It is a remaining myth that a key duty of a trader is to make the trend your friend: Find what moves and hold it forever.

In reality, asset prices only trend 1/3-rd of the time.

What does this mean for your trading?

In 67% of the cases, you will be stopped, by entering in a cyclic period, where typically price moves trigger stops.

Even when you got the trade direction right, you need to give your trade an excessive risk tolerance to not get stopped in the continuation of the price move, when prices alternate on the way up or down.

Basically, you are caught in a situation with no chance of wining, even so you might have the direction right.

What to do?

Consider to be a momentum trader:

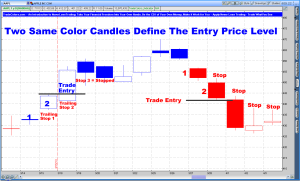

- You enter at clearly defined price continuation patterns.

- With the help of a price move approximation calculation, you pre-define your target-exit and stop.

- Using a position sizing model, the relation of risk to reward at the entry signal will specify the size of investment you take.

- With the help of market alerts and own watch list, you always have an idea for assets to trade at multiple time frames.

Where do you find this?

With NeverLossTrading: Even or basic trading algorithm, which is called TradeColors.com has this ability and beats any standard indicator in its performance.

Check out our latest introduction video…. click here.

If you want to be part of this:

The TradeColors.com mentorship is taught in one-on-one sessions, where you learn in 4-hours how to apply the system for your specific wants and needs. All trade setups are documented in a 60 page electronic booklet; every session is recorded for you to repeat what you learned.

Review the details at: http://www.neverlosstrading.com/TradeColors_Intro.html

Contact us or even schedule your personal consulting hour at:

Call: +1 866 455 4520 or contact@NeverLossTrading.com

We are looking forward to hearing back from you:

If you are not yet part of our trading tips and free webinars, please sign up here and we keep you up-to-date….sign up here.

No comments:

Post a Comment