Let us take some indications and prepare for our last quarter trading in 2015:

What are the world markets telling us?

- Nikkei: Down 15% from August highs.

- DAX: Down 20% from April highs and Deutsche Bank declaring an earnings problem.

- Heng Seng: Down 15% from April highs.

- S&P 500: Down 3.5% from July highs.

- Crude Oil below $50, and below the cost base of most on land and sea productions, bringing the CAD down 20% in relation to the USD.

There is some room for movement in catching up to the overall world development.

Are you prepared for this?

- Do you have a clear cut downside strategy to short the markets even in your retirement account?

- Are your charts telling you when the move is happening?

- Can you deal with volatility, where after a sharp down move a strong up-reversal is expected?

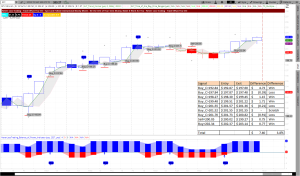

Imagine, you had the help of the following vector graphic for defining your trade direction and instead of staying in a trend forever, you traded for two-bars, with exit at the closing of the second bar or if the price of the asset moves to the red horizontal stop line. Your buy- or sell stop order placed three cents above the spelled out price threshold.

SPY October 1 – 16, 2015, Trend Catching Chart

A 3.8% net return in 15 days does surely not sound too exciting; however, the NLT Trend Catching system caught 75% of the directional move and if you compounded interest, you would even be ahead of the overall price move of the market: we show you how to do this in our mentorships.

Too make it more exciting for you, let us now take a leveraged product and trade the same index performance with the with a futures product and measure the return based on the same rules:

Now we are talking: A 67% return was achieved, calculated based on the overnight margin of $5,060 for the Emini S&P Future.

We surely can also show you how the performance would have been, had you traded options or other leveraged products.

NeverLossTrading systems measure the activity of institutional investors and we do not most ingenious, we trade along with the move, from where it starts, to where it ends; only accepting little risk and aiming for what we call explosive breakouts that pay us along the price move.

We are a primer education institution with focus on one-on-one training, were you and your wants and needs are in focus and not the questions of other education participants that might just ask more than you do: Our focus is you and helping you to turn yourself into the trader you want to be.

To be part of this, schedule your personal consulting hour:

Call +1 866 455 4520 or contact@NeverLossTrading.com

We are open of new students now: Do not miss out.

If you are not yet part of our free reports, trading tips, and webinars sign up here..click.

Good trading,

NeverLossTrading

No comments:

Post a Comment