What return can you expect when putting your money in the financial

markets: Stock Market, Currencies, Commodities, and Treasuries?

Our answer: It depends on the time frame you plan to stay in your investment.

Let us take an example of an average stock:

When institutional money starts flowing in or out, you can expect an average price move of about 1.8% of the share value in the next 1-5 days. If you are a long-term investor, expect about a 3.5% price move in the next 1-5 weeks. If you rather open and close your trade in the same day, expect about a 0.6% value change in 1-5 hours.

With a median time in the trade of three bars, this means:

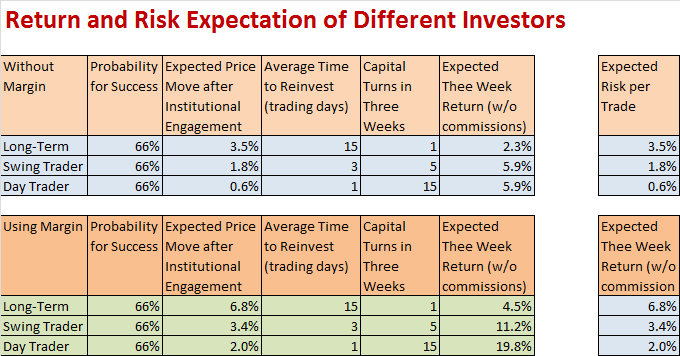

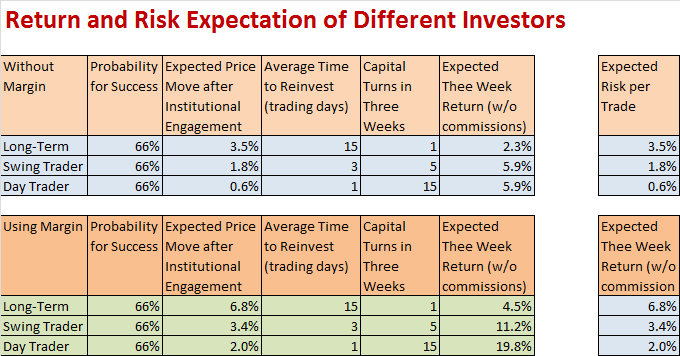

However, let us continue the stock trading example, assuming: Your trading system gives you two wins out of three trades; you constantly reinvested and you allow the price move a wiggle room of the expected return, then this will be the expected calculated returns:

The above table shows that the day trader, when using margin can expect the highest return and is risking the least amount of money per trade, while the long-term investor is taking a risk above the average expected return. Swing Traders in both examples have a positive expectation between risk and reward.

Why do so many people prefer long-term investing?

Our answer: This is what you been thought investing in; thus you prefer long-term holding of Mutual funds, 401(k), and broker held assets or ETF’s.

Make a change, learn to engage your money with the odds (reward over risk) in your favor: NeverLossTrading is a premier trading education institution teaching you how to benefit from utilizing algorithmic trading, where you trade with the odds in your favor, constantly engage your money and strive for above market average returns. We offer multiple mentorship classes that are tailor made to your trading style as a day trader, swing trader or long term investor. Two of our most liked programs;

Call +1 866 455 4520 or contact@NeverLossTrading.com

In case you are not yet subscribed to our free trading tips and market reports, sign up here:

http://www.neverlosstrading.com/Reports/FreeReports.html

We are looking forward to hearing back from you.

Good trading,

Thomas

Our answer: It depends on the time frame you plan to stay in your investment.

Let us take an example of an average stock:

When institutional money starts flowing in or out, you can expect an average price move of about 1.8% of the share value in the next 1-5 days. If you are a long-term investor, expect about a 3.5% price move in the next 1-5 weeks. If you rather open and close your trade in the same day, expect about a 0.6% value change in 1-5 hours.

With a median time in the trade of three bars, this means:

- Long-term Investments: 3.5% return in three weeks.

- Swing Trading: 1.8% return in three days.

- Day Trading: 0.6% return in 3 hours.

However, let us continue the stock trading example, assuming: Your trading system gives you two wins out of three trades; you constantly reinvested and you allow the price move a wiggle room of the expected return, then this will be the expected calculated returns:

The above table shows that the day trader, when using margin can expect the highest return and is risking the least amount of money per trade, while the long-term investor is taking a risk above the average expected return. Swing Traders in both examples have a positive expectation between risk and reward.

Why do so many people prefer long-term investing?

Our answer: This is what you been thought investing in; thus you prefer long-term holding of Mutual funds, 401(k), and broker held assets or ETF’s.

Make a change, learn to engage your money with the odds (reward over risk) in your favor: NeverLossTrading is a premier trading education institution teaching you how to benefit from utilizing algorithmic trading, where you trade with the odds in your favor, constantly engage your money and strive for above market average returns. We offer multiple mentorship classes that are tailor made to your trading style as a day trader, swing trader or long term investor. Two of our most liked programs;

- NeverLossTrading HF-Day Trading: For the high probability day trader and swing trader.

- NeverLossTrading Top-Line: For the high probability day trader.

Call +1 866 455 4520 or contact@NeverLossTrading.com

In case you are not yet subscribed to our free trading tips and market reports, sign up here:

http://www.neverlosstrading.com/Reports/FreeReports.html

We are looking forward to hearing back from you.

Good trading,

Thomas

No comments:

Post a Comment