Trading and chess-playing may seem like vastly different activities, but they share a common thread: the need for discipline and adherence to specific rules or algorithms to succeed. Just as a chess player carefully plans their moves and considers their opponent’s strategy, a trader must develop a systematic approach to navigate the dynamic world of financial markets. In this article, we will explore how traders can draw parallels between chess principles and trading strategies to help traders increase their chances of success.

Learn Different Openings and Control the Center of the Board

In chess, mastering various openings and controlling the center of the board is essential for gaining an advantage over your opponent. Similarly, understanding price-move patterns and identifying assets with predictable, high-probability price movements is crucial in trading. Traders should study historical price data, technical indicators, and chart patterns to develop a deep understanding of market dynamics. You are entering a world where professionals are prepared to win. Still, you have a solid chance for success; however, only with solid preparation. Hence, you will only succeed or win by following a high-probability system with a success rate to forecast price moves with an accuracy above 65%.

Develop Your Pieces

In chess, developing your pieces involves bringing them into the game to maximize their potential. Competing against professionals in trading means working with buy-stop and sell-stop conditions to enter trades only when price movements are confirmed. By waiting for the right conditions, traders can reduce the risk of entering trades prematurely.

Build an Attack Strategy

Chess players often build attack strategies to advance toward their opponent’s side of the board. Similarly, traders should act on system-specified entries, exits, stops, or price adjustment levels to execute their trading plan effectively. Having a well-defined strategy is vital to achieving consistent results.

Consider Opponent Strategies and Moves

As chess players consider their opponent’s moves and strategies, traders should be aware of economic news events and corporate developments that can impact the markets. Understanding that market participants often follow the actions of institutional players is crucial. Traders should also have a trade repair strategy ready in case a trade goes against them.

Activate Your Least Active Piece

In chess, activating your least active piece can improve your position on the board. Similarly, traders should allocate 80% of their capital to trades and avoid allowing a single trade to affect their account by more than 5% of their total capital. The remaining 20% can be reserved for hedging purposes if necessary.

Watch for Gaining Tempo in the End Game

In chess, gaining tempo in the endgame can lead to victory. In trading, traders should establish a signal-defined maximum time for each trade. If a trade is not progressing as expected or hits the predetermined stop, it’s essential to exit the position promptly. Staying nimble is critical to preserving capital.

Play Carefully, and Do Not Underestimate Your Opponent

In chess and trading, caution and respect for the opponent’s capabilities are essential. Traders should be aware that the counterparties in their trades may have a different perspective and strategy. Always approach each trade with care and prudence.

Overview of Trading and Chess Playing Algorithms

| Chess | Trading |

| Learn different openings and care for controlling the center of the board | Understand price-move patterns and find assets with predictable, high-probability price moves |

| Develop your pieces. | Work with buy-stop and sell-stop conditions to only enter into confirmed price moves. |

| Build an attack strategy by advancing toward the other side of the board. | Act on system-specified entries, exits and stops or price adjustment levels |

| Consider opponent strategies and moves. | Know about economic news events and corporate events and that the crowd follows the leaders and has a trade repair strategy ready. |

| Activate your least active piece. | Invest a maximum 80% of your capital and let no single trade affect your account for more than 5% of the held capital. Keep 20% for hedging if needed. |

| Watch for gaining tempo in the end game. | Consider a signal-defined maximum time in a trade and exit the position if not on target or stop. |

| Play carefully, carefully, carefully, and do not underestimate your opponent. | Consider that the one accepting your trade is an institution ready to win on an opposite assumption than yours. |

Conclusion

Following the abovementioned principles does not guarantee success in trading or chess, but it certainly increases your chances. Trading, like chess, requires a disciplined and rule-based approach. NeverLossTrading is one such methodology that incorporates these principles into a comprehensive trading strategy. Applying these chess-inspired principles to your trading can enhance your decision-making, manage risk effectively, and ultimately improve your chances of success in the dynamic world of financial markets. Remember, success in both chess and trading is a continuous learning process that requires dedication and practice.

Here are some examples to position yourself for trading:

Trading the Opening

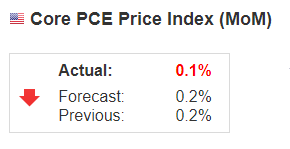

Yesterday at 8:30 a.m., we had a critical news report: PCE.

The Core Personal Consumption Expenditure (PCE) Price Index measures the changes in the price of goods and services purchased by consumers for the purpose of consumption, excluding food and energy. Prices are weighted according to total expenditure per item. It measures price change from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

All pre-signs were positive and so was the report:

For demo purposes, we share a one-contract trade example.

The canldes on the chart form purely price based not time based, and this is why we called this char type: NLT Timeless Chart.

/ES on September 29, 2023

We operated with a bracket order based on the NLT-Signal: Buy > $4,359.30, Floating up. The trade was good for an income of $362.50.

When you go left to right, you see a signal reading: Floating Up, Buy > 4341.8, which was valid and led to a trade to target (gray dot on the chart). At this signal, a black dot was painted, which signifies the maximum price expansion at this signal and we expect an opposite price move when the price gets there on the first attempt.

Hence, we would not accept the buy on the high, assuming a pullback before another rise, and this happened.

Next came our signal and action for the opening rules in trading.

We will add the middle gameplay for September 28, 2023, to demonstrate that this is not a singular play.

/ES on September 28, 2023 – Middle Game

We highlighted suggested trades with green checkmarks and the trade signal that failed with a stop sign, letting you check yourself if we had highly probable rules to follow.

It is a simple thing in trading as in chess; you need to follow rules and oversight of what is going on. Considering crucial daily news events are necessary, we prepare our subscribers daily at 5:55 a.m. ET in our Telegram channel with what to consider and a market sentiment reading, increasing the likelihood of striving for constant trading income.

For the skeptics: Where is the opening play for September 28?

Critical news that day was at 10 a.m. that day. Our chart shows an NLT Purple Zone, a sign of directional ambiguity, and we do not accept signals inside, but when the zone is over – this was the case:

/ES on September 28, 2023 – Opening

We placed a buy-stop bracket order, which was filled at 9:56 a.m. ET, and it came to its target at 10:01 a.m. ET, resulting in a $350 income per contract.

Do such rules also play a role in swing trading and longer-term investing?

Absolutely! However, in a slightly adjusted way.

We take longer-term decisions from weekly charts, and the price development of the stock market, measured by SPY (ETF of the S&P 500 Index), shows an NLT Purple Zone. When the key market players do not commit directionally, why should we?

Stock Market Development by SPY

As a result, concentrating on day trading and swing trading is the strategy of choice.

For swing traders, we report daily assets on the move, and if you like a free week of NLT Swing Trading Alerts, email us, and we cater them to your inbox.

contact@NeverLossTrading.com Subj.: Swing Alerts

You can find more examples of our trading decisions in our latest eBook, The AI Revolution in Trading – ready to download.

We help our students simplify technical analysis by providing a holistic approach that combines chart patterns, trend analysis, and market indicators. Traders are equipped with practical tools and methodologies to identify high-probability trade setups, helping them make informed decisions based on market trends and price action.

Subscribe to receive our trading tips.

Executing trades at the right time and price can be challenging, especially in fast-moving markets. NeverLossTrading offers techniques for precise trade entries and exits, allowing traders to capture optimal returns. With its focus on high-probability setups and systematic approach, NeverLossTrading helps traders improve their trade execution and timing, maximizing their profit potential.

The financial markets are dynamic and ever-evolving, requiring traders to stay updated and continuously learn. NeverLossTrading promotes a culture of continuous learning, providing educational resources, webinars, and personalized mentoring. Traders gain access to a wealth of knowledge and expertise, empowering them to adapt to changing market conditions and enhance their trading skills.

Trading challenges are an inherent part of the financial markets, but with the solutions offered by NeverLossTrading, traders can overcome these hurdles and thrive in their trading endeavors. By addressing emotional biases, providing effective risk management techniques, simplifying technical analysis, optimizing trade execution, and fostering continuous learning, NeverLossTrading equips traders with the tools and knowledge needed for success. Embrace the solutions provided by NeverLossTrading and embark on a journey toward consistent profitability and trading excellence.

To succeed in trading, you best work with an experienced coach. Our #1 competitive advantage is the support and customer service we offer. Veteran traders have been through more ups and downs than you can imagine. So, experienced pros have probably experienced whatever you’re going through. Suppose you are ready to make a difference in your trading. We are happy to share our experiences and help you build your trading business. Trading is not a typical career, and you best learn from those who are long-term in this business to cope with the rollercoaster of the financial markets. We are here to help and provide feedback on what you might be doing right or wrong. Strive for improved trading results, and we will determine which of our systems suits you best. The markets changed, and if you do not change your trading strategies with them, it can be a very costly undertaking. Hence, take trading seriously, build the skills, and acquire the tools needed. Trading success has a structure you can learn and follow.

We have a year-end 2023 offer where we combine multiple systems in package deals (code NLT 2023).

We are looking forward to hearing back from you:

contact@NeverLossTrading.com Subj. Demo, and we will find out which system package suits you best.

Disclaimer, Terms and Conditions, Privacy | Customer Support

No comments:

Post a Comment