How to tailor your trading program to your wants and needs? Success has a structure, and if you are not applying a structured approach, your chances for a positive outcome will be random.

Depending on which trading style fits your life, different concepts or structures support your goals.

Therefore, we distinguish three trading styles and recommend choosing a style that fits your lifestyle, and indeed, you can combine trading styles:

- Day Trading: Opening and closing positions the same day

- Swing Trading: Keeping open positions for a couple of days

- Longer-Term Investing: Holding open positions for weeks, months

Our teaching and coaching are individual and focused on your preference, return expectations and available time. Over the years in business, we did not find two trades with precisely the same style or program adaptation; people are different in:

- Overall time commitment

- Time to trade and decide

- Risk tolerance

- Return expectations

- The primary income, side income, retirement income

- Account size

- Affinity to assets (stocks, options, futures, FOREX)

- Level of skill and knowledge

- Average time to keep open positions

- Account type: margin, IRA, 401(k)

- Commitment to documentation and continued improvement

Hence, our system and strategies adjust to you like a tailor-made suit because we know one size does not fit all!

In any case, we can still share some base principles to consider through all trading styles and put those in a table for you.

The Structure of Trading Success

| Trading Style | Day Trading | Swing Trading | Longer-Term |

| System | Mechanical | Mechanical | Mechanical |

| Return Expectation | Example: $1,000 per week trading one futures contract | 2% – 5% return on capital engaged per week | 2% to 5% return on capital engaged per month |

| Activity (number of transactions) | 2-3 trades per day | 2-5 trades per week | 2-5 trades per month |

| Risk Limiting Strategies | Given | Combining assets with options | Combining assets with options |

| Trade Repair | None | Important | Important |

| Asset Preference | Futures, FOREX, Stocks | Stocks & Options Futures, FOREX | Stocks & Options Futures, FOREX |

| Average time in a position | Minutes or hours One to five bars | One to five days | One to five weeks or one to five months |

| Skill Level | Highest: solid short-term decisions | High | High |

| Documentation | Every trade and 20-trade review | Every trade and 20-trade review | Every trade and 20-trade review |

Let us elaborate on this:

System

You want a high-probability trading system that forecasts the price movement with clearly defined entry, exit, and stop conditions regardless of the time of holding positions. Give yourself little to no room for discretionary decisions: Trust your system and accept that you work with uncertainty at or above a rate of 65%, and we can help you achieve this.

Return Expectations

The higher your return expectations are, the better your skill and dedication need to be. If trading and investing were easy, nobody would ever go to work. Return, risk and investment size go hand in hand, and we share strategies to specify a fixed income per time period, achievable with a small number of trades.

Why a small number of trades?

Retail traders tend to overdo their trading activity and accept too much risk. Trading is all about risk control and folding when you achieve your goal. For example, when working with day traders who trade Futures, we specify two contracts to trade and complete the weekly income budget of $1,000. Depending on the broker you work with, you need about $2,000 to $12,000 of capital to conduct these trades. When you reach the budget consistently, upscaling (trading more than one contract) is the conclusive next step, and you follow the same principle.

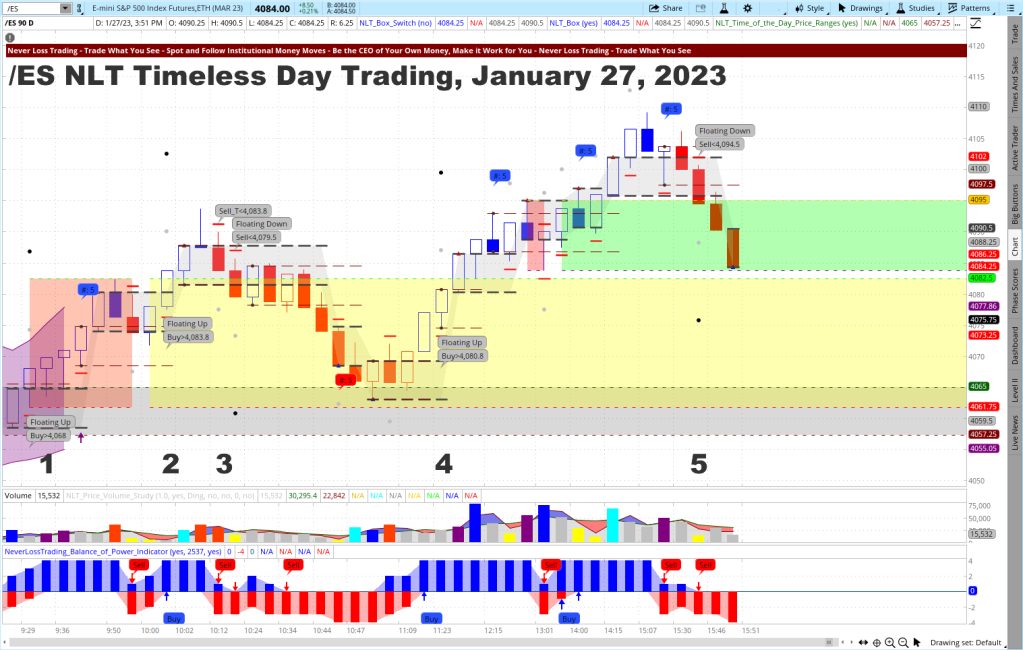

Here are two chart examples that combine NLT Top-Line, Trend Catching, and Timeless.

The first chart shows five potential trade situations; each spells out a price threshold like Buy > $4068 and provides a basis to trade for a price change of about $300 of the underlying contract. To execute a transaction, we operate with a buy-stop bracket order, and the trade only goes to the exchange when in the price development of the next candle, the set threshold is reached and the order executed. Five trade situations were highlighted, and all met their desired target (gray dot on the chart). Non got stopped (red crossbar on the chart).

E-Mini S&P 500 Index Futures Example

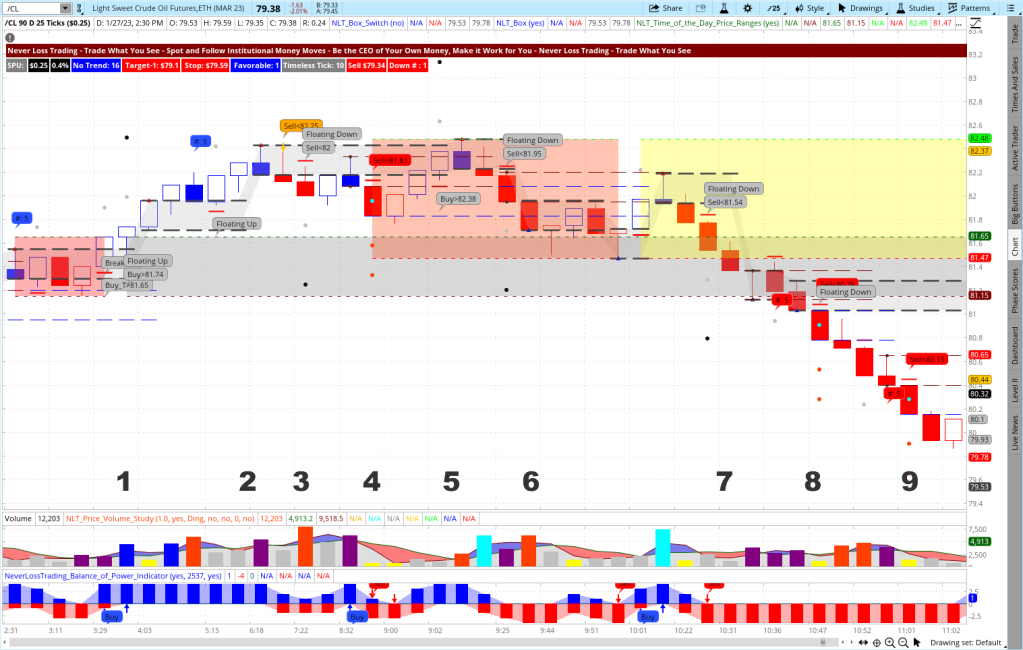

Next, we pick a crude oil futures example for the same day.

Crude Oil Futures Example

The Crude Oil Futures Chart shows nine trade situations with the same conditions and price thresholds. Accepting trades mechanically, without the evaluation to learn: six trade setups came to target (1, 2, 3, 5, 6, 7, 8, 9), and two got stopped (4, 5).

We hope you see in the red crossbars where to put the stop. Targets are expressed in dots, and we only enter into a trade when the price threshold is ticked out in the price movement of the next candle.

We could add multiple charts, and if you want to see more:

contact@NeverLossTrading.com Subj.: Demo

Next, let us discuss swing trading and longer-term investing with the same principles:

Imagine you are a swing trader, and you hold $50,000; a two percent return on cash would be, again, an income of $1,000 weekly. Now let us quickly calculate how many trades you need, winning two out of three to get to the budget, assuming that your accepted risk is 1.2 times your reward. So the answer is again about four trades. Hence, you do not need to transact that often to achieve your goals. The example for a longer-term investor with a 2% monthly return would calculate equally and ask for about four trades to complete the budget. We combine this concept in what we call less is more: – = +, but we wanted to give you a meaningful introduction to a different way of thinking and acting to achieve your trading goals long-term. Striving for constant income from the financial markets, you need more than a buy-and-hold strategy. You need the knowledge of how to combine, for example, stocks with options or trade options to limit your risk because opposite gaps quickly can get you way outside of your assumed risk and cut deep into your profits. When you get into action, you will notice that some trades go opposite, and then our method of trade repair comes into play, which gave us our brand name: Never Stop Loss Trading was a bit lengthy.

Swing Trading Example QQQ

The QQQ chart shows a swing trading example, and you see multiple directional indications with buy and sell thresholds: Buy > or Sell <, and we only act if the set number is reached in the price movement of the next candle. The holding time is a couple of days. Dots specify trade targets, and red crossbars are the stop levels.

The daily NLT Speed Unit (SPU) for the QQQ swing trade is around 2.5% and as such, this is the return you strive for per trade. When using the NLT Delta Force Concept, surely multiple times higher, but you also have a higher associated percentage risk. In the continuation of this article you will learn how the return you strive for will support meaningful weekly swing trading goals and the QQQs are perfectly in spec. for stock and options trades.

If you want to hold open positions for multiple weeks, the SPX provides a solid basis for longer-term positions. Again, you will find buy and sell indications with thresholds; horizontal lines build express supply lines on pullbacks, where we propose to exit in the current overall bear market.

Longer-Term Trading Example SPX

The SPX chart shows six trade situations where five worked according to plan and one failed.

Depending on the account type you are holding, a change in strategy is required to participate in downside moves:

- IRAs do not allow for short-selling stock, and we help you with the NLT Delta Force Concept to participate in falling prices by options trading strategies, allowed in this account type

- If you are operating from a margin account, you have fewer limitations, but you must hold more than $25,000 to short stocks. Again, we provide options trading strategies that limit your risk and leverage your reward per trade.

You now see how goal setting influences your way to market and requires you to change because needs constantly change, and you do not want to be left behind. So at this point, our support kicks in, and we provide the required tools and knowledge.

Also, in day trading, we recommend formulating a goal and measuring success in getting there. Hence, we recommend that our traders work towards short-term budgets. For example, as a day trader, to produce an income of $1,000 by trading one contract of either the E-Mini S&P 500 Futures Contract or Crude Oil Futures – two highly liquid assets with no limitations for following the up or downside direction. Then, when the weekly budget is hit, you stop trading. In addition, we encourage you to limit the maximum number of daily trades to three – following our concept that less trading is more: – = +. Finally, you restart the clock every week and journal your achievements to discuss what went right or wrong to improve your actions after every set of twenty trades. Depending on your broker’s margin requirement, you can participate in this exercise with a capital between $500 and $12,000.

Day trading success has a structure or pattern to follow, and I want to show you some tools that can help you form sound decisions at high probable price turning points. We pick two examples to demonstrate what our systems can do and discuss the individual trade setups. Again, the systems will formulate buy or sell thresholds (buy < or sell >). Target (dot on the chart) and stop (red crossbar) are system set, allowing you to operate with buy-stop and sell-stop bracket orders. For days trading, we choose a timeless chart setup, where candles form purely price based, and the system sets the price increment to trade. With modern AI technology and highly probable algorithmic trading systems, your market outlook and action will change, helping you to form sound mechanical decisions and act repetitively. With what we show you, three to four weekly winning trades make the $1,000 budget. We then encourage you to stop trading: overtrading is one of the strongest pitfalls of a day trader: reach the budget and be good, and trust our advice: less trading is more: – = +.

We share two examples showing NLT Timeless Day Trading Charts for the E-Mini S&P 500 and the Crude Oil Futures contract. On an NLT Timeless chart, candles are formed purely price-based, and the system defines the price increment to trade for. In our examples, we evaluate each signal as it appears valid while following the concept of less is more; you will learn during our trading sessions selection criteria to distinguish higher from lower probability setups.

Risk Limiting Stragegies

As a day trader, risk limiting is simple: you work with bracket orders (OCO, once cancels the other); however, your system, not you, needs to decide on entry, exit, and stop.

When we come to swing trading or longer-term investing, you are exposed to overnight gaps that increase your risk acceptance. To get around an extended risk, combining, for example, stocks with options or trading options limits your risk exposure. We teach the NLT Delta Force Concept, which specifies at any point:

- The strike price to pick

- The time to expiration to choose

- The maximum price to pay or apply a different strategy

Skill and knowledge make a significant difference to your expected returns. We are here to support you in gaining the knowledge needed to strive for solid returns regardless of market direction.

Trade Repair

As a day trader, when a trade goes wrong, it goes wrong, period. We tested methods of opening up opposite-oriented trades but found no value in this concept. The reason is: we want to trade on solid system indications, and a transaction coming to a stop does not mean it allows for opening an opposite trade and successfully bringing it to target. In rare cases, was the stop-candle a candle with a strong opposite signal indication, and we are trading at high probability setups only. However, trade repair enormously impacts swing trading and longer-term investing. Imagine a set of six trades, each winning $1,000 or losing $1,200; when winning two out of three transactions, your expected income from a group of six trades is $1,600. If you reduce your losing trades through a trade repair to half ($600), the expected outcome is $2,800 or a 75% improvement, and often you can even do better or turn losers into winners. However, the average retail trader does not possess the skills we bring to the party and share in our mentorships.

Skill

Trading is not just about an indicator; it takes multiple dimensions to turn yourself into the trader or investor you want to be. Therefore, we support you in acquiring the necessary knowledge and skills.

Success Factors for Trading and Investing

To succeed in trading, you best work with an experienced coach and learn much about trading. Our #1 competitive advantage is the support and customer service we offer. We work one-on-one with you to specify what we teach to your specific wants and needs; hence, if your knowledge base is not expanding rapidly, you are doing something wrong.

Ongoing education and mentoring are crucial to longevity in this business. Veteran traders have been through more ups and downs than you can imagine. So, experienced pros have probably experienced whatever you’re going through.

If you are ready to make a difference in your trading:

We are happy to share our experiences and help you build your trading business. Trading is not a typical career, and you best learn from those who are long-term in this business to cope with the rollercoaster of the financial markets. We are here to help and provide feedback on what you might be doing right or wrong.

Strive for improved trading results, and we will find out which of our systems suits you best.

The markets changed, and if you do not change your trading strategies with them, it can be a very costly undertaking.

We are looking forward to hearing back from you,

Thomas Barmann (inventor and founder of NeverLossTrading)

Disclaimer, Terms and Conditions, Privacy | Customer Support

No comments:

Post a Comment