Trading is a numbers game; hence, we recommend for you to calculate in advance the implications of your doing:

Why to risk $525 to make $100? (We will explain this in more detail)

Sounds logic; however, most traders focus on making $100 regardless of the risk to accept.

Recently, I participated in a day trading system introduction with the following setup:

- Risk 8-ticks to produce 2-ticks of income.

- Reasoning: Operate in a volatility range and harvest on small intra-volatility moves.

The trading room was filled with about 200 people, subscribing and applying to this trading strategy on a daily basis.

Let us do a quick check on the odds of the basic setup: The breakeven point is at a 4:1 win/loss ratio, requiring you to win with a > 80% predictability to produce a zero?

The trade entry was based on Bollinger Bands, RSI and a MACD. By our statistics, those indicators have a 53% to 55% predictability; which in itself shows the challenge to trade at an above 80% attainment rate.

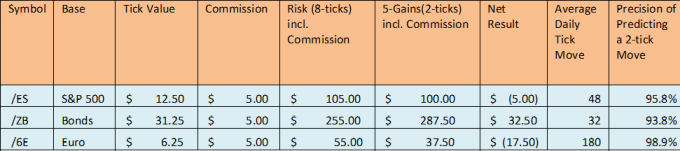

Some indicator based systems claim: overlaying multiple 53% probability indicators a higher precision can be achieved: Mathematically this is not the fact; however, let us assume it is true and the system produces in average five winners on one losing trade what will be the financial expectation considering some of the futures that were traded:

- /ES: E-Mini S&P 500 Futures

- /ZB: 30-Year Bond Futures

- /6E: Euro Futures

Expected Return on Winning Five out of Six Trades, Risking 8-Ticks for a 2-Tick Gain

The above table shows that only one out of three symbols has a positive expectation: the /ZB and this on a predictability of the price move of 83%. In the last two columns, we show the average expected price move per day of the referring trading instruments and the amount of precision needed to predict those on such a small scale of 2-ticks.

What is this telling you?

Consider and calculate the implications of your system by a feasibility study, telling you the likelihood that you get where you want to be as a trader or investor.

When you learn trading with us, we put an end to this: We introduce you to systems that have a ≥ 65% predictability and you only trade with the odds in your favor and you adjust your position size based on the odds evaluation of each trade setup.

In addition, you will learn to follow a business plan for trading success:

- Financial plan (return expectation and risk per setup).

- Action plan (what to do, when and how: includes a trade adjustment strategy).

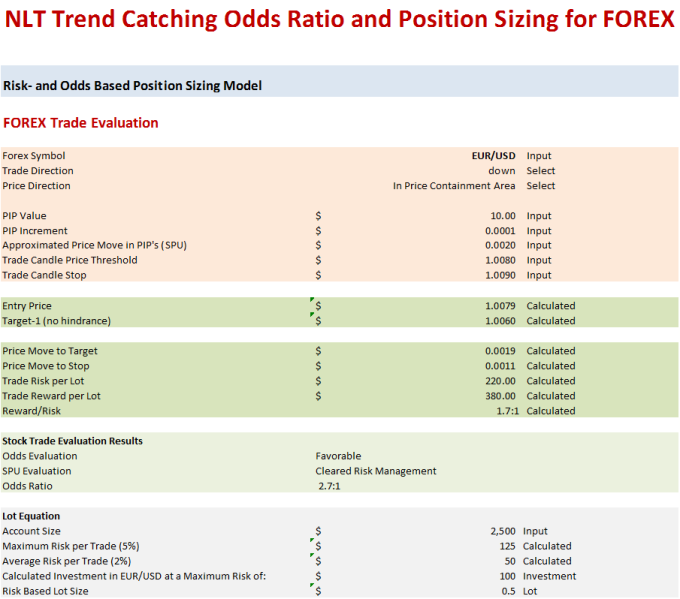

Overview Table of an Odds Appraised Position Sizing Model

The above table tells you: By your system defined entry, exit, and stop, the odds are in your favor and you bets invest into 0.50-Lot for staying in your system described risk agreement.

If you like to see how a fully integrated trading concept helps you to appraise each trade situation right from the chart, with clear cut entries, exits, and stops, register for our upcoming free webinar:

Why You Want a High Probability Trading System

May 10, 2017, 4:30 p.m. EDT….click here to register.

There will not be a recording (proprietary details will be shared). In case you cannot participate, register and we will send you a written summary of the webinar content.

What you will learn at the webinar:

- How a high probability trading system increases your chance for positive trading results by ≥50%; how and why!

- How to trade with clearly defined, entries, exits, and stops.

- The importance of position sizing for producing money from trading long-term.

- How to build a business plan for your trading success (financial plan and action plan)

If you are serious and dedicated to learn how to operate with a high probability trading system, ask us for a personal demonstration:

Call: +1 866 455 4520 or contact@NeverLossTrading.com

To subscribe to our FREE trading tips, webinars, and reports…click here.

We are looking forward to hearing back from you,

Thomas

No comments:

Post a Comment