In the world of trading, timing is everything. Every move in the market presents an opportunity, but those opportunities can easily slip away without the right timing. As the saying goes, “If you never open a position, you never have an open position to trade.” This underscores the importance of identifying and executing potential trades at the right moment.

Here’s where NeverLossTrading comes in. With its cutting-edge technology and sophisticated analysis tools, NeverLossTrading equips traders with the ability to master market timing like never before. By leveraging its proprietary indicators and strategies, traders can precisely identify optimal entry and exit points, maximizing their profit potential while minimizing risk.

One of the critical advantages of NeverLossTrading is its focus on comprehensive market analysis. Rather than relying on gut instinct or guesswork, NeverLossTrading employs a data-driven approach to identify high-probability trading opportunities. Its advanced algorithms analyze market trends, price movements, and key indicators in real-time, allowing traders to stay one step ahead of the competition.

But timing isn’t just about knowing when to enter a trade; it’s also about knowing when to stay out. With NeverLossTrading’s sophisticated risk management tools, traders can avoid unnecessary losses by sitting on the sidelines during uncertain market conditions. By waiting for the right opportunities to present themselves, traders can ensure that every trade they make has the highest possible chance of success.

In addition to its advanced timing capabilities, NeverLossTrading offers a range of educational resources and personalized coaching to help traders hone their skills and maximize their profits. From live trading sessions to in-depth tutorials, NeverLossTrading provides traders with the knowledge and support they need to succeed in today’s competitive markets.

So, suppose you’re tired of missing out on profitable trading opportunities or getting caught on the wrong side of the market. In that case, it’s time to take control of your trading destiny with NeverLossTrading. With its unparalleled timing capabilities and comprehensive support, NeverLossTrading empowers traders to trade confidently to achieve their financial goals like never before.

Our software is paining trading opportunities on the chart for you:

Trade what you see; let the chart tell when to buy or sell.

To demonstrate how this imperative works in different situations, we share some examples:

- Longer-term trading: weekly chart based.

- Swing trading: daily chart-based.

- Day trading: NLT Timeless Concept.

NLT trading decisions are indicator-based, where the system defines a price threshold: buy > or sell<, and we enter into a trade when this threshold is confirmed in the price movement of the next candle. In addition, at entry, the system defines the exit (dot on the chart).

Longer-Term Trading Examples

When accepting NLT Signals from weekly charts, the expected time to hold an open position is one to ten weeks, with a statistical peak of three weeks.

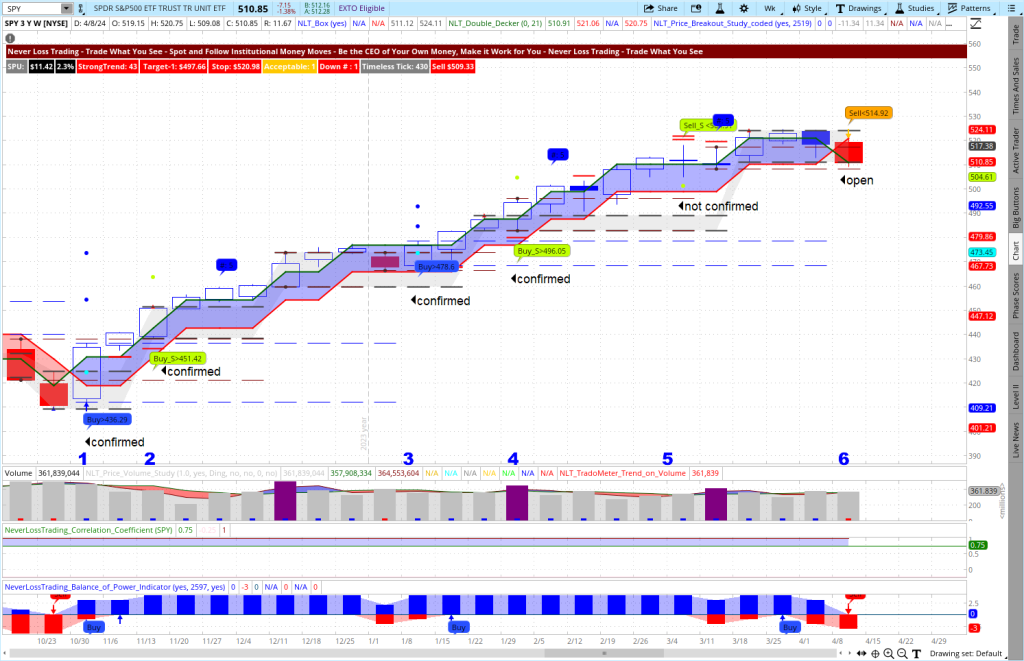

To demonstrate the strength of our systems, we pick SPY, ETF of the S&P 500 stock market index, and check the most recent market timing of the NLT indications between mid-October 2023 and mid-April 2024.

SPY, NLT Weekly Chart

The SPY chart shows four confirmed trade situations, one not confirmed, and one open signal.

Situation-1(11/13/23): Confirmed NLT PowerTower signal with two target dots to be reached in one to ten weeks.

Situation-2 (11/13/23): NLT SwingPower signal, adding to the directional move of the prior signal.

Situation-3 (1/8/24): Confirmed NLT PowerTower signal with two target dots.

Situation-4 (1/29/24): NLT SwingPower signal, pointing out a further upward move.

Situation-5 (3/4/24): NLT SwingPower signal, but the direction is not confirmed by the price move of the next candle not reaching the price threshold of selling < $ 504.91.

Situation-6 (4/8/24): NLT Early down signal will only validate when the low is ticked out in the price move of the next candle – and it happened.

Swing Trading Example

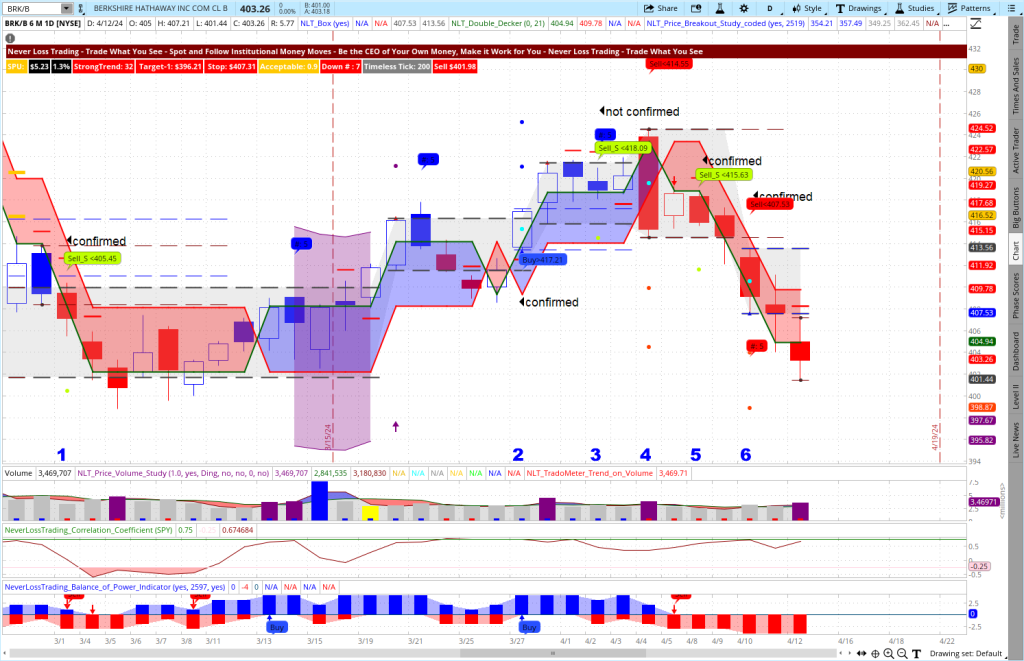

Here, we decide from daily charts with an expected holding time for open positions between one and ten trading days and a culmination point at three days.

To demonstrate the strength of our system, we pick BRK-B, Berkshire Hathaway, between 2/28 and 4/12/24 and highlight if the price direction indicated is confirmed or not. The following chart shows six potential trade indications, four confirmed and two not (signals 4 and 5). The confirmed indications came to their system-defined target: dot on the chart, which closed the trade based on the system’s timing.

BRK/B NLT Daily Combined System Chart

Day Trading Example

The NLT Timeless concept enables traders to diversify their strategies and capture broader market movements by identifying trading opportunities across various price frames and asset classes, allowing decisions at multiple price increment levels.

NLT day trading decisions are based on a couple of rules, and we best start when not to accept a signal:

- In an NLT Purple Zone, because of the ambiguity of price direction.

- When an NLT Box Line cuts the way to target short, indicating supply or demand levels.

- There is no entry at the exit level of the prior signal.

We enter a trade when the spelled-out buy> or sell < price threshold is ticked out in the price development of the next candle. If this does not happen in the price move of the next candle, we will delete our order.

The trade target is highlighted by a dot on the chart and specified by the system.

We now take a recent example for the E-Mini S&P 500 Futures Contract on April 8, 2024, between 3 a.m. and 1:30 p.m. EST, highlighting and discussing eight trade situations.

E-Mini S&P 500 Futures Contract April 8, 2024

Situation-1: A confirmed short signal came to target two after two candles, and we do not consider the second signal on the way down (down moves are framed in red, up in blue).

Situation-2: A confirmed long signal needed five candles to reach the system set target.

Situation-3: A confirmed short signal came to the target.

Situation-4: A dashed NLT Box Line cuts the way to target short, and we do not accept the trade.

Situation-5: A confirmed long signal came to the target. All signals have their tops at the red dashed line, which was not infringed on the way to the target.

Situation-6: No trades in the NLT Purple zone and no trades at exit levels.

Situation-7: A confirmed short signal that reached its target.

Situation-8: A confirmed long signal came to the target, and we did not consider the next signal after the trade initiation candle.

We do not always claim to have all winning trades, but we offer high probability setups above 68% by combining NLT Systems.

Conclusion

Whether your preferred trading style is, regardless if you are a novice trader or an experienced pro, NeverLossTrading has the solutions you need to navigate today’s markets confidently. With our comprehensive range of trading tools and education, you’ll be well-equipped to master the art of trading, striving to achieve consistent profits.

When you are ready to trade and invest in high-probability setups, ask us for our system bundle, and we work with you in a live session to find out what suits you best.

contact@NeverLossTrading.com Subj.: Demo

All our teaching and coaching is one-on-one; hence, spots are limited, and you do not want to miss out.

To receive our free trading tips, subscribe here.

We are looking forward to hearing back from you,

Thomas

Disclaimer, Terms and Conditions, Privacy | Customer Support

No comments:

Post a Comment