, we prevent drawdowns.

When you are

familiar with options trading, you know that Vega, the volatility component in

the options price, accelerates the cost of the option over news events like

earnings. To not pay too much for the time we want to control the stock; we

cover the potential time decay by combining risk-limiting options strategies on

the stock options put- and call side: collecting premium and paying premium.

If trading

was easy, nobody would ever go back to work. The good news: it is learnable.

The NLT

trading concept over earnings announcement is only one strategy of many; we

teach in the hours of working together.

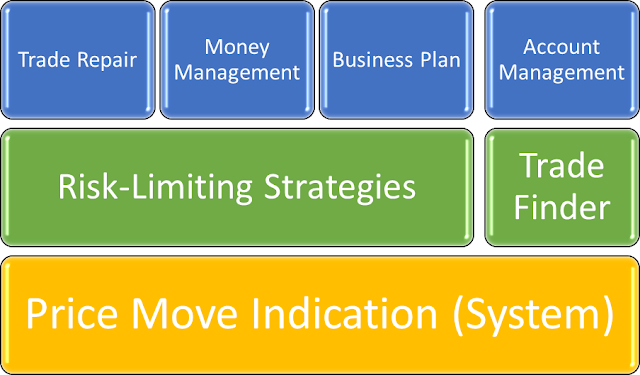

Here a short overview of what you will all experience by operating with rule-based

trading decisions as a day trader, swing trader or long-term investor in

margin-, IRA, and even 401(k) accounts.

NLT

Learning Program Overview

contact@NeverLossTrading.com Subj: Consulting Hour

Working

one-on-one spots are extremely limited: Do not miss out!

For more of

our free publications and webinars…sign up here.

We are looking

forward to hearing back from you.

Disclaimer, Terms and Conditions, Privacy | Customer

Support

No comments:

Post a Comment