Newton's first law of motion - sometimes referred to as the law of inertia: An object at rest stays at rest and an object in motion stays in motion with the same speed and in the same direction unless acted upon by an unbalanced force.

Unfortunately, Newton’s law of inertia accounts for many traders and investors, who never progress to the next level; boxed into their own paradigms:

- I only trade /ES Futures and SPY.

- I am trading from a 1-minute chart.

- I am only participating in upside opportunities by trading from an IRA.

- I am not profitable, but I only trade 3:1 opportunities.

Unfortunately, it is our human nature to repeat behavior patterns; even so they did not lead to the desired results.

When at times, we are telling new students that one definition of insanity is:

“Doing the same over and over and expecting different results”.

When this is said, everybody has a good time and smiles, until realization kicks in:

- Who is telling you that you can only trade /ES and SPY: Do those prices even move?

- Why to consider a 1-minute time frame: You are trading in the middle of volatility, with the odds in your disfavor?

- You can trade both strategies, long or short from any account; you just need to know the applicable trading strategies?

- How do you know in advance a 3:1 opportunity arises; however, if this worked for you, why do we have a reason to talk?

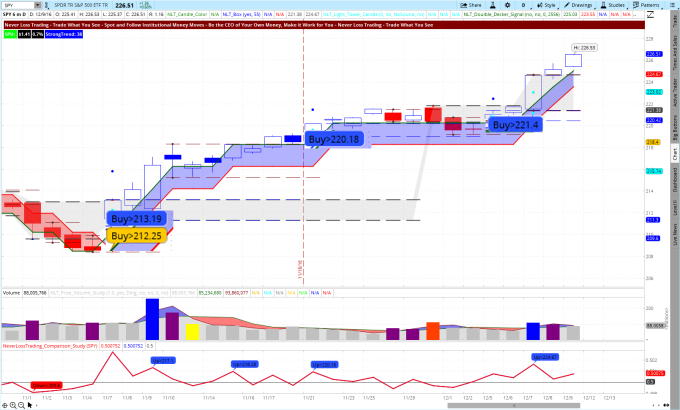

Did your system invite you recently to the following long opportunities?

SPY Daily NLT Top-Line Chart, November 1 – December 9, 2016

In our mentorships, we teach you the details of how to enter with multiple trading strategies when the spelled out price threshold: Buy > $221.40 for example is surpassed in the candle following the signal candle. Why is that important?

You want to trade confirmed directions, where institutional leaders initiated a move and the market follows. This way you can work with buy-stop and sell-stop orders, allowing you to pre-program your orders without the need for sitting in front of your computer at trade entry and exit.

Take a look at the NeverLossTrading Price Move Model:

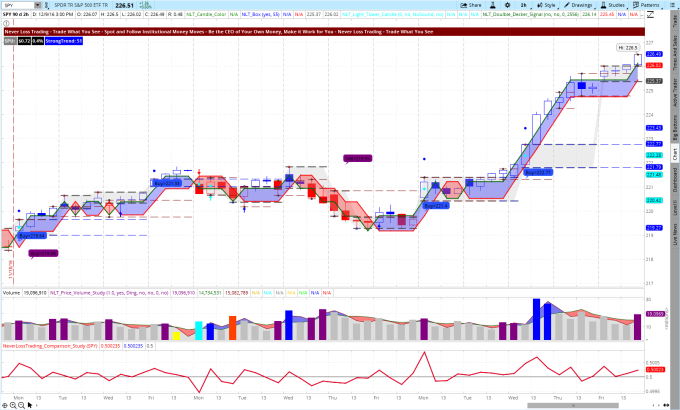

How does it look at lower time frames?

SPY 2-Hour NLT Top-Line Chart, November 18 – December 9, 2016

The 2-hour chart displayed five confirmed directional opportunities, four of those lead to the desired result and one to a stop: An 80% attainment rate.

Consider putting an end to your trading inertia:

- Only those traders that are up for a change have a chance to make money.

- You need to trade with clear cut rules at system specified entries, exits, and stop or adjustment levels.

- Understand when and how to appraise the odds of every trade situation and only risk your money when the odds are in your favor.

- Have a system, follow the system, and act upon multiple time-frames, multiple trading instruments and multiple trading strategies.

We are in the trading education business since 2008. With us, you have the pleasure to learn at your preferred days and times. Check our offering…click.

Find a system that suites your wants and needs and we are happy to organize a personal demonstration:

Call +1 866 455 4520 or contact@NeverLossTrading.com

Teaching one-on-one, spots are extremely limited, so do not miss out.

We are looking forward to hearing back from you,

Thomas

No comments:

Post a Comment