Blitz chess and day trading are similar in their fast-paced and high-pressure nature.

Blitz chess is a type of chess where each player has minimal time to make their moves, often just a few minutes for the entire game: players must think and act quickly, making decisions on the fly and adapting to changing circumstances in real-time. Similarly, day trading is where traders buy and sell assets within one day, often making multiple trades and decisions based on real-time market data.

Both blitz chess and day trading requires quick thinking and decision-making under pressure, as well as the ability to adapt to changing circumstances in real time. In addition, both disciplines require a deep understanding of the underlying rules and mechanics of the game or market and a solid ability to analyze and predict outcomes based on available information.

However, there are also significant differences between blitz chess and day trading. For example, in blitz chess, players typically compete against a single opponent, while in day trading, traders compete against a large and complex market. Additionally, while blitz chess is a game of skill and strategy, day trading can involve significant risk and uncertainty, as traders must navigate fluctuating market conditions and make quick decisions based on incomplete information.

Actually, I am a decent blitz player, but there is no chance for me to beat Magnus Carlsen (world champ). However, we could undoubtedly show him how to trade the financial markets with the help of our systems, where you do not need to be in the top ten of the world to make money; you do this by following system indications and applying rules.

If you give yourself little time for acting, a high skill set is required, and this is where we come into play: NeverLossTrading is a technical trading strategy seeking to minimize losses and maximize gains. It is based on the principles of technical analysis and the idea that price movements can be predicted and used as a way of trading with a higher probability of success. The strategy involves using various indicators, which constantly adjust to actual and consider crucial support and resistance levels to identify entry and exit points. The method also requires discipline to stick to the rules and follow the plan, as it is easy to get carried away and make emotional decisions.

"NeverNossTrading" comes from the idea of repairing a trade instead of taking the stop; however, never stop loss trading was a bit lengthy. Hence, we do not want to portray a trading system that purports to allow traders to make profitable trades without ever experiencing a loss. Instead, we rely on high-probability trade setups and use algorithms to spot and act on crucial price turning points.

Let us share some chart situations and crucial decision-making points:

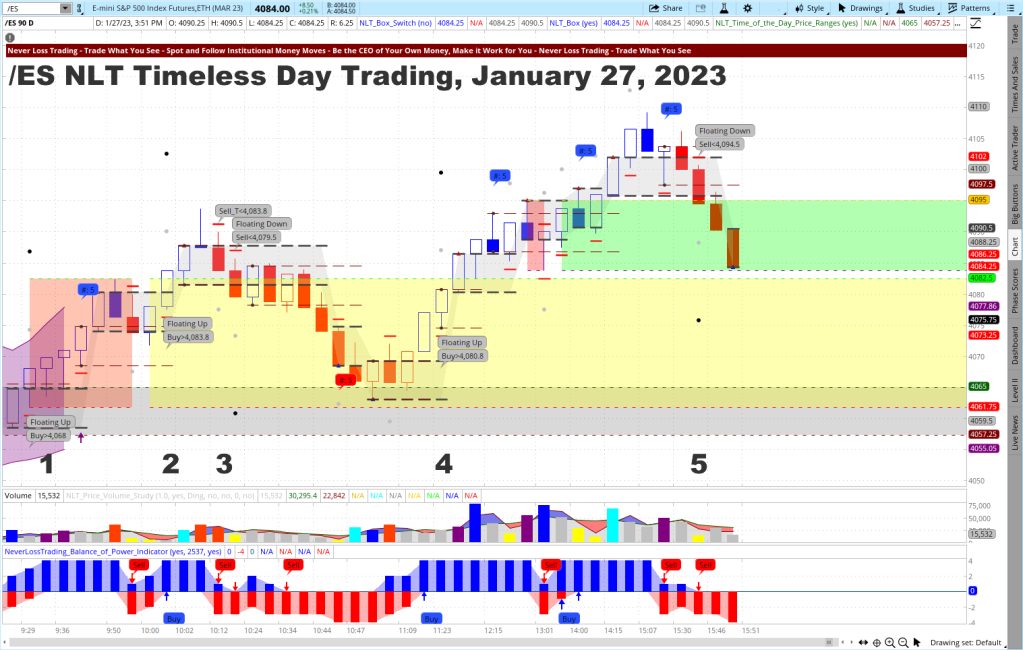

The following chart example will show potential instances to act based on the E-Mini S&P 500 Futures Contract on February 22, 2023, combining NLT Top-Line, Trend Catching and NLT Timeless.

/ES, NLT Timeless Chart, February 22, 2023

On February 22, between 9:45 a.m. ET and 2:20 p.m. ET, seven opportunities showed on the chart. Each had a price threshold like buy > or sell <, allowing traders to operate with buy-stop and sell-stop orders. Gray dots on the chart specify the trade exits, and red crossbars the stop: this way, you select the price points for bracket orders. The candles on the chart appear by system-specified price increments where only price change is the determining factor, not time; hence, we call this NLT Timeless Trading. The average decision-making time to enter a trade was about five minutes, giving traders enough time to participate in the opportunities without being rushed.

Some of the rules to follow are:

- On a down-move, we spare trading indications of a first-leg reversal but accept a trade indication on the second leg.

- We do not enter a trade at the exit level of a prior indication.

Five of the seven trading opportunities were positive if you followed those rules and spared two instances where the indication did not work. If you purely mechanically accepted trade after trade, you won five out of seven (71%), which is on the rate of expectation. Our high probability systems focus on forecasting ≥ 65% of the opportunities to come to the system-defined targets.

More details are on the chart; we best explain those in a personal online meeting.

contact@NeverLossTrading.com Subj.: Day Trading Demo

For day trading, Futures offer excellent opportunities. They trade six days a week and around the clock. However, our systems work for other assets like stocks, options, and FOREX. Besides day trading NLT Systems build a solid decision-making basis for:

- Swing Trading (holding open positions for a couple of days)

- Longer-Term Investing (holding positions for multiple weeks or months)

When you check our blog and YouTube channel, you will find multiple examples of how NLT systems support your decision-making on high-probability setups, letting the chart tell when to buy or sell.

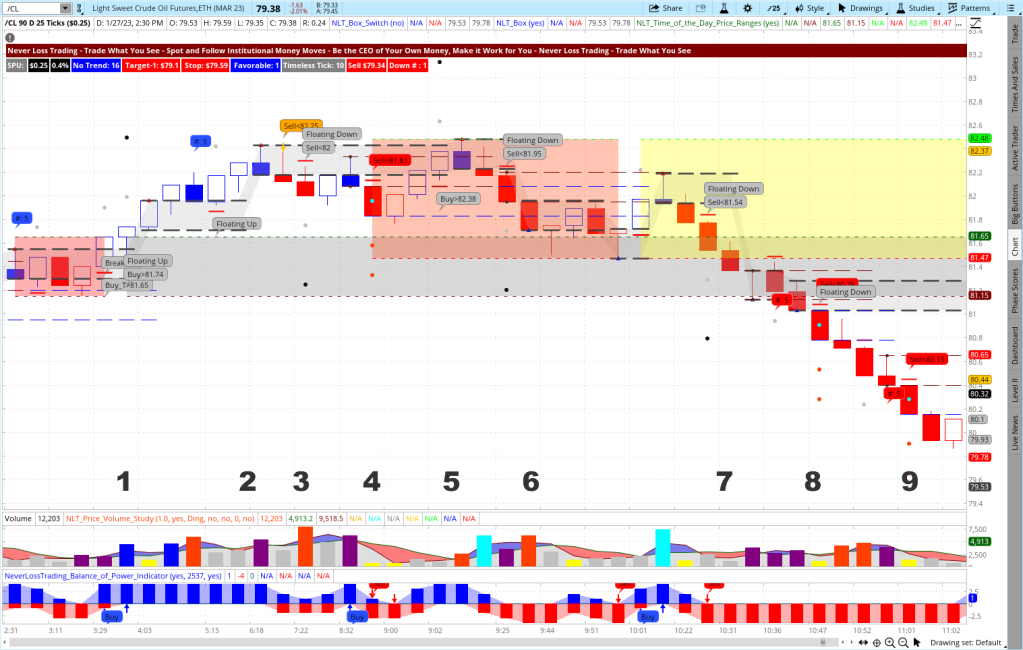

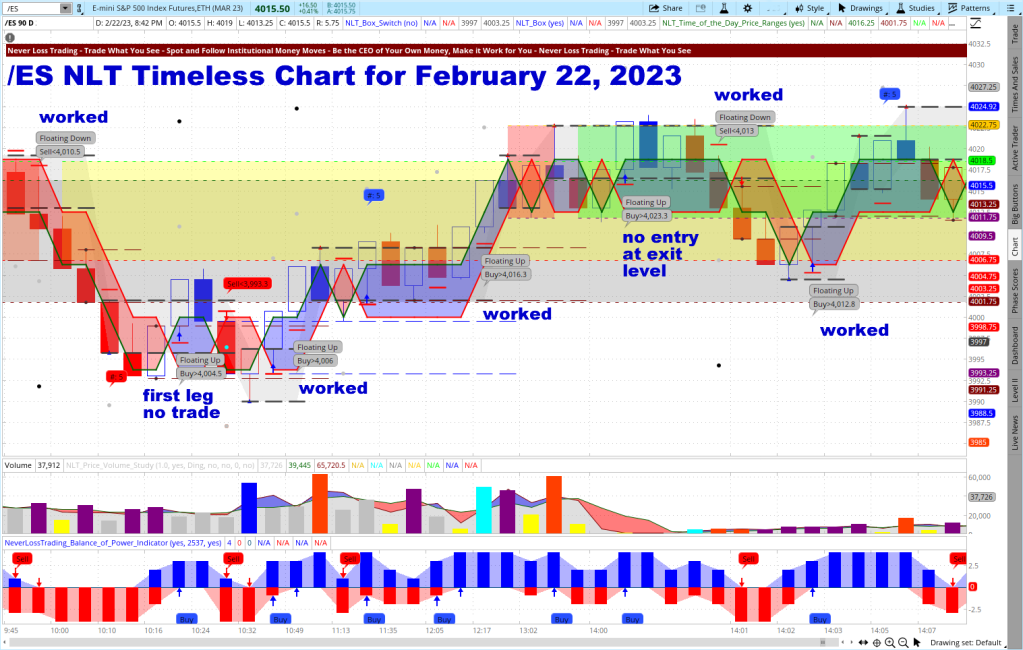

To demonstrate that we did not share a one-hit wonder, here is again an NLT Timeless chart for February 17, 2023, and it shows six opportunities, where five worked and one failed. However, had you considered the first leg rule, the instance marked as failure should not have been a trade for you.

We do not want to make it sound simple. Still, daily trading requires a solid skill base and training to overcome the emotions involved and apply a reliable situational analysis before acting by letting the chart tell when to buy or sell instead of assuming on your own what you feel will come next.

/ES, NLT Timeless Trading, February 17, 2023

We are long-termers in algorithmic trading. Our systems have AI components and help you to form sound decisions at high-probability setups, but there are rules to learn and follow. We teach those in one-on-one sessions at your best available days and times.

We helped many strive for their trading success and assure you it is not coming without sound knowledge and skill.

If you are ready to make a difference in your trading, we will share our experiences and help you build your trading success. Trading is not a typical career, and you best learn from those who are long-term in this business to cope with the rollercoaster of the financial markets. We are here to help and provide feedback on what you might be doing right or wrong.

Strive for improved trading results, and we will determine which of our systems suits you best.

The markets changed, and if you do not change your trading strategies with them, it can be a very costly undertaking. However, you can make a difference with the right skills and tools!

SPX, S&P 500 Index, NLT HF Price Turning Points

Imagine if you could spot and act on the price turning points our indicators put on the chart.

Hence, take trading seriously, build the skills, and acquire the tools needed. Trading success has a structure you can create and follow.

We are looking forward to hearing back from you.

Good trading,

Thomas Barmann (inventor and founder of NeverLossTrading)

Disclaimer, Terms and Conditions, Privacy | Customer Support